The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Tractor Supply (NASDAQ: TSCO) and the rest of the specialty retail stocks fared in Q3.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 4 specialty retail stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.4% since the latest earnings results.

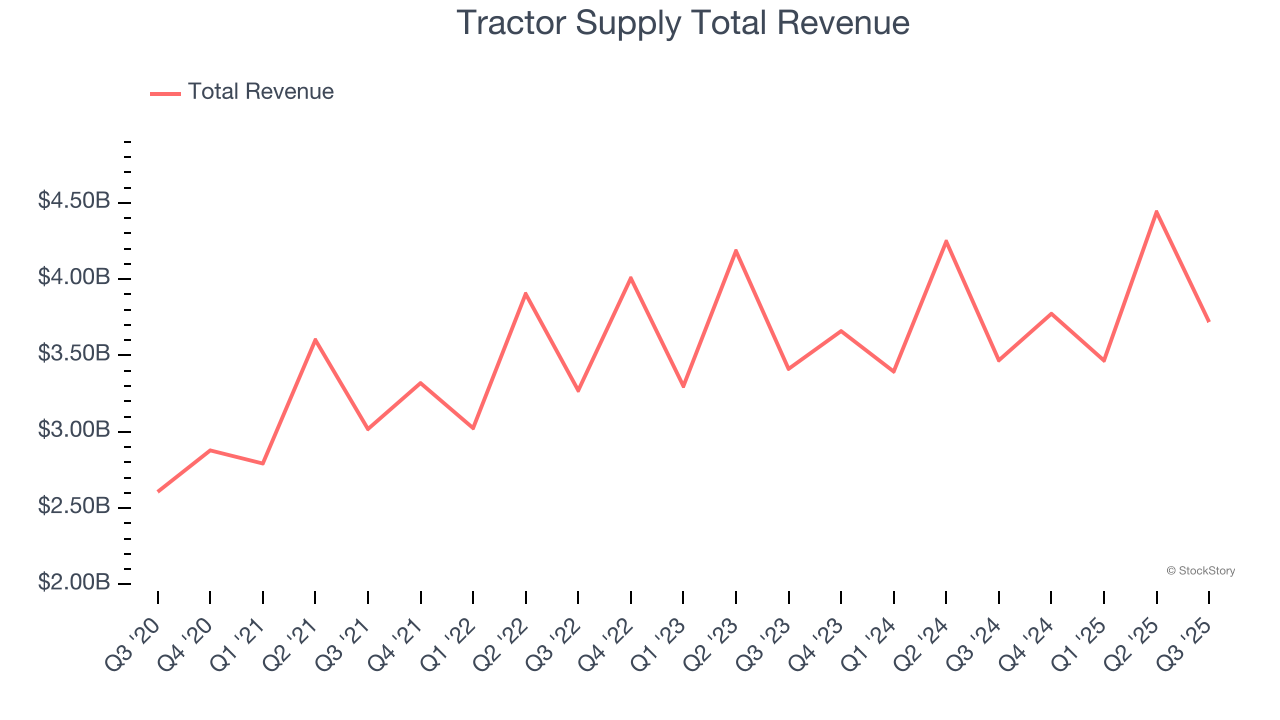

Tractor Supply (NASDAQ: TSCO)

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ: TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Tractor Supply reported revenues of $3.72 billion, up 7.2% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with EPS in line with analysts’ estimates but a slight miss of analysts’ EBITDA estimates.

“The Tractor Supply team delivered a strong third quarter. This performance was driven by ongoing share gains, agile execution through an extended summer season and healthy transaction growth,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

Unsurprisingly, the stock is down 1.1% since reporting and currently trades at $54.25.

Read our full report on Tractor Supply here, it’s free.

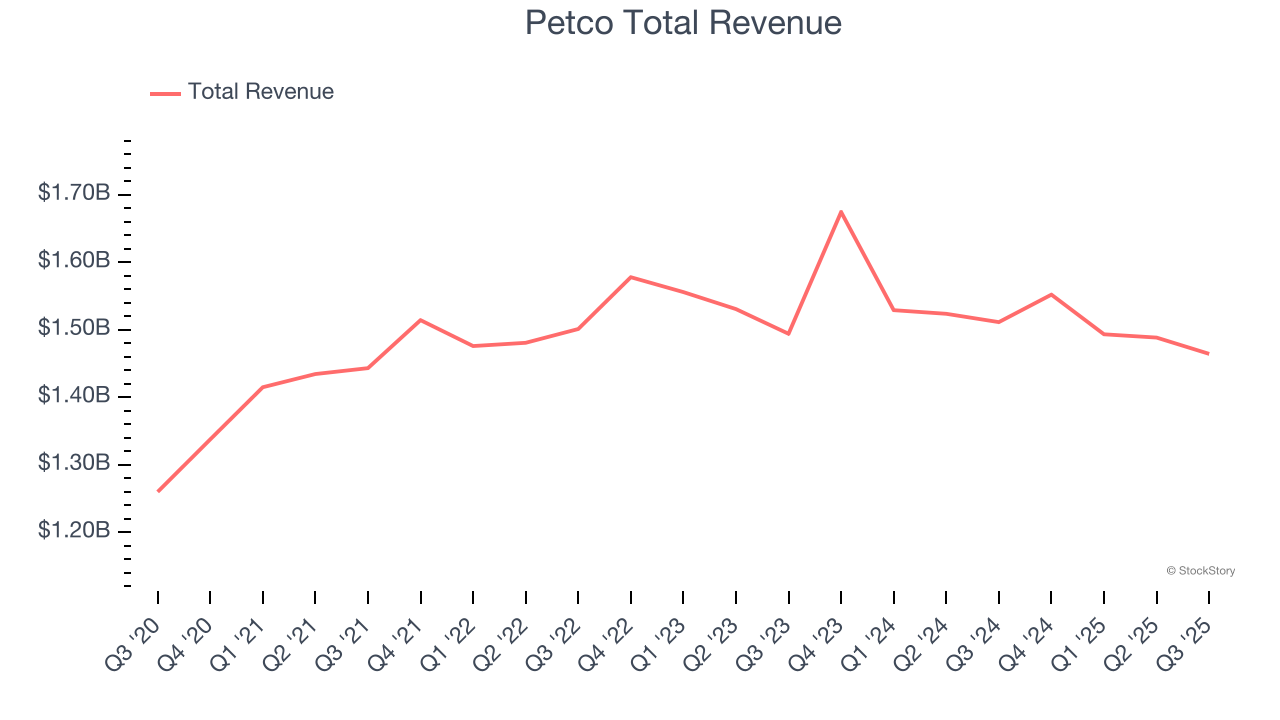

Best Q3: Petco (NASDAQ: WOOF)

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ: WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Petco reported revenues of $1.46 billion, down 3.1% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a mixed quarter with a beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $2.95.

Is now the time to buy Petco? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Leslie's (NASDAQ: LESL)

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ: LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

Leslie's reported revenues of $389.2 million, down 2.2% year on year, exceeding analysts’ expectations by 4.2%. Still, it was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

Leslie's delivered the biggest analyst estimates beat but had the weakest full-year guidance update in the group. As expected, the stock is down 52% since the results and currently trades at $1.72.

Read our full analysis of Leslie’s results here.

National Vision (NASDAQ: EYE)

Operating under multiple brands, National Vision (NYSE: EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

National Vision reported revenues of $487.3 million, up 7.9% year on year. This number topped analysts’ expectations by 3%. Zooming out, it was a mixed quarter as it also logged a solid beat of analysts’ revenue estimates but full-year EPS guidance missing analysts’ expectations.

National Vision delivered the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 4.1% since reporting and currently trades at $26.66.

Read our full, actionable report on National Vision here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.