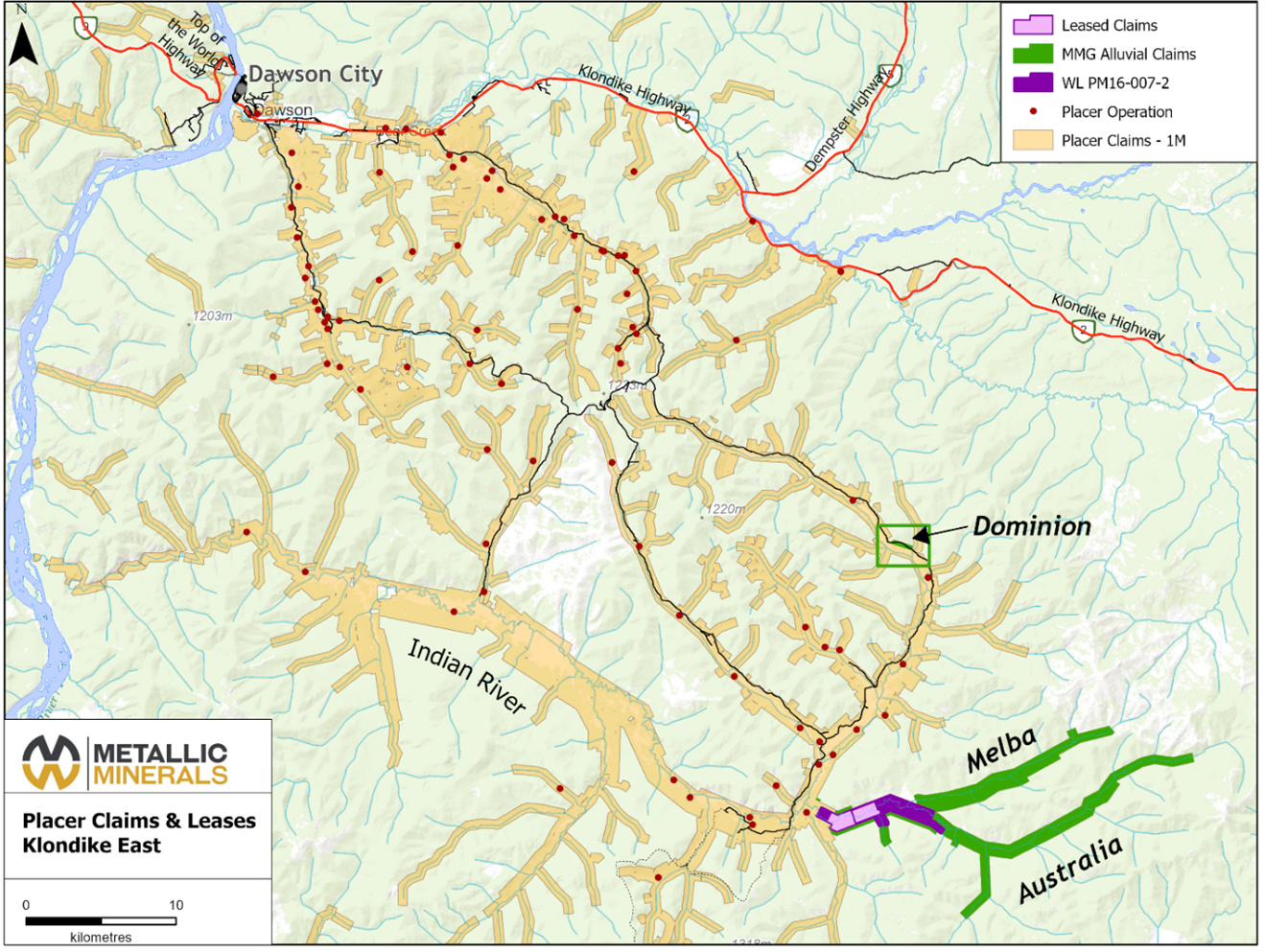

VANCOUVER, BC / ACCESS Newswire / April 15, 2025 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to announce the signing of a new production royalty agreement for a mile of alluvial gold claims at its Australia Creek property in the Klondike Gold District, Yukon Territory (see Figure 1).

Strategic Expansion Amid Rising Gold Prices

This agreement builds on Metallic Minerals gold royalty business in 2025 and has been signed with an experienced mining operator, who brings over 40 years of gold mining experience in the Yukon. This marks the second agreement at Australia Creek expanding the Company's leased ground to over two miles from the original one-mile lease in Australia Creek. With this additional agreement the Company anticipates at least two gold mining operations on its Klondike Gold District claims for the 2025 season with discussions underway with other potential operators on other properties.

"With gold prices at historic highs, we've seen strong interest in our alluvial gold royalty portfolio," said Greg Johnson, Chairman & CEO of Metallic Minerals. "We are pleased to be able to expand our leased ground in the Klondike, which follows the Company's first gold production at Australia Creek in 2023 and 2024 (see Figure 2). This agreement supports a second operation capitalizing on today's market conditions with an operator that has a track record of operational excellence and environmental stewardship, aligning with our commitment to responsible resource development."

The agreement is effective immediately, with production on this block anticipated to begin this summer. Under the terms of the lease, the operator must meet a minimum $500,000 annual work commitment and pay a royalty of 12% on all gold production to Metallic Minerals.

Australia Creek represents a significant eastern extension of the historic Klondike Gold District and is one of the most important discoveries in the region in decades. Metallic Minerals is among the largest holders of alluvial gold mining claims in the Yukon, and additional gold production royalties from Australia Creek will contribute funds toward the Company's hard rock silver and copper exploration projects in Yukon and Colorado.

Camp setup and road clearing is underway at Australia Creek in preparation for exploration drilling and mine operations on the two leased blocks.

About Australia Creek

Metallic Minerals holds a 100% interest in 36.4 square kilometers of mining rights along the Australia Creek drainage south of Dawson City, Yukon. Australia Creek is part of the historic Klondike gold district that is estimated to have produced over 20 million ounces of gold since its discovery in 18981. Australia Creek and its benches are now recognized by Yukon Geological Survey as the eastern continuation of the highly productive Klondike Goldfields, which is the largest placer gold producing area in the Yukon. Modern, open-pit operations in the Klondike have doubled production in the region over the past decade1.

Despite extensive mining activity nearby, Australia Creek itself was not historically mined due to its importance as a source of water and hydro-electric power for the floating dredge operations that were conducted in the region between the 1920s and 1960s. However, exploration drilling at Australia Creek has returned gold-in-gravel values that compare to some of the best producing areas of the Klondike presenting an exciting opportunity for the Company.

The Company has additional ground for lease to experienced operators in Dominion and Australia Creek in the Klondike District, and Granite Creek near Keno City, Yukon that have active water licenses. New operating permits are being advanced on additional ground in both areas.

Figure 1: Klondike Gold District and Metallic Minerals' Properties

Figure 2: Gold Operations on Australia Creek on Metallic Minerals Claims in 2024

Grant of Long-Term Performance Incentives

The Company also announces that, subject to the approval of the TSX Venture Exchange, it has granted 1,400,000 stock options (each, an "Option") to certain directors, officers, consultants and employees of the Company in accordance with the Company's Long-Term Performance Incentive Plan. Each Option is exercisable into one common share in the capital of the Company ("Share") at a price of $0.23 per share, being the five-day moving average volume weighted price of the Shares on the TSX Venture Exchange as of April 14, 2025. The Options are valid for a period of five years from the date of grant and subject to certain vesting requirements in accordance with the shareholder approved plan.

Upcoming Events

Metallic Minerals management will be available at the following upcoming events in 2025, in addition to other events to be added as the Company rolls out its marketing plans over the coming year:

INVEST Fair - Stuttgart, Germany, May 9-10, 2025. For information, click here.

Global Commodity Expo Florida - Fort Lauderdale, Florida, USA, May 11-13, 2025. For information, click here.

Global Commodity Expo Atlanta - Atlanta, Georgia, USA, May 14-16, 2025. For information, click here.

Precious Metals Summit - Beaver Creek, Colorado, September 9-12, 2025. For information, click here.

Precious Metals Summit - Zurich, Switzerland, November 10-11, 2025. For information, click here.

About Metallic Minerals

Metallic Minerals Corp. is a leading exploration and development stage company, focused on Cu, Ag, Au, and other critical minerals in the La Plata mining district in Colorado, and Ag and Au in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company's La Plata project in southwestern Colorado, the expanded 2023 NI 43-101 Inferred Mineral Resource Estimate highlights a significant porphyry Cu-Ag resource containing 1.21 Blbs Cu and 17.6 Moz Ag2, with numerous additional targets showing potential for a district-scale porphyry system. Newmont is a 9.5% strategic investor in Metallic Minerals and provides expertise and collaboration on the La Plata project through a joint technical committee. The U.S. Geological Survey has identified the La Plata mining district as a critical minerals resource area under the Earth Mapping Resources Initiative program and has completed significant geologic and geophysical studies to enhance understanding of the critical mineral potential in the district.

In Canada's Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the high-grade Keno Hill silver district, directly adjacent to Hecla Mining's operations, with more than 300 million ounces of high-grade silver in past production and current Reserves and Resources3. The 2024 Inferred Mineral Resource Estimate at the Company's Keno Silver project adds 18.2 Moz Ag Eq grading 223 g/t Ag Eq (120 g/t Ag, 0.10 g/t Au, 0.80% Pb and 1.77% Zn)4 to the Company's total resources. Hecla is the largest primary silver producer in the USA and now in Canada with production from its Keno Hill operations.

Metallic Minerals is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators.

The Company is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in North America, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

www.metallic-minerals.com and info@metallic-minerals.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Footnotes

Yukon Geological Survey ("YGS") Yukon Placer Mining Industry Report 2010-2014.

La Plata Mineral Resource Estimate see news release dated July 31, 2023 and associated NI 43-101 Technical Report dated September 14, 2023, entitled "Mineral Resource Estimate Update for the Allard Cu-Ag Porphyry Deposit, La Plata Project", with an effective date of July 12, 2023. The Mineral Resource has been estimated by Allan Armitage, Ph.D., P.Geo of SGS Geological Services who is an independent Qualified Person. In addition to the company website, the Technical Report is available under the Company's profile at www.sedarplus.ca.

Cathro, R. J. (Bob). Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850; Boyle, R.W., 1965. "Geology, Geochemistry, and Origin of the Lead-Zinc-Silver Deposits of the Keno Hill-Galena Hill Area, Yukon Territory". Bulletin 111, Geological Survey of Canada.

Keno Silver Mineral Resource Estimate see news release dated February 26, 2024 and Technical Report dated April 12, 2024, entitled "Mineral Resource Estimate for the Keno Silver Project, Yukon, Canada", with an effective date of February 1, 2024. The Mineral Resource has been estimated by Allan Armitage, Ph.D., P.Geo of SGS Geological Services who is an independent Qualified Person. In addition to the company website, the Technical Report is available under the Company's profile at www.sedarplus.ca.

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals' mineral properties has been reviewed and approved by Catherine Knight, P. Geo, Vice President, Technical Services for The Metallic Group of Companies, who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Ms. Knight is not independent of the Company.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on ACCESS Newswire