Compass Diversified has gotten torched over the last six months - since March 2025, its stock price has dropped 62.5% to $7.23 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Compass Diversified, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Compass Diversified Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in Compass Diversified. Here are three reasons we avoid CODI and a stock we'd rather own.

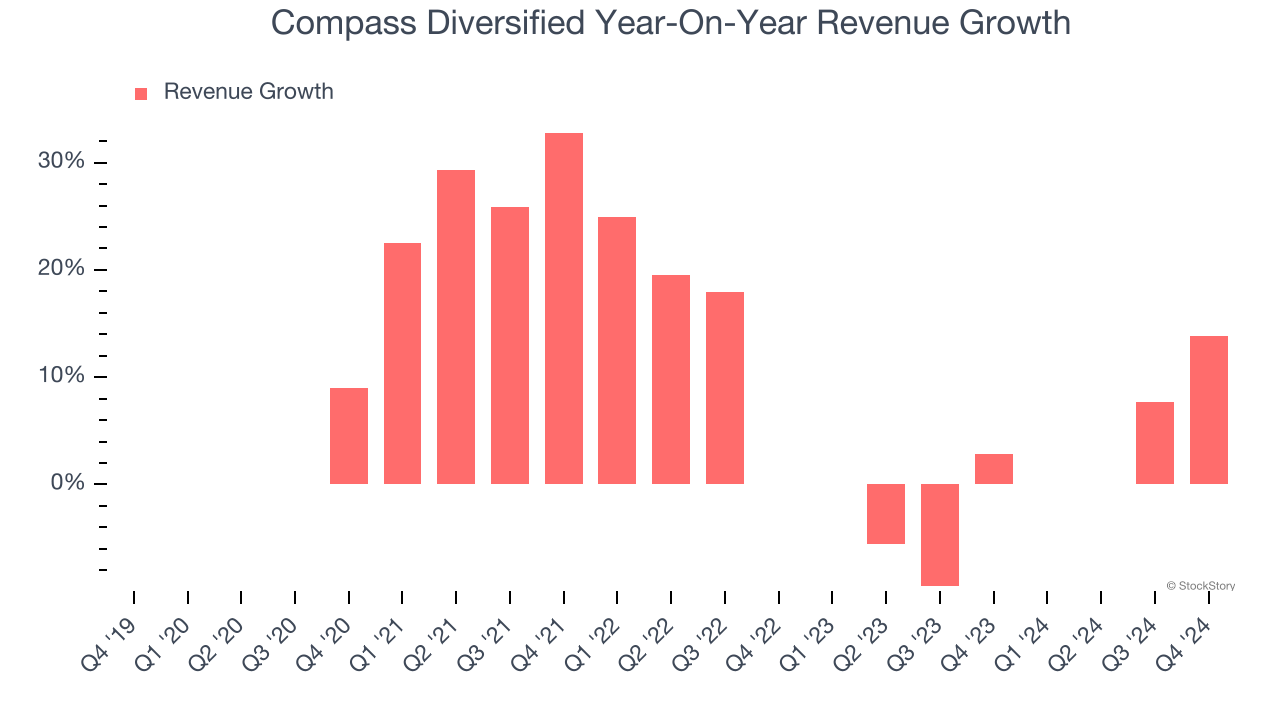

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Compass Diversified’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

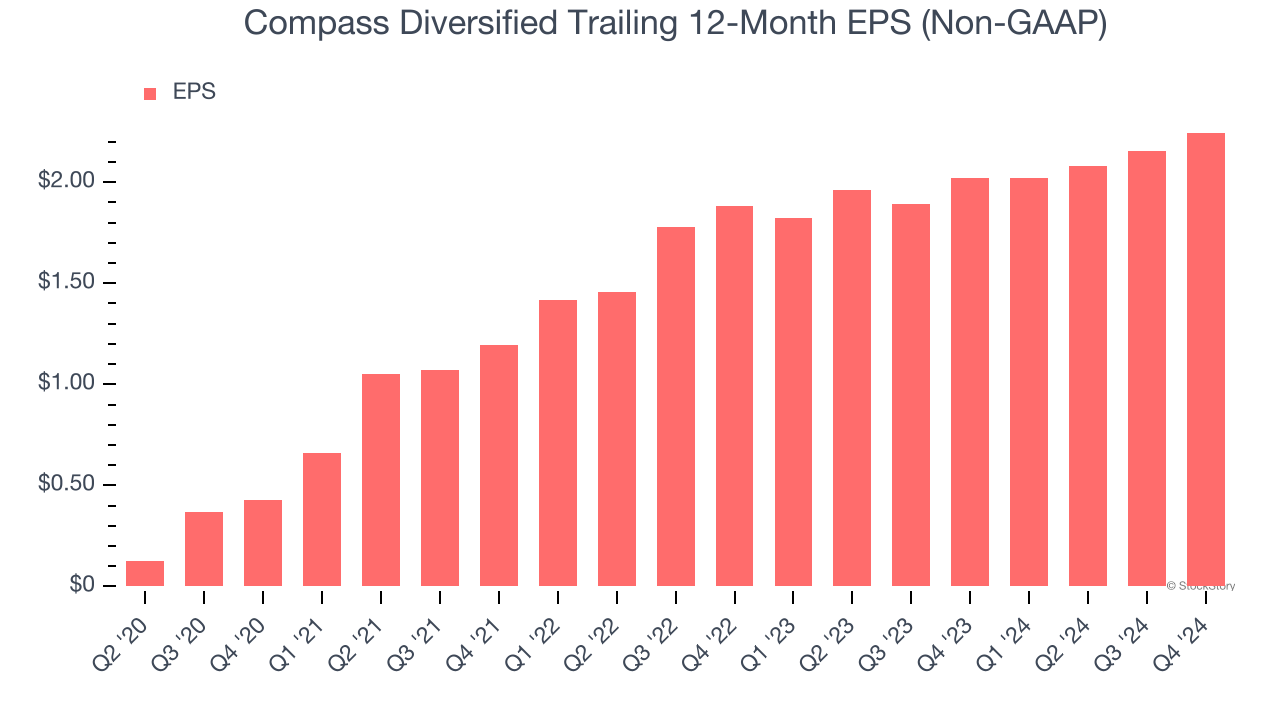

2. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Compass Diversified’s EPS grew at an unimpressive 9.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

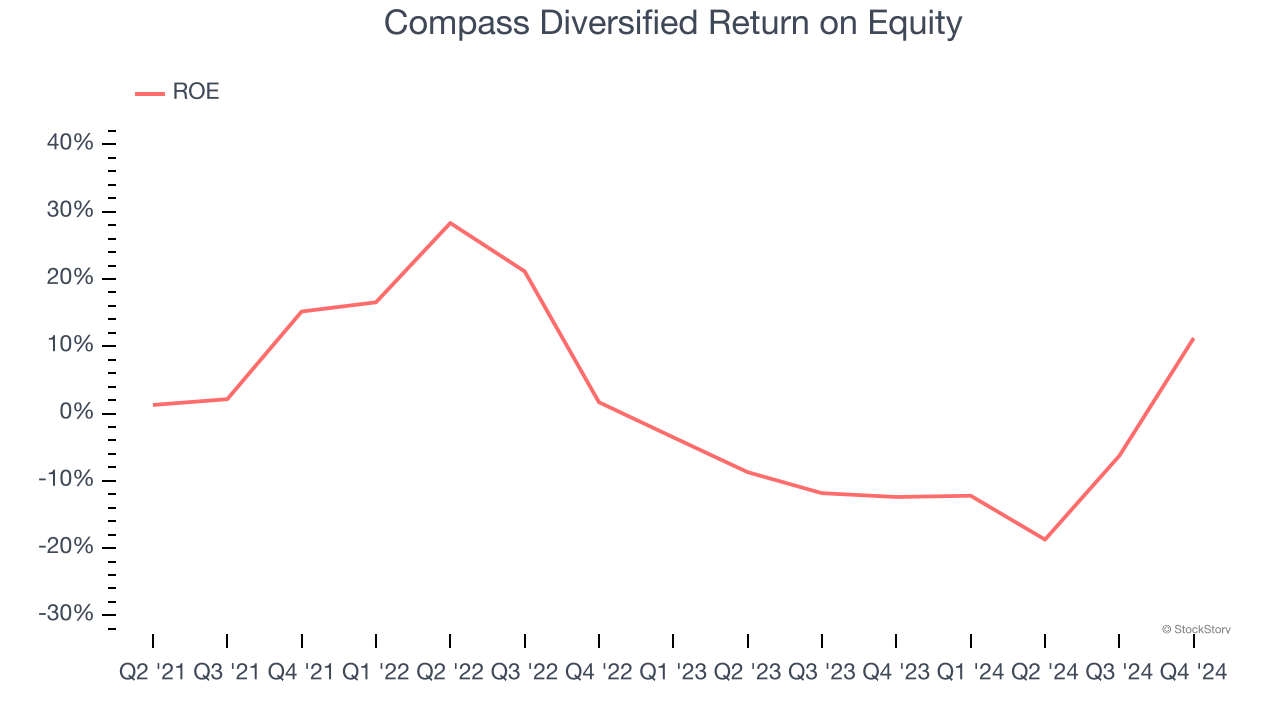

3. Previous Growth Initiatives Haven’t Paid Off Yet

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Compass Diversified has averaged an ROE of 1%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

Compass Diversified isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 3.1× forward P/E (or $7.23 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Compass Diversified

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.