Telecommunications and cable services provider Altice USA (NYSE: ATUS) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 2.9% year on year to $2.24 billion. Its GAAP loss of $0.12 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Altice? Find out by accessing our full research report, it’s free.

Altice (ATUS) Q4 CY2024 Highlights:

- Revenue: $2.24 billion vs analyst estimates of $2.23 billion (2.9% year-on-year decline, in line)

- EPS (GAAP): -$0.12 vs analyst estimates of $0.04 (significant miss)

- Adjusted EBITDA: $837.5 million vs analyst estimates of $872.4 million (37.5% margin, 4% miss)

- Operating Margin: 15.2%, up from 13.1% in the same quarter last year

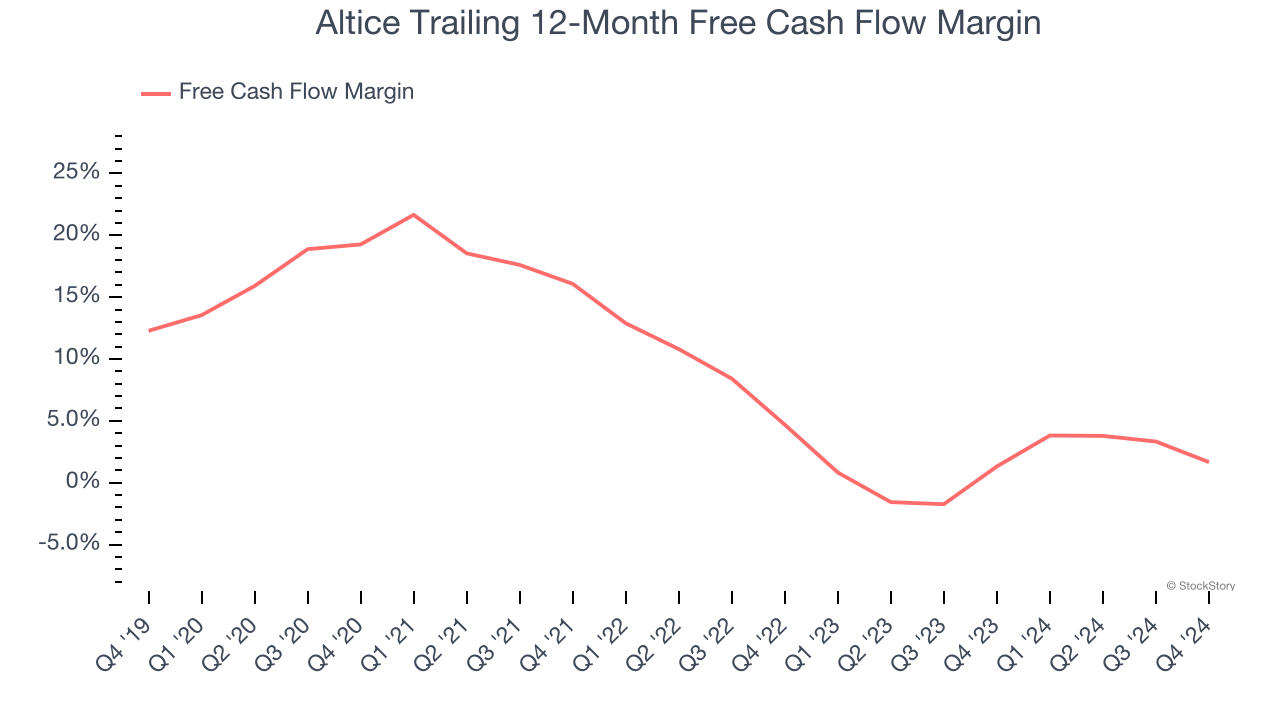

- Free Cash Flow Margin: 2.2%, down from 8.7% in the same quarter last year

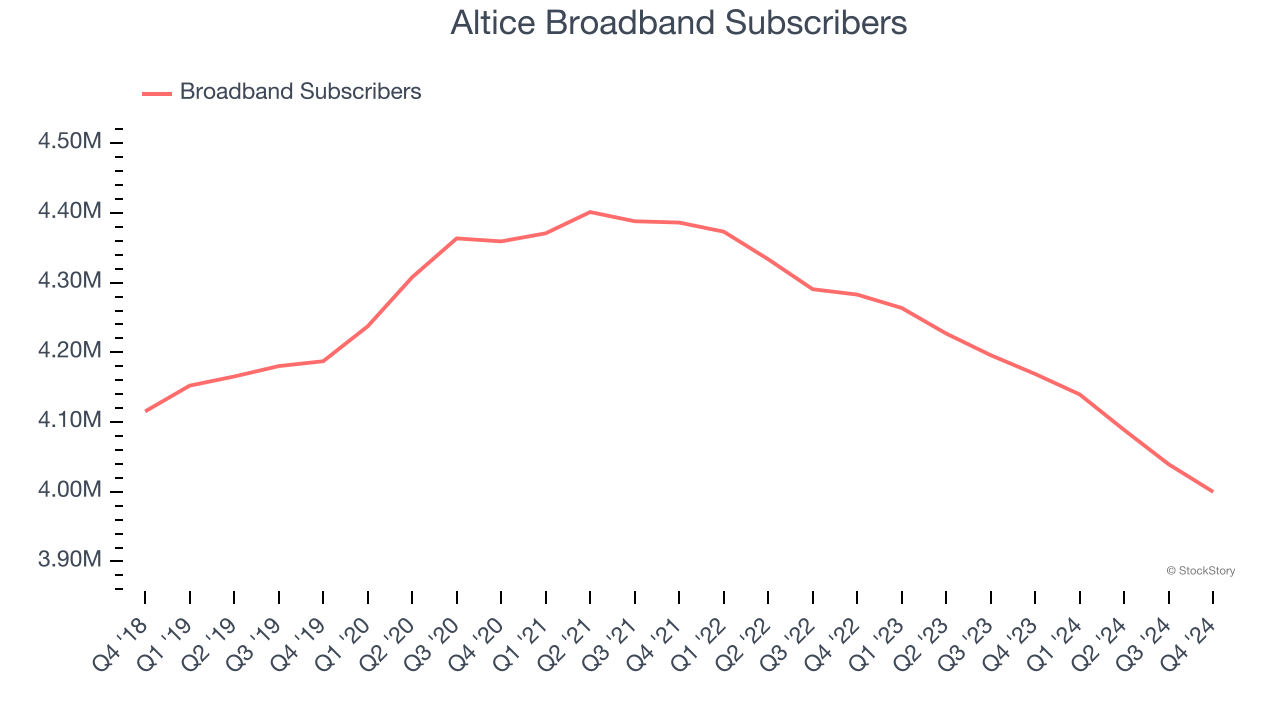

- Broadband Subscribers: 4 million, down 169,100 year on year

- Market Capitalization: $1.25 billion

Company Overview

Based in Long Island City, Altice USA (NYSE: ATUS) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Sales Growth

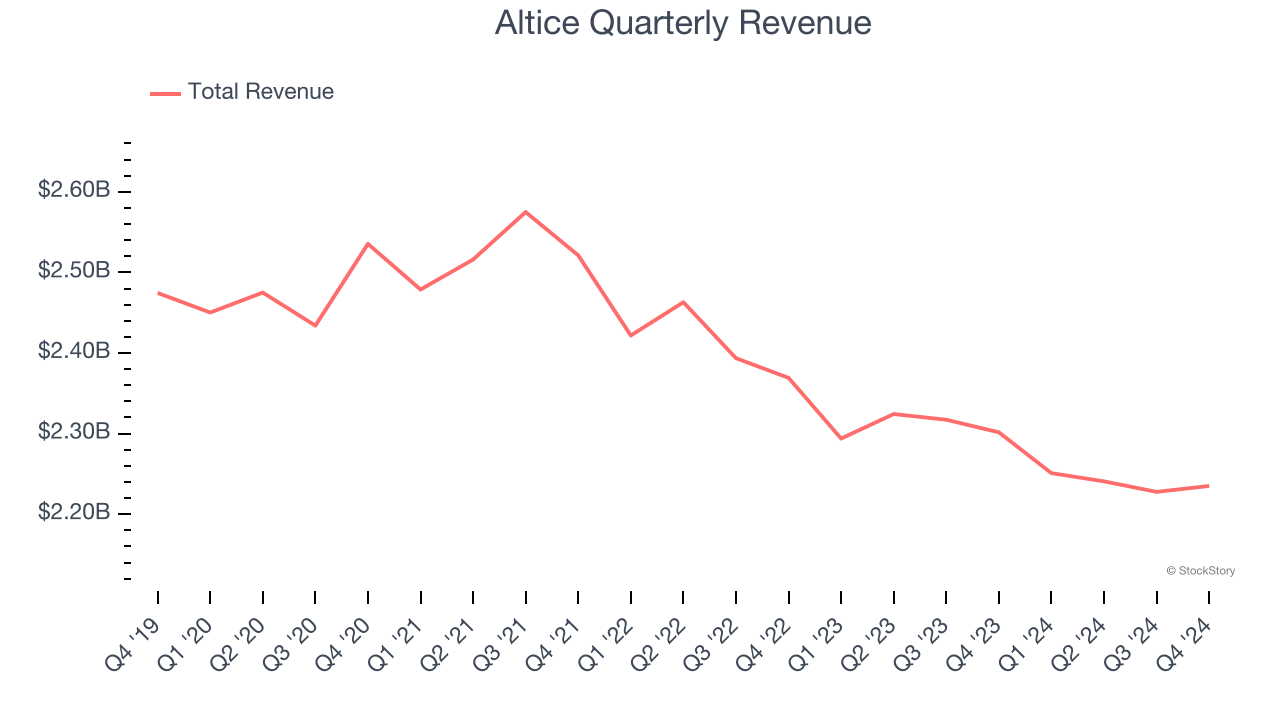

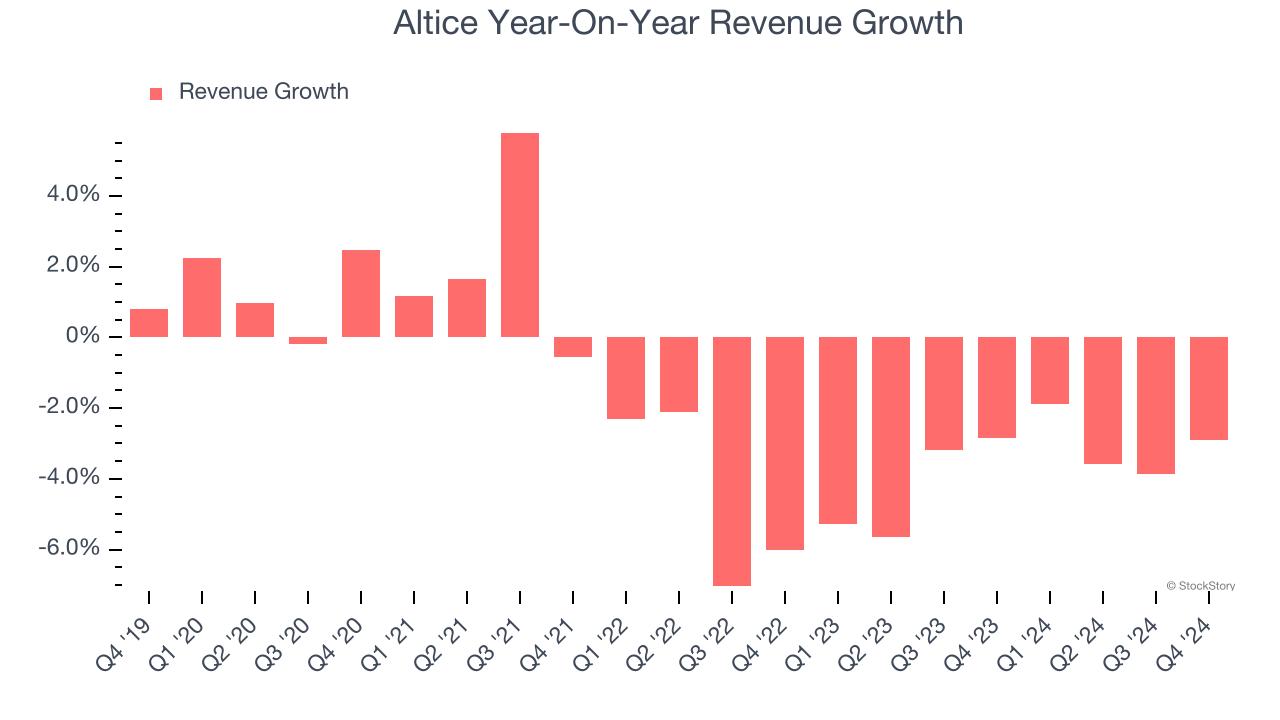

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Altice’s demand was weak over the last five years as its sales fell at a 1.7% annual rate. This was below our standards and signals it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Altice’s recent history shows its demand has stayed suppressed as its revenue has declined by 3.7% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of broadband subscribers and pay tv subscribers, which clocked in at 4 million and 1.88 million in the latest quarter. Over the last two years, Altice’s broadband subscribers averaged 3% year-on-year declines while its pay tv subscribers averaged 11.6% year-on-year declines.

This quarter, Altice reported a rather uninspiring 2.9% year-on-year revenue decline to $2.24 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 4.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Altice has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, lousy for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Altice to make large cash investments in working capital and capital expenditures.

Altice’s free cash flow clocked in at $49.88 million in Q4, equivalent to a 2.2% margin. The company’s cash profitability regressed as it was 6.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Altice’s Q4 Results

We struggled to find many positives in these results. Its EPS missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.3% to $2.54 immediately after reporting.

The latest quarter from Altice’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.