The past six months have been a windfall for Nubank’s shareholders. The company’s stock price has jumped 51.1%, hitting $18.18 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy NU? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On NU?

With well over one hundred million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE: NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

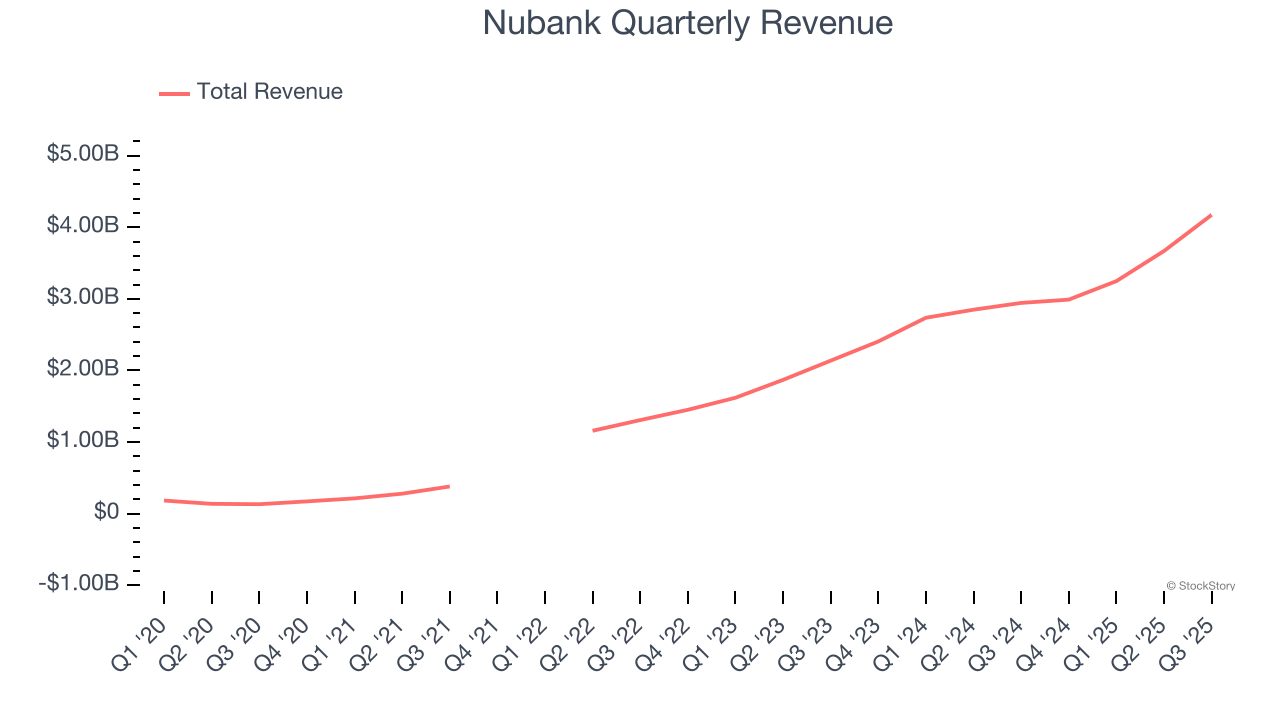

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Luckily, Nubank’s revenue grew at an incredible 89.6% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

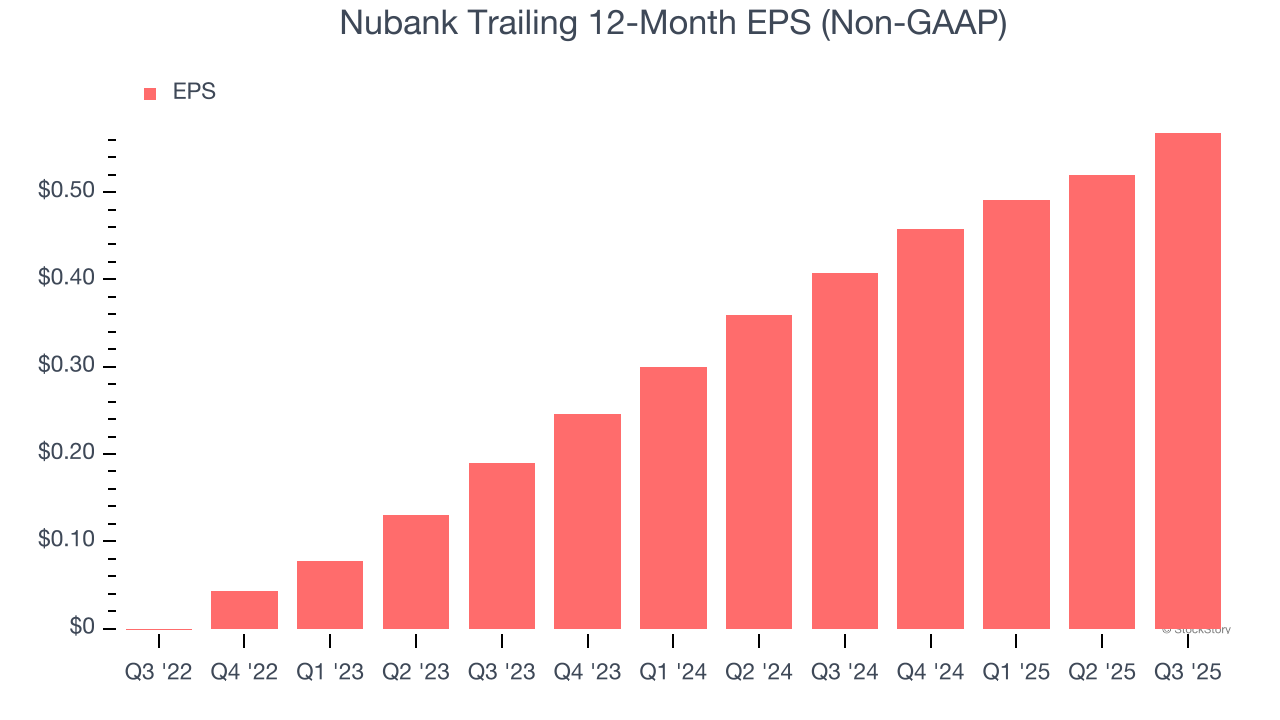

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Nubank’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why Nubank is a cream-of-the-crop financials company, and with the recent rally, the stock trades at 20.7× forward P/E (or $18.18 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Nubank

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.