With a market cap of $58 billion, Kinder Morgan, Inc. (KMI) is one of North America’s largest energy infrastructure companies, specializing in the transportation, storage, and handling of natural gas, refined petroleum products, crude oil, CO₂, and other energy commodities. Headquartered in Houston, the company operates an extensive network of pipeline systems and storage terminals, moving energy products essential for power generation, heating, industrial use, and transportation.

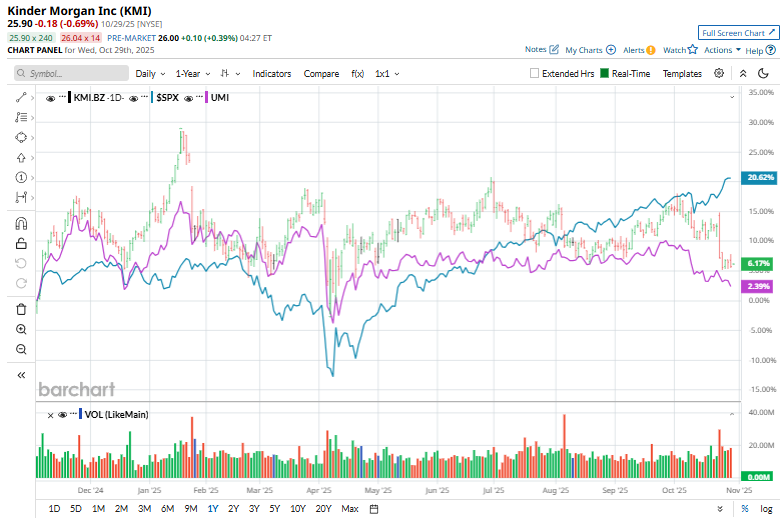

Over the past 52 weeks, KMI stock has soared 5.2%, underperforming the S&P 500 Index’s ($SPX) 18.1% returns. Moreover, in 2025, KMI dipped 5.5%, lagging behind SPX’s 17.2% gains on a YTD basis.

Kinder Morgan hasn’t matched the market’s fireworks, but it’s quietly holding its ground in a tougher corner of the energy world. KMI has outperformed the industry-focused USCF Midstream Energy Income Fund’s (UMI) 3.1% surge over the past year.

The U.S. LNG industry is heating up again, with export projects ramping back to life after President Trump lifted the permit freeze, but Kinder Morgan shares lost steam. The company delivered its Q3 2025 earnings on Oct. 22, and its shares dwindled 4.8% in the following trading session. Its revenue improved 12.1% year over year to $4.1 billion, and adjusted EPS increased 16% to $0.29. Adjusted EBITDA climbed 6% to $1.99 billion, supported by higher natural-gas transport volumes. Kinder Morgan also raised its quarterly dividend to $0.2925 per share, up 2% from the third quarter of 2024 and ended the third quarter with a sizeable $9.3 billion project backlog.

Analysts expect Kinder Morgan to post steady growth in fiscal 2025 ending December, with adjusted EPS projected at $1.28, up 11.3% year over year. That said, the company’s earnings track record has been mixed as it matched Street expectations in two of the past four quarters and fell short in the other two.

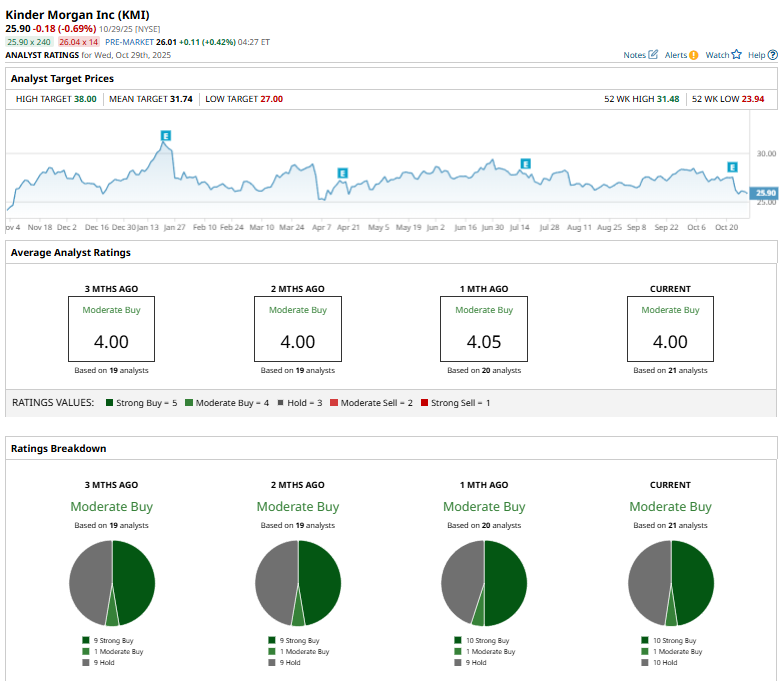

The KMI stock has a consensus rating of “Moderate Buy.” Of the 21 analysts covering the stock, opinions include ten “Strong Buys,” one “Moderate Buy,” and ten “Holds.”

This configuration is notably more bullish than two months ago, when nine analysts gave “Strong Buy” recommendations.

On Oct. 1, Morgan Stanley (MS) analyst Devin McDermott reiterated an “Equal-Weight” rating on Kinder Morgan and slightly raised the price target to $35 from $34

KMI’s mean price target of $31.74 suggests a 22.5% upside potential. Meanwhile, the Street-high target of $38 represents a substantial 46.7% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Muted Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit

- Dear Apple Stock Fans, Mark Your Calendars for October 30