Real estate franchise company RE/MAX (NYSE: RMAX) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.8% year on year to $71.14 million. On the other hand, next quarter’s revenue guidance of $71.5 million was less impressive, coming in 3% below analysts’ estimates. Its non-GAAP profit of $0.30 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy RE/MAX? Find out by accessing our full research report, it’s free.

RE/MAX (RMAX) Q4 CY2025 Highlights:

- Revenue: $71.14 million vs analyst estimates of $71.42 million (1.8% year-on-year decline, in line)

- Adjusted EPS: $0.30 vs analyst estimates of $0.28 (5.4% beat)

- Adjusted EBITDA: $22.4 million vs analyst estimates of $21.22 million (31.5% margin, 5.6% beat)

- Revenue Guidance for Q1 CY2026 is $71.5 million at the midpoint, below analyst estimates of $73.71 million

- EBITDA guidance for the upcoming financial year 2026 is $95 million at the midpoint, above analyst estimates of $93.61 million

- Operating Margin: 13.1%, up from 5.9% in the same quarter last year

- Free Cash Flow Margin: 14.3%, down from 22.1% in the same quarter last year

- Agents: 148,660, up 2,033 year on year

- Market Capitalization: $137 million

"Our strategy is working and is beginning to yield results even though 2025 marked the third consecutive year of a historically tough housing market in the United States and Canada. We exited 2025 with strong momentum across both of our networks, driven by record global agent count growth, our best fourth quarter U.S. agent performance since 2021, and a renewed excitement for the REMAX brand given enhancements to our overall value proposition. In January we also saw the largest conversion in our history as nearly 1,200 agents led by visionary entrepreneurs chose to join our market-leading brand in Canada, an exciting start to the year," said Erik Carlson, Chief Executive Officer.

Company Overview

Short for Real Estate Maximums, RE/MAX (NYSE: RMAX) operates a real estate franchise network spanning over 100 countries and territories.

Revenue Growth

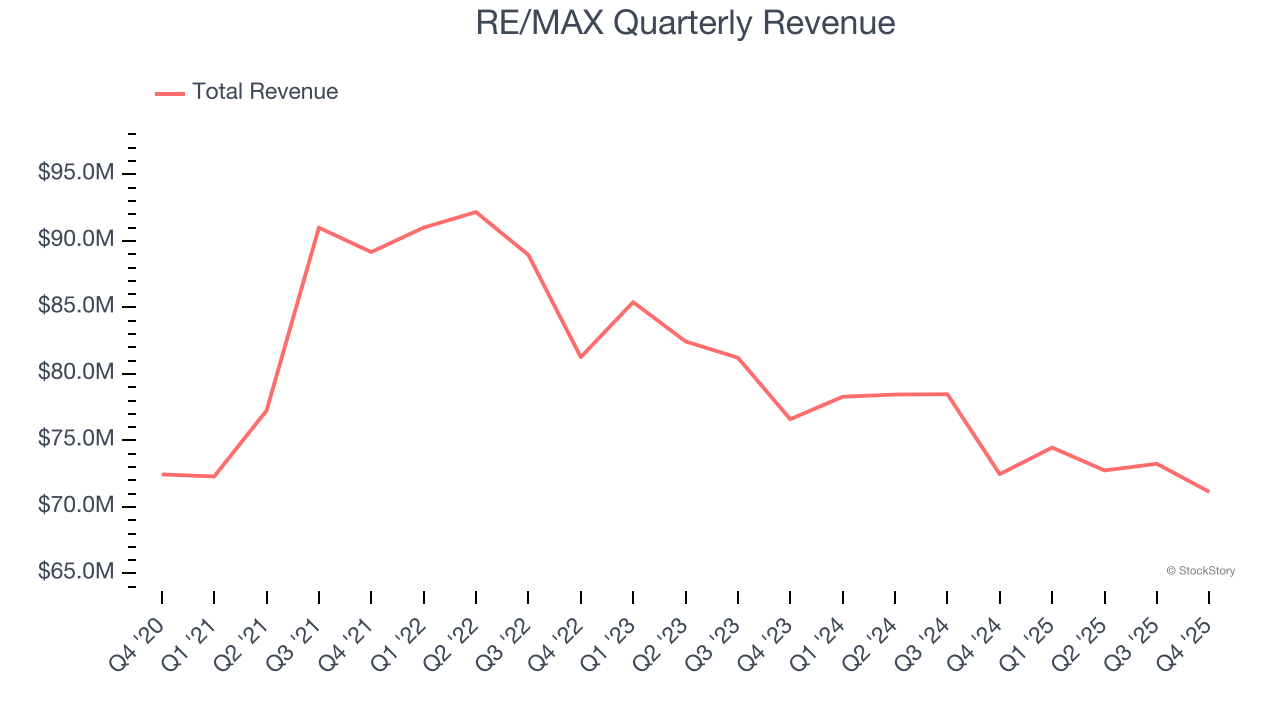

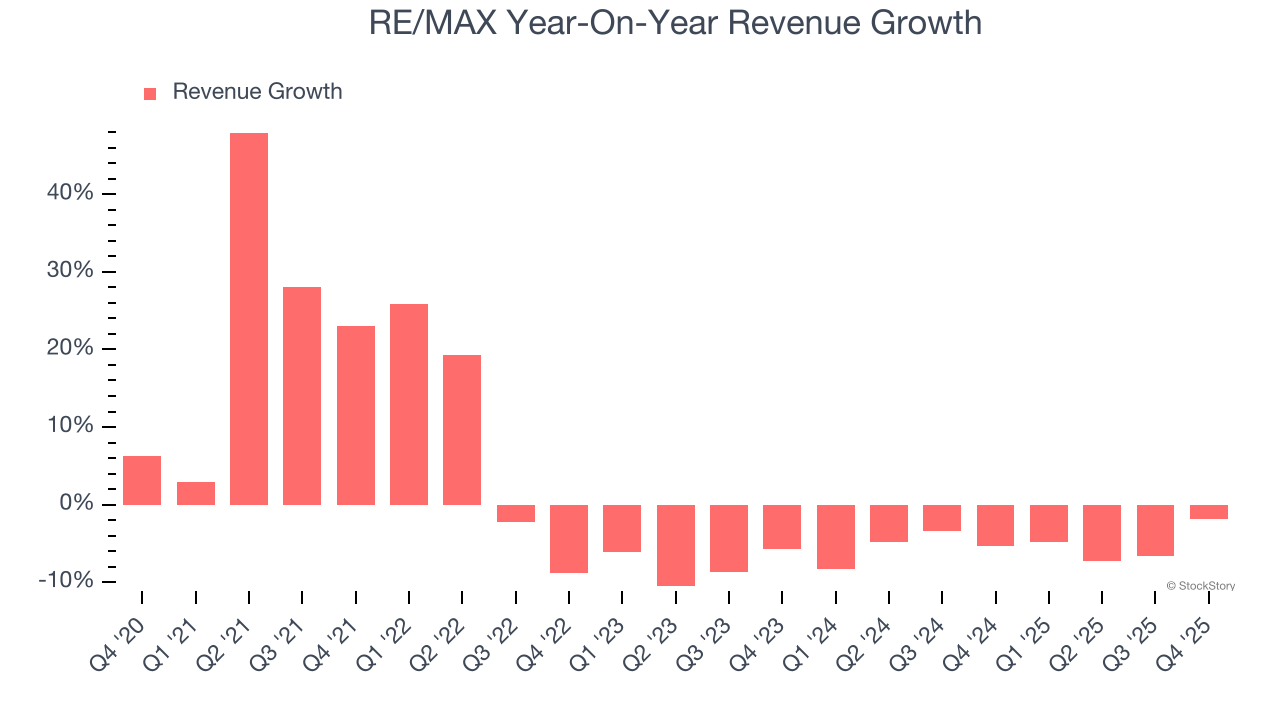

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, RE/MAX’s 1.9% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. RE/MAX’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.4% annually.

We can dig further into the company’s revenue dynamics by analyzing its number of agents, which reached 148,660 in the latest quarter. Over the last two years, RE/MAX’s agents averaged 1.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, RE/MAX reported a rather uninspiring 1.8% year-on-year revenue decline to $71.14 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

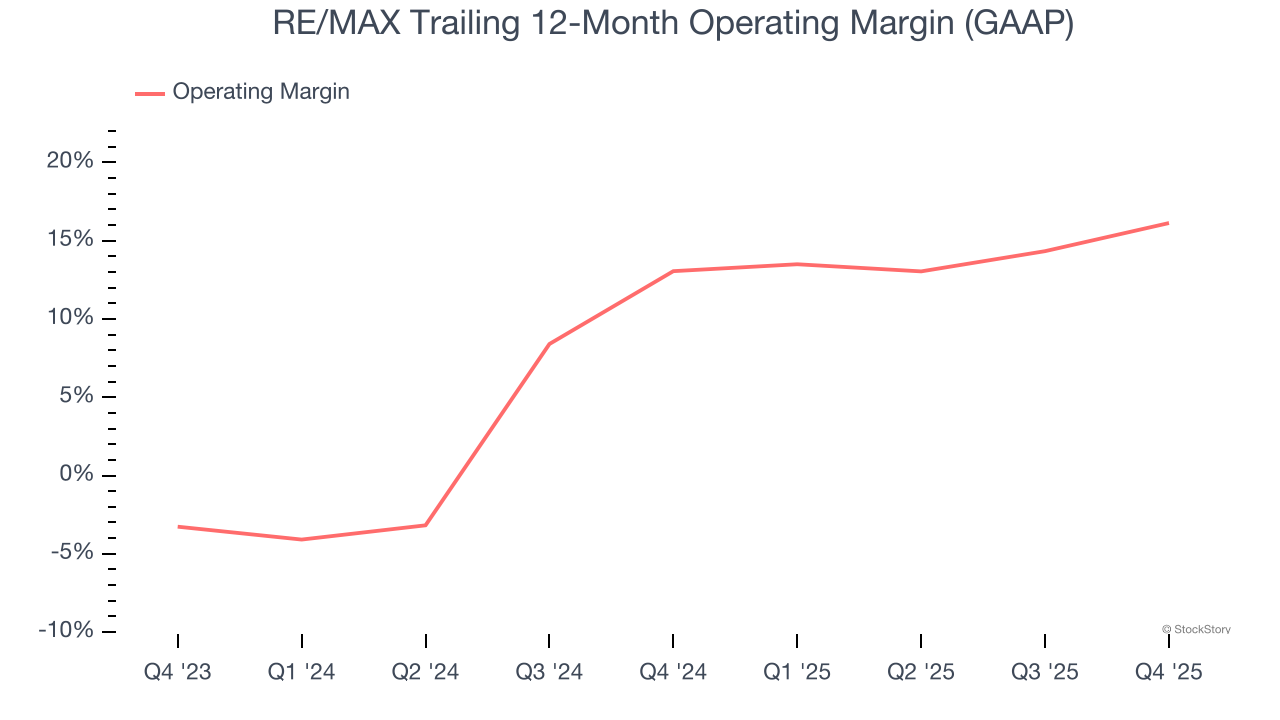

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

RE/MAX’s operating margin has risen over the last 12 months and averaged 14.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q4, RE/MAX generated an operating margin profit margin of 13.1%, up 7.2 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

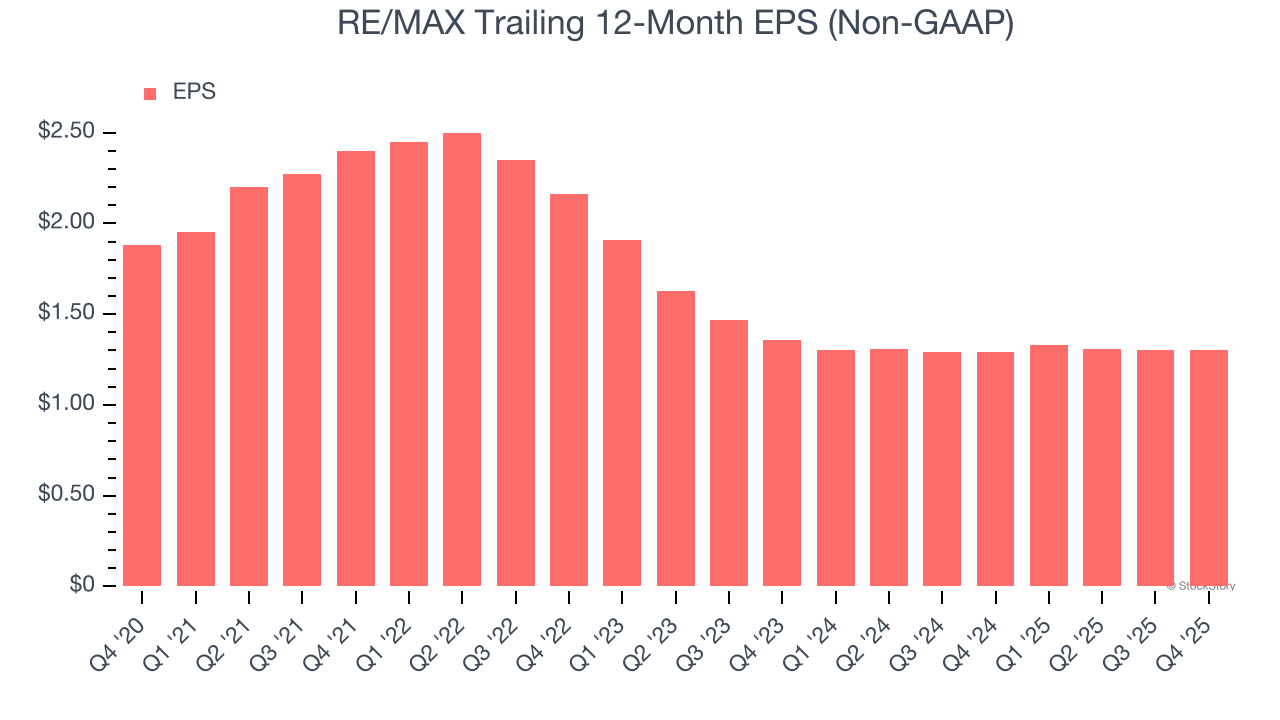

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for RE/MAX, its EPS declined by 7.1% annually over the last five years while its revenue grew by 1.9%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q4, RE/MAX reported adjusted EPS of $0.30, in line with the same quarter last year. This print beat analysts’ estimates by 5.4%. Over the next 12 months, Wall Street expects RE/MAX’s full-year EPS of $1.30 to stay about the same.

Key Takeaways from RE/MAX’s Q4 Results

It was encouraging to see RE/MAX beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.6% to $6.76 immediately following the results.

RE/MAX may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).