Nasdaq trades at $101.49 per share and has stayed right on track with the overall market, gaining 13.7% over the last six months. At the same time, the S&P 500 has returned 10%.

Is there a buying opportunity in Nasdaq, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Nasdaq Not Exciting?

We're sitting this one out for now. Here is one reason there are better opportunities than NDAQ and a stock we'd rather own.

Recent EPS Growth Below Our Standards

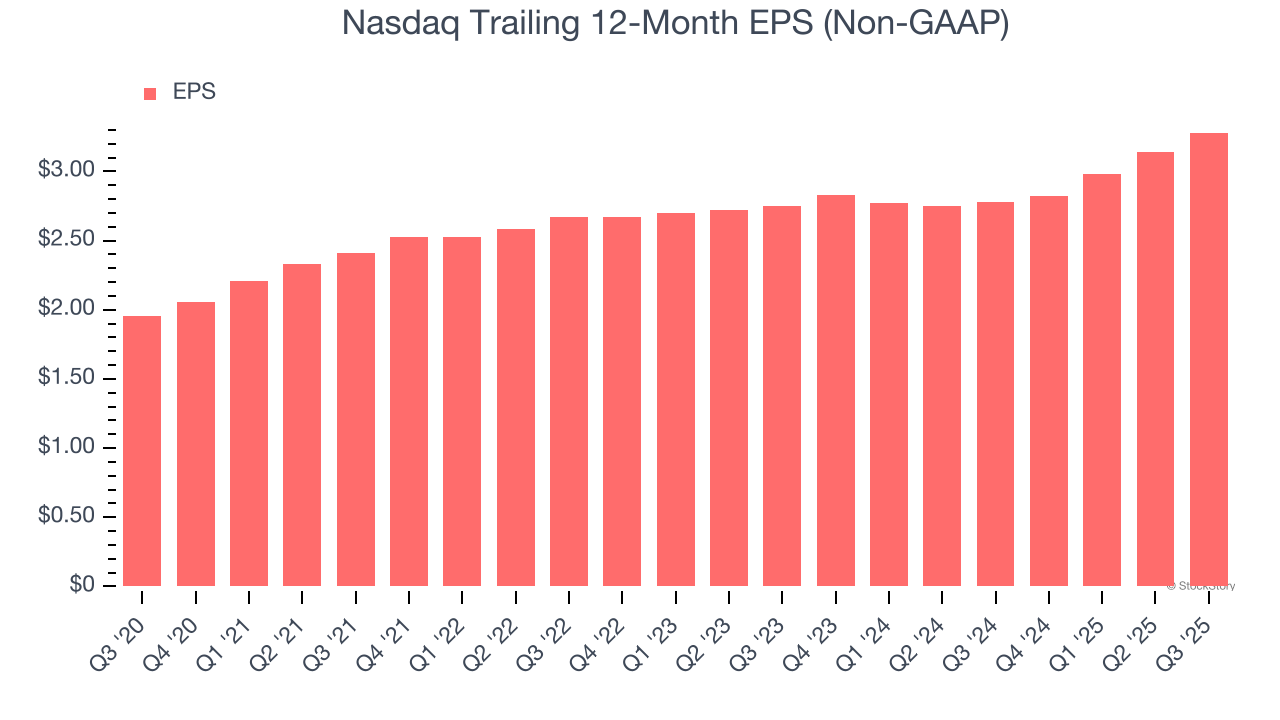

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Nasdaq’s EPS grew at an unimpressive 9.2% compounded annual growth rate over the last two years, lower than its 17.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Nasdaq isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 26.9× forward P/E (or $101.49 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Nasdaq

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.