Global payments company American Express (NYSE: AXP) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 10.6% year on year to $17.57 billion. Its GAAP profit of $3.53 per share was in line with analysts’ consensus estimates.

Is now the time to buy American Express? Find out by accessing our full research report, it’s free.

American Express (AXP) Q4 CY2025 Highlights:

- Revenue: $17.57 billion vs analyst estimates of $18.93 billion (10.6% year-on-year growth, 7.2% miss)

- Pre-tax Profit: $3.09 billion (17.6% margin)

- EPS (GAAP): $3.53 vs analyst estimates of $3.53 (in line)

- Market Capitalization: $247 billion

Company Overview

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE: AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

Revenue Growth

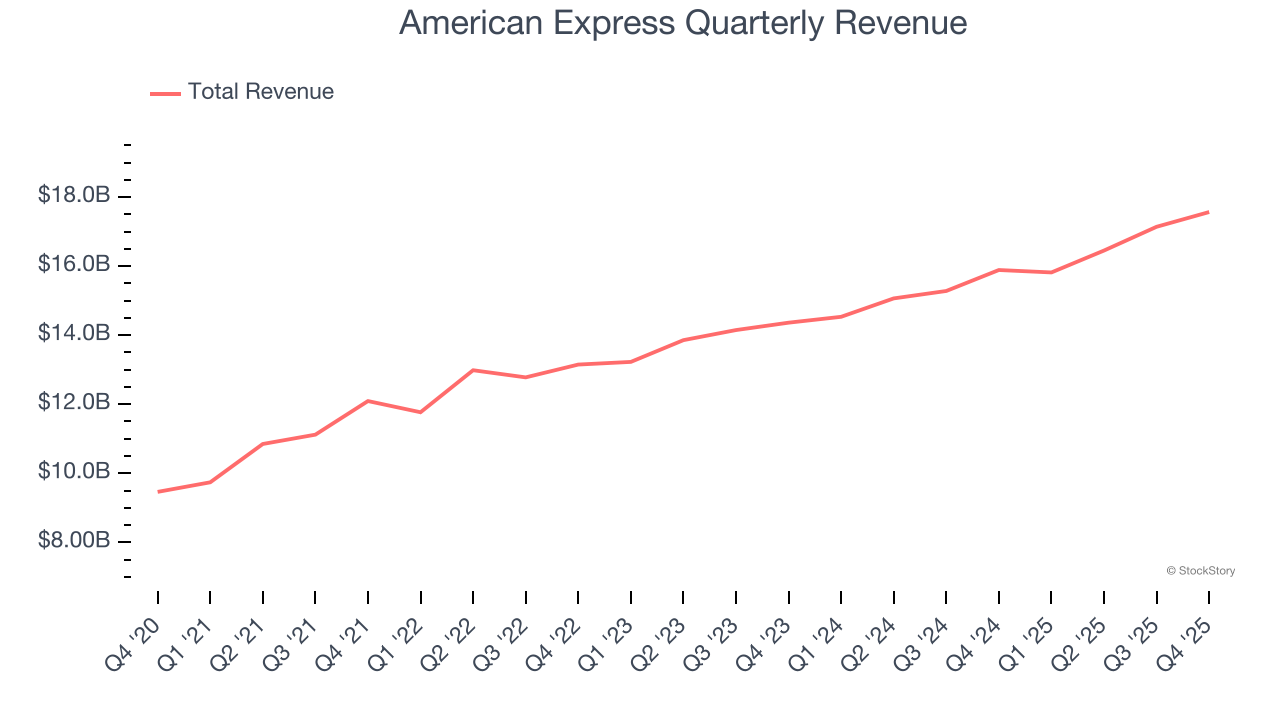

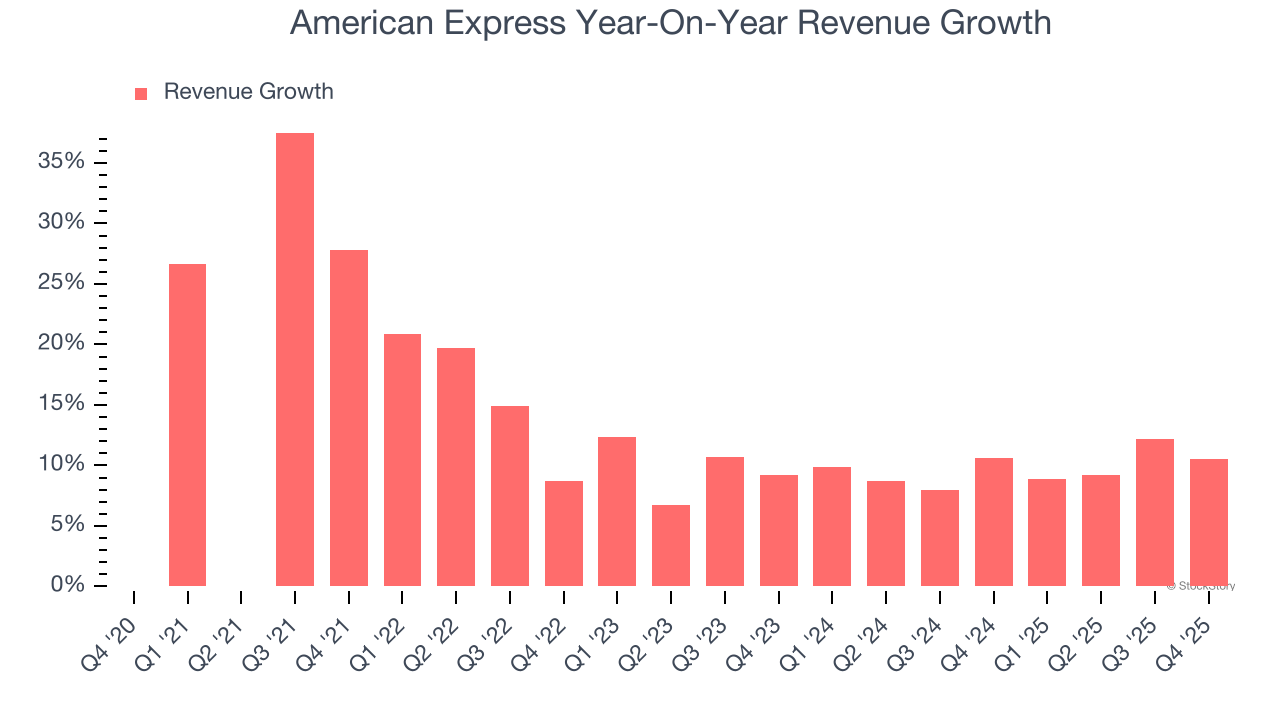

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, American Express’s 16.4% annualized revenue growth over the last five years was impressive. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. American Express’s annualized revenue growth of 9.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, American Express’s revenue grew by 10.6% year on year to $17.57 billion but fell short of Wall Street’s estimates.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from American Express’s Q4 Results

We struggled to find many positives in these results. Revenue missed, and EPS was just in line. Overall, this was a weaker quarter. The stock traded down 2.6% to $349.20 immediately following the results.

The latest quarter from American Express’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).