Wrapping up Q1 earnings, we look at the numbers and key takeaways for the automation software stocks, including UiPath (NYSE: PATH) and its peers.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 5.9% while next quarter’s revenue guidance was in line.

Luckily, automation software stocks have performed well with share prices up 10.1% on average since the latest earnings results.

UiPath (NYSE: PATH)

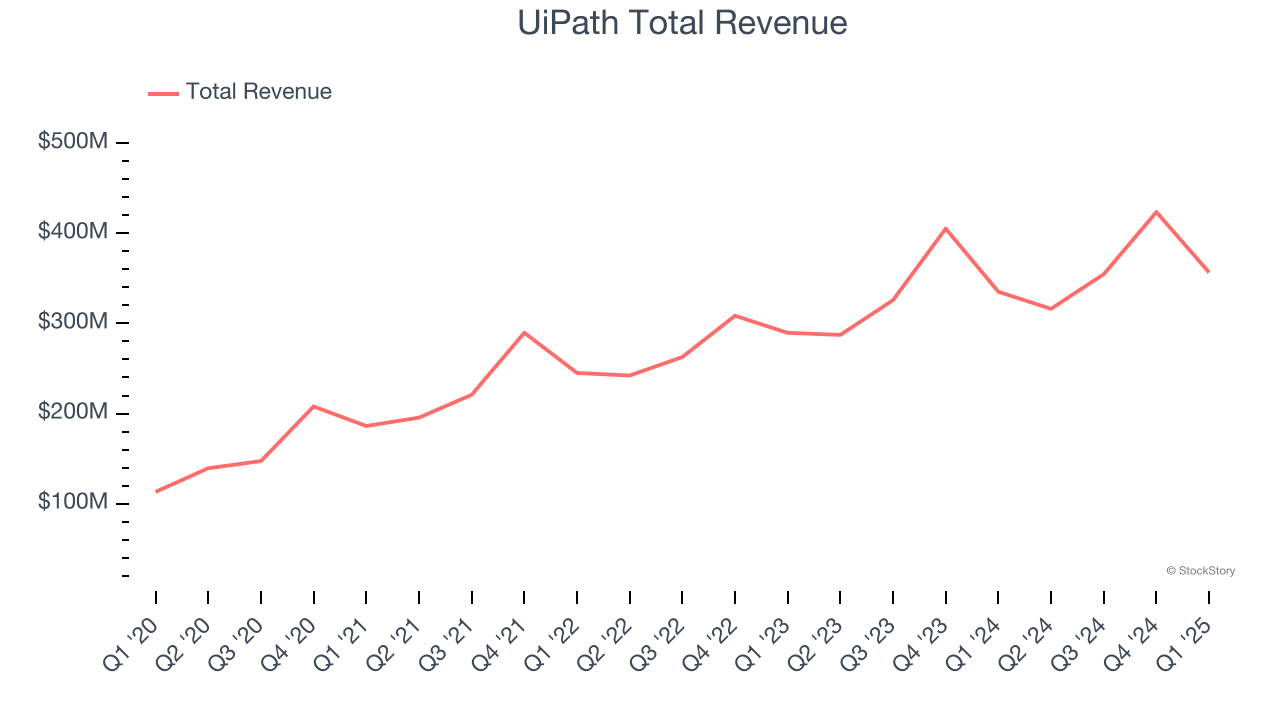

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE: PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $356.6 million, up 6.4% year on year. This print exceeded analysts’ expectations by 7.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

“I'm pleased with our first quarter results, highlighted by ARR of $1.693 billion, up 12 percent year-over-year, a reflection of our improved execution and the meaningful ROI our customers are realizing through our automation platform,” said Daniel Dines, UiPath Founder and Chief Executive Officer.

UiPath delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 4.1% since reporting and currently trades at $12.43.

Is now the time to buy UiPath? Access our full analysis of the earnings results here, it’s free.

Best Q1: Pegasystems (NASDAQ: PEGA)

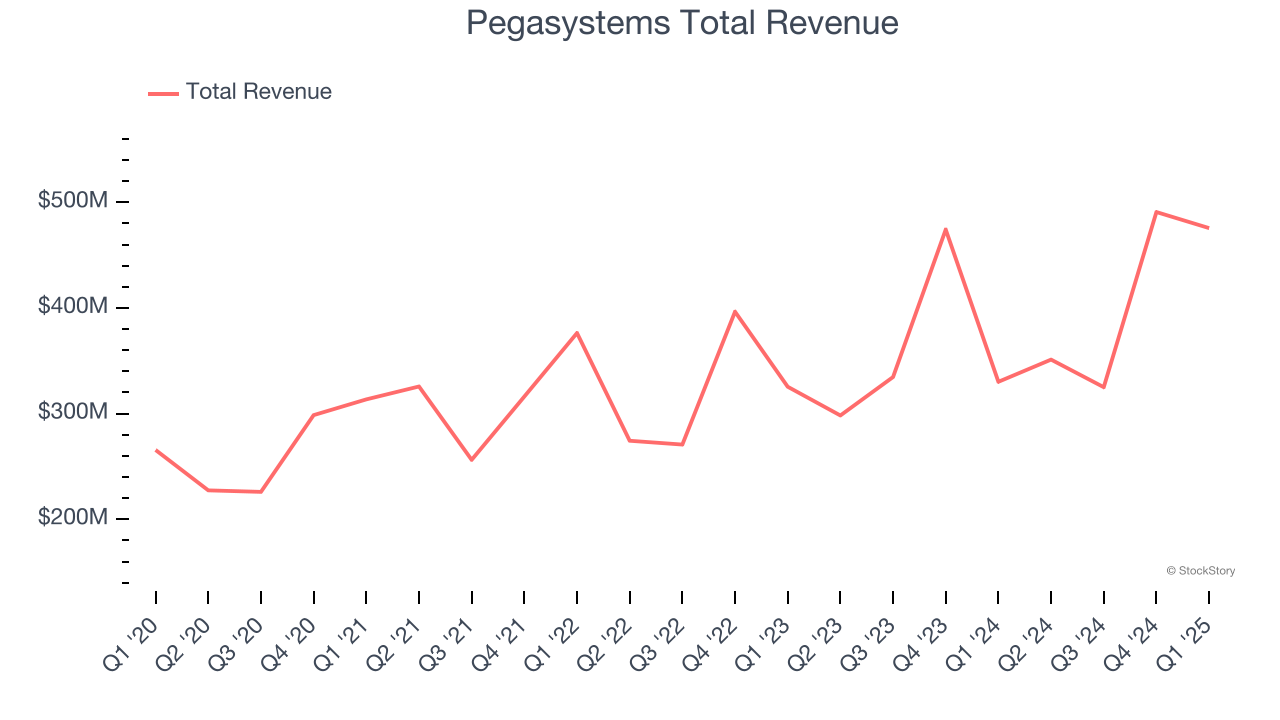

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 44.1% since reporting. It currently trades at $49.59.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 15.7% since the results and currently trades at $11.26.

Read our full analysis of SoundHound AI’s results here.

ServiceNow (NYSE: NOW)

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE: NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $3.09 billion, up 18.6% year on year. This print was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ current remaining performance obligation estimates but a miss of analysts’ billings estimates.

The stock is up 17.2% since reporting and currently trades at $954.34.

Read our full, actionable report on ServiceNow here, it’s free.

Microsoft (NASDAQ: MSFT)

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $70.07 billion, up 13.3% year on year. This result surpassed analysts’ expectations by 2.3%. It was a very strong quarter as it also put up an impressive beat of analysts’ operating income estimates and a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat.

The stock is up 28.4% since reporting and currently trades at $503.72.

Read our full, actionable report on Microsoft here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.