As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at consumer internet stocks, starting with Amazon (NASDAQ: AMZN).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 19 consumer internet stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 1.1% above.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

Best Q4: Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

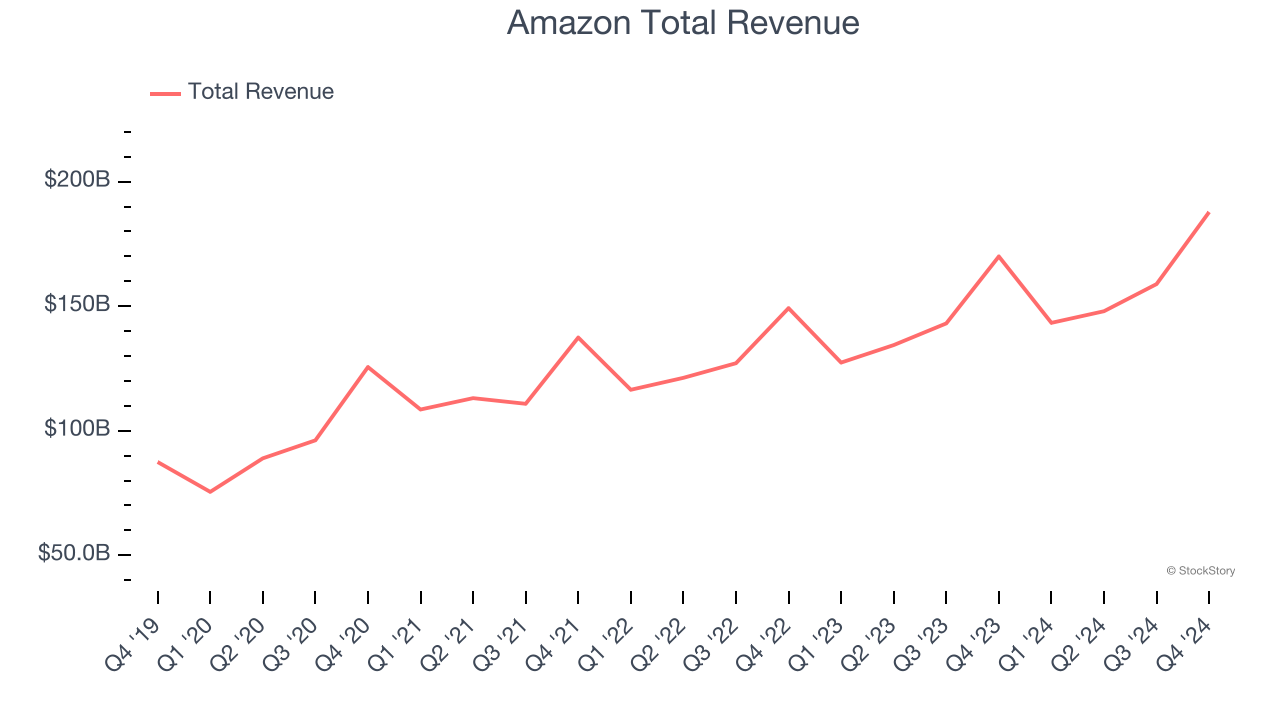

Amazon reported revenues of $187.8 billion, up 10.5% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates but operating income guidance for next quarter missing analysts’ expectations.

“The holiday shopping season was the most successful yet for Amazon and we appreciate the support of our customers, selling partners, and employees who helped make it so,” said Andy Jassy, President and CEO, Amazon.

The stock is down 4.4% since reporting and currently trades at $228.25.

Is now the time to buy Amazon? Access our full analysis of the earnings results here, it’s free.

Alphabet (NASDAQ: GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

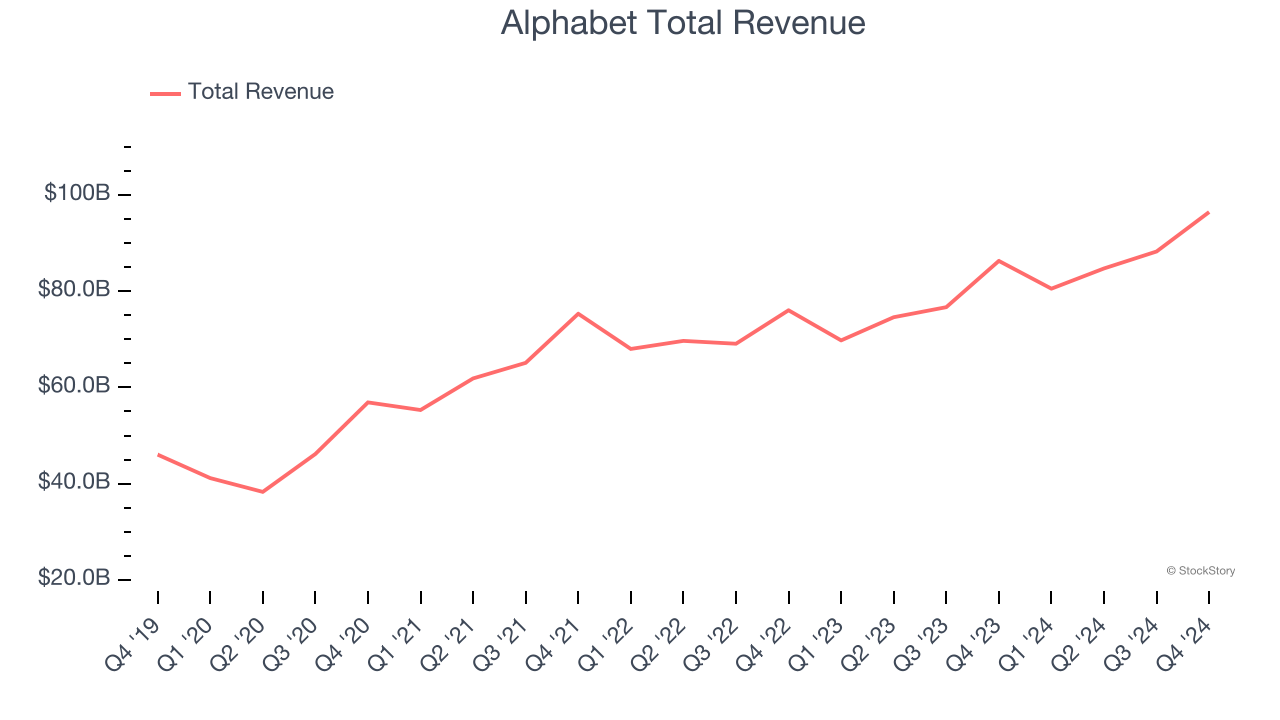

Alphabet reported revenues of $96.47 billion, up 11.8% year on year, in line with analysts’ expectations. It was encouraging to see Alphabet beat analysts’ operating income expectations this quarter. On the other hand, its total revenue was in line and its all-important Google Cloud revenue missed, spooking some investors with high expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11.3% since reporting. It currently trades at $182.95.

Is now the time to buy Alphabet? Access our full analysis of the earnings results here, it’s free.

Robinhood (NASDAQ: HOOD)

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $1.01 billion, up 115% year on year, exceeding analysts’ expectations by 7.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of funded customers estimates.

Interestingly, the stock is up 14.6% since the results and currently trades at $64.15.

Read our full analysis of Robinhood’s results here.

Meta (NASDAQ: META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Meta reported revenues of $48.39 billion, up 20.6% year on year. This print topped analysts’ expectations by 2.9%. More broadly, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates, but revenue guidance for next quarter missing analysts’ expectations significantly.

The company reported 3.35 billion daily active users, up 5%xx year on year. The stock is up 6.8% since reporting and currently trades at $722.58.

Read our full, actionable report on Meta here, it’s free.

Uber (NYSE: UBER)

Notoriously funded with $7.7 billion from the Softbank Vision Fund, Uber (NYSE: UBER) operates a platform of on-demand services such as ride-hailing, food delivery, and freight.

Uber reported revenues of $11.96 billion, up 20.4% year on year. This number beat analysts’ expectations by 1.6%. Zooming out, it was a satisfactory quarter as it also produced strong growth in its users but EBITDA in line with analysts’ estimates.

The company reported 171 million users, up 14%xx year on year. The stock is up 13.6% since reporting and currently trades at $79.25.

Read our full, actionable report on Uber here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.