Food ingredient solutions provider Ingredion (NYSE: INGR) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 2.4% year on year to $1.76 billion. Its non-GAAP profit of $2.53 per share was 3.1% below analysts’ consensus estimates.

Is now the time to buy Ingredion? Find out by accessing our full research report, it’s free.

Ingredion (INGR) Q4 CY2025 Highlights:

- Revenue: $1.76 billion vs analyst estimates of $1.79 billion (2.4% year-on-year decline, 1.6% miss)

- Adjusted EPS: $2.53 vs analyst expectations of $2.61 (3.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.40 at the midpoint, in line with analyst estimates

- Operating Margin: 12.5%, up from 9% in the same quarter last year

- Free Cash Flow Margin: 15.4%, down from 16.9% in the same quarter last year

- Constant Currency Revenue fell 3% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $7.45 billion

“We delivered record full-year financial results driven by continued strength in Texture & Healthful Solutions and solid results from our Food & Industrial Ingredients—LATAM business,” stated Jim Zallie, president and CEO of Ingredion.

Company Overview

Known for its ability to turn ordinary corn into thousands of different food ingredients, Ingredion (NYSE: INGR) transforms grains, fruits, vegetables and other plant-based materials into specialty starches, sweeteners and other ingredients for food, beverage and industrial markets.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $7.22 billion in revenue over the past 12 months, Ingredion is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Ingredion likely needs to optimize its pricing or lean into new products and international expansion.

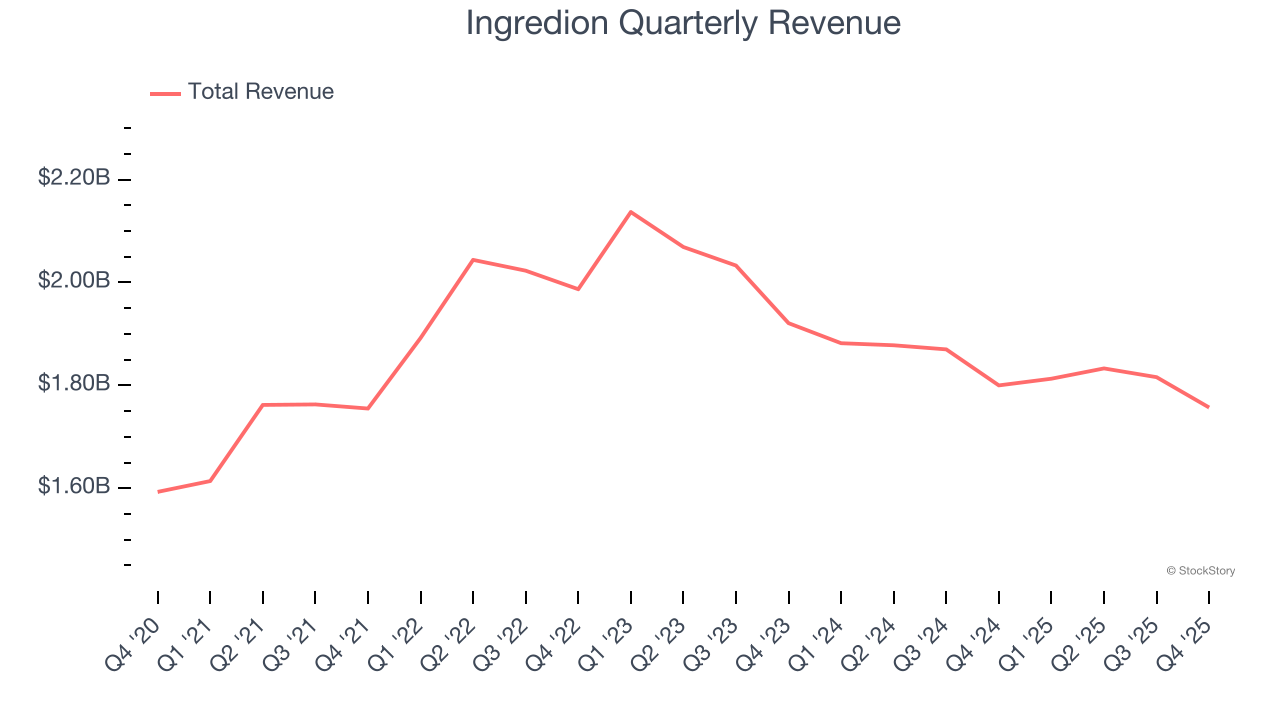

As you can see below, Ingredion struggled to generate demand over the last three years. Its sales dropped by 3.1% annually, a tough starting point for our analysis.

This quarter, Ingredion missed Wall Street’s estimates and reported a rather uninspiring 2.4% year-on-year revenue decline, generating $1.76 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1% over the next 12 months. While this projection implies its newer products will fuel better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

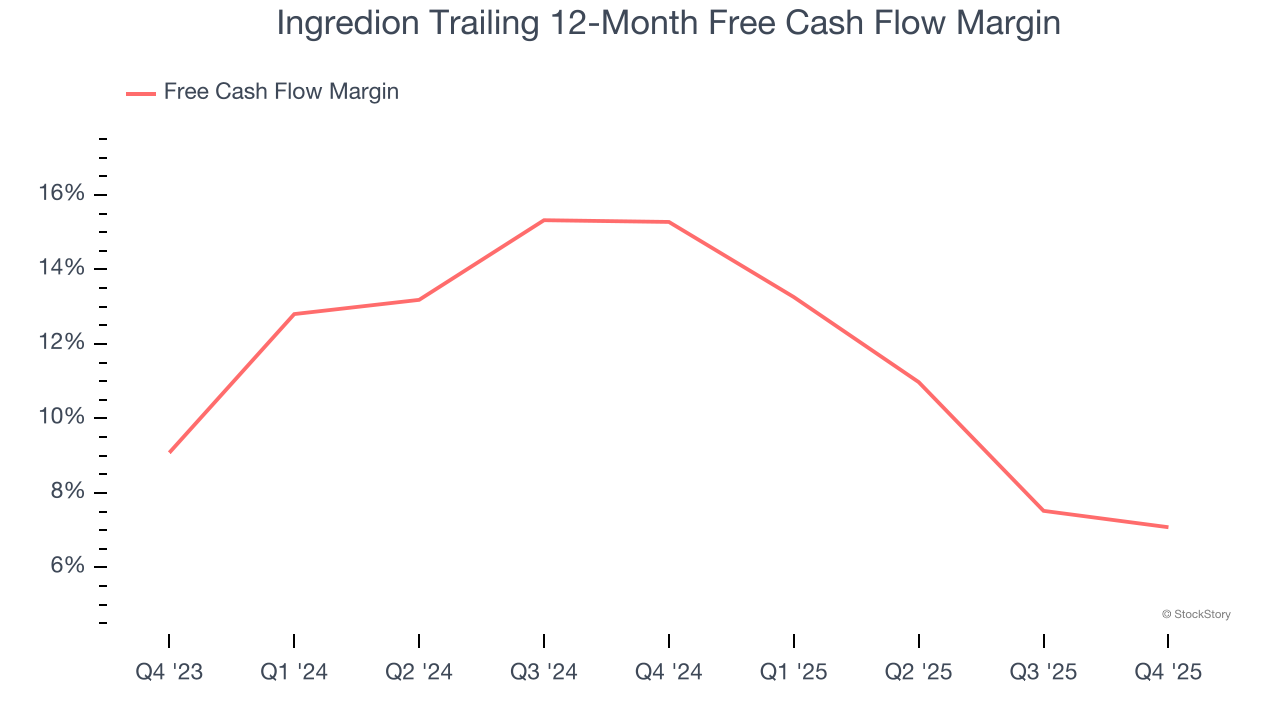

Ingredion has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.2% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that Ingredion’s margin dropped by 8.2 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Ingredion’s free cash flow clocked in at $270 million in Q4, equivalent to a 15.4% margin. The company’s cash profitability regressed as it was 1.6 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Key Takeaways from Ingredion’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its gross margin fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $117.20 immediately following the results.

Ingredion didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).