Nutrition products company Bellring Brands (NYSE: BRBR) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $537.3 million. The company’s full-year revenue guidance of $2.44 billion at the midpoint came in 0.9% above analysts’ estimates. Its non-GAAP profit of $0.37 per share was 16.7% above analysts’ consensus estimates.

Is now the time to buy BellRing Brands? Find out by accessing our full research report, it’s free.

BellRing Brands (BRBR) Q4 CY2025 Highlights:

- Revenue: $537.3 million vs analyst estimates of $503.7 million (flat year on year, 6.7% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.32 (16.7% beat)

- Adjusted EBITDA: $90.3 million vs analyst estimates of $80.97 million (16.8% margin, 11.5% beat)

- The company dropped its revenue guidance for the full year to $2.44 billion at the midpoint from $2.45 billion, a 0.6% decrease

- EBITDA guidance for the full year is $432.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 14.6%, down from 21.6% in the same quarter last year

- Organic Revenue was flat year on year (beat)

- Sales Volumes were flat year on year (20.8% in the same quarter last year)

- Market Capitalization: $2.89 billion

“We delivered first quarter results ahead of our guidance, primarily due to favorable timing, and our operating plans remain on track,” said Darcy H. Davenport, President and Chief Executive Officer of BellRing.

Company Overview

Spun out of Post Holdings in 2019, Bellring Brands (NYSE: BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.32 billion in revenue over the past 12 months, BellRing Brands is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

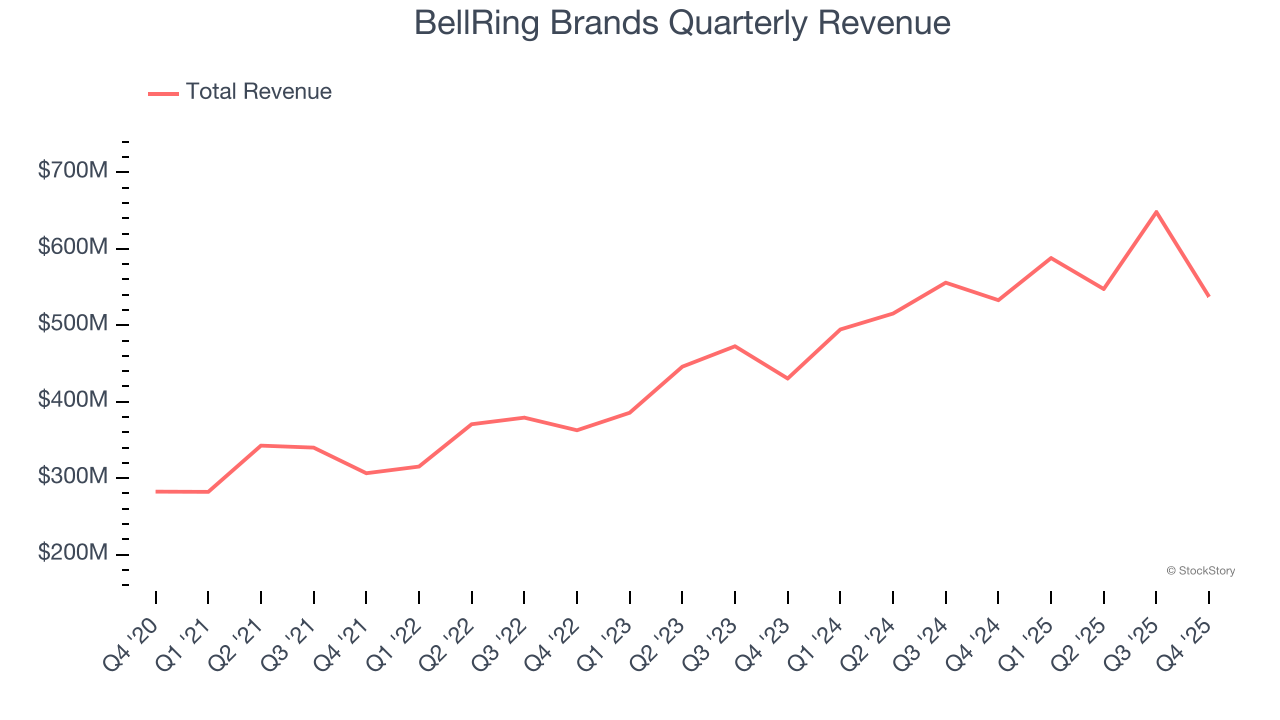

As you can see below, BellRing Brands’s 17.6% annualized revenue growth over the last three years was impressive as consumers bought more of its products.

This quarter, BellRing Brands’s $537.3 million of revenue was flat year on year but beat Wall Street’s estimates by 6.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market is forecasting some success for its newer products.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Volume Growth

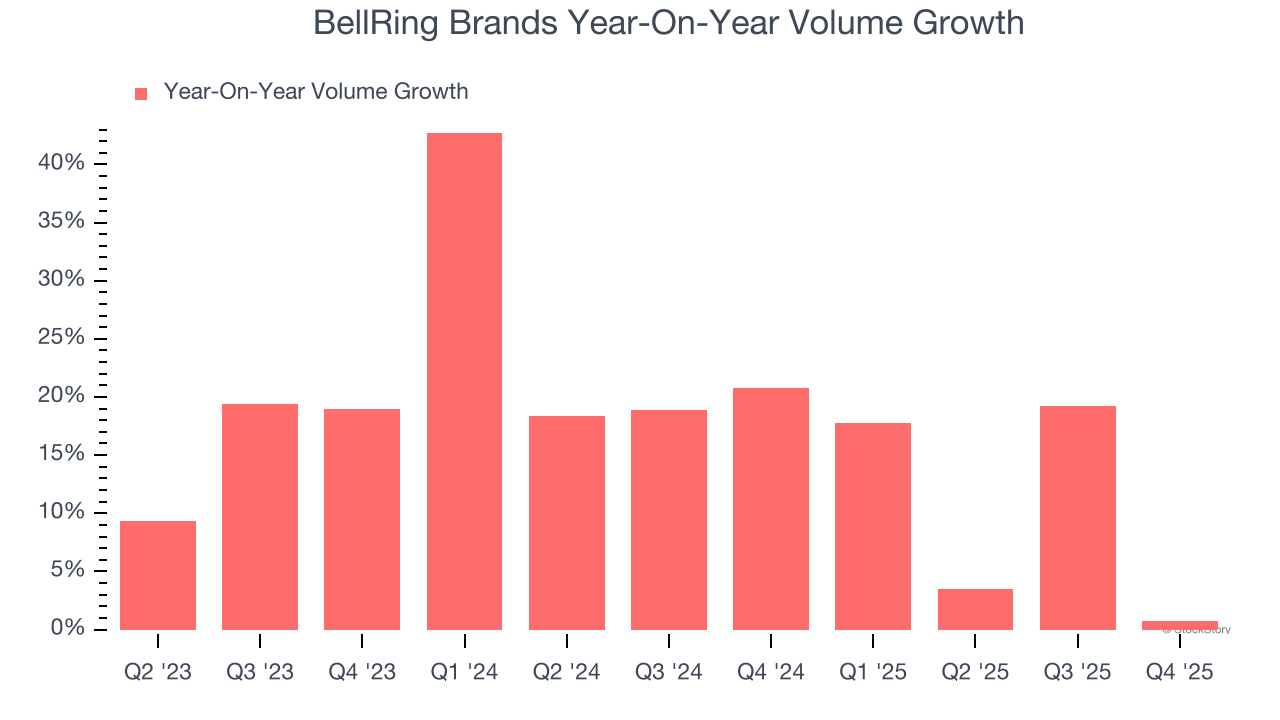

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether BellRing Brands generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, BellRing Brands’s average quarterly volume growth of 17.8% has outpaced the competition by a long shot. In the context of its 16.3% average organic revenue growth, we can see that most of the company’s gains have come from more customers purchasing its products.

In BellRing Brands’s Q4 2026, year on year sales volumes were flat. This result was a meaningful deceleration from its historical levels. We’ll be watching closely to see if BellRing Brands can reaccelerate demand for its products.

Key Takeaways from BellRing Brands’s Q4 Results

We were impressed by how significantly BellRing Brands blew past analysts’ EBITDA expectations this quarter. We were also excited its organic revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its gross margin missed and full year revenue guidance was slightly reduced. Zooming out, we think this quarter was mixed. The stock remained flat at $24.39 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).