Health insurance company Humana (NYSE: HUM) announced better-than-expected revenue in Q4 CY2024, with sales up 13.5% year on year to $29.21 billion. The company’s full-year revenue guidance of $127 billion at the midpoint came in 6.8% above analysts’ estimates. Its GAAP loss of $5.76 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Humana? Find out by accessing our full research report, it’s free.

Humana (HUM) Q4 CY2024 Highlights:

- Revenue: $29.21 billion vs analyst estimates of $28.83 billion (13.5% year-on-year growth, 1.3% beat)

- EPS (GAAP): -$5.76 vs analyst estimates of -$2.44 (significant miss)

- Adjusted EBITDA: -$281 million vs analyst estimates of $7.21 million (-1% margin, significant miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $127 billion at the midpoint, beating analyst estimates by 6.8% and implying 8.1% growth (vs 14.5% in FY2024)

- Operating Margin: -1.9%, in line with the same quarter last year

- Free Cash Flow was -$682 million compared to -$7.21 billion in the same quarter last year

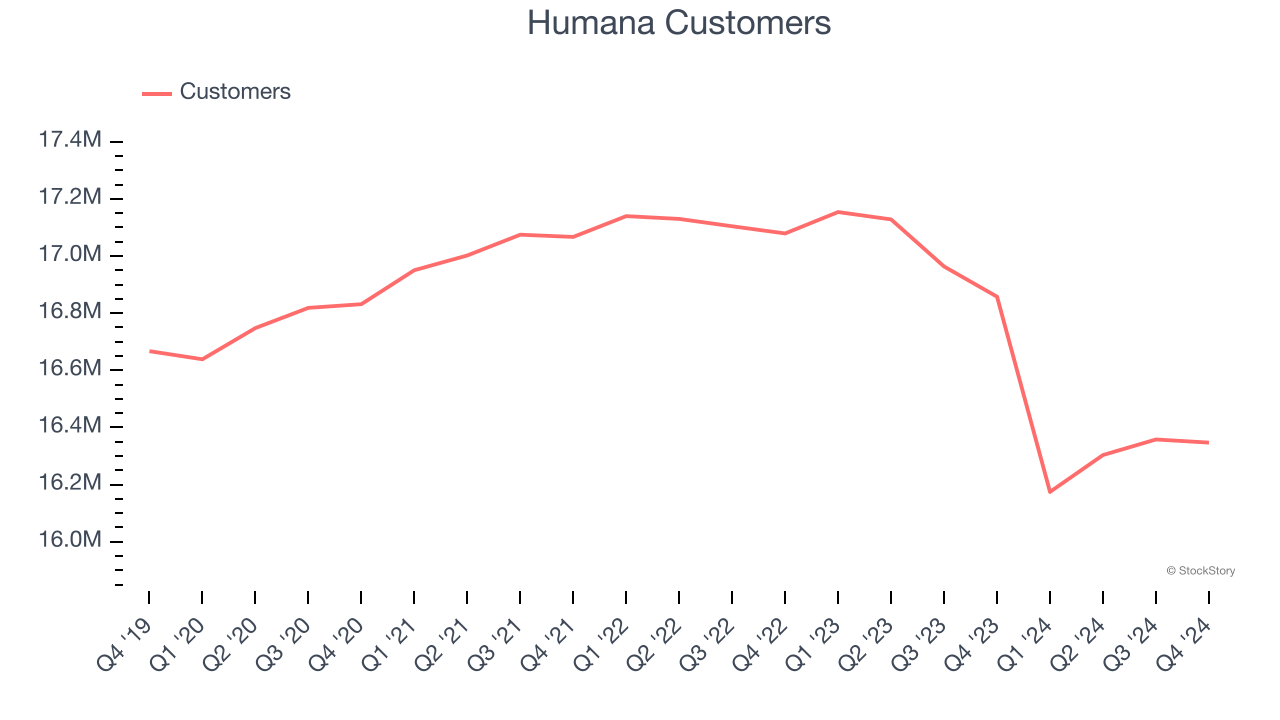

- Customers: 16.35 million, down from 16.36 million in the previous quarter

- Market Capitalization: $32.13 billion

Company Overview

Founded in 1961 as a nursing home company, Humana (NYSE: HUM) today offers health insurance plans that cover medical, dental, and vision needs.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

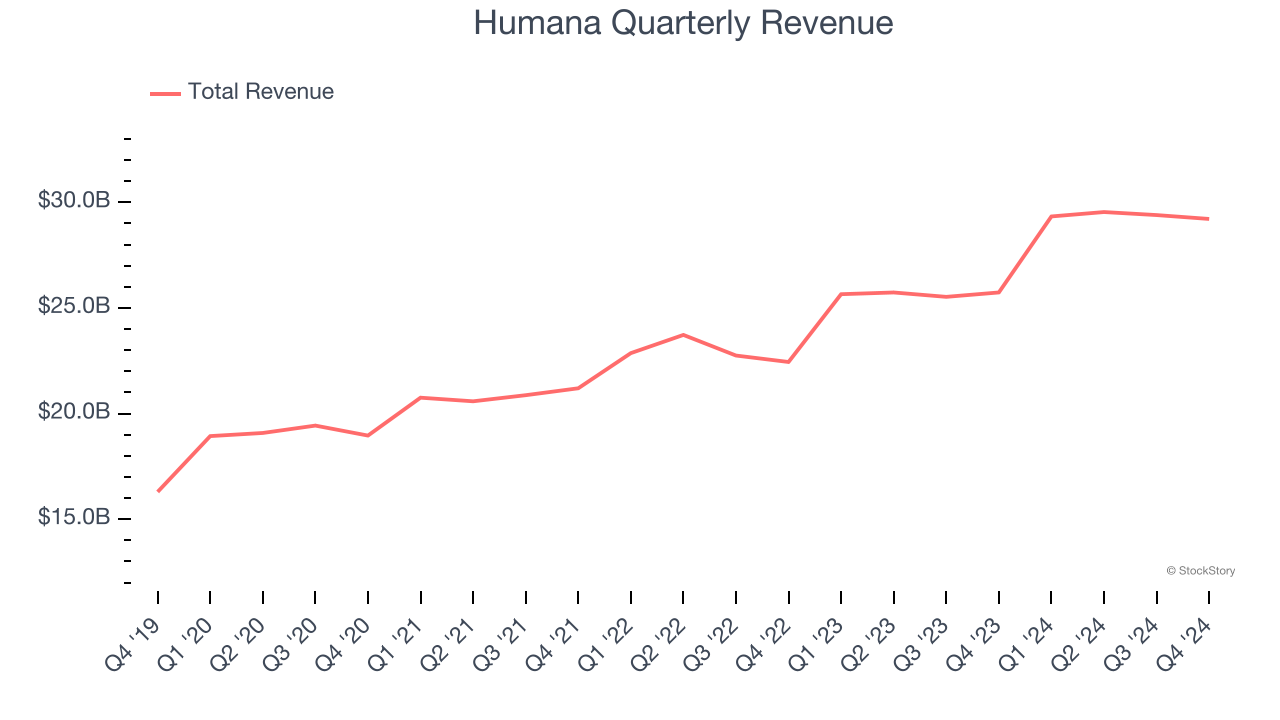

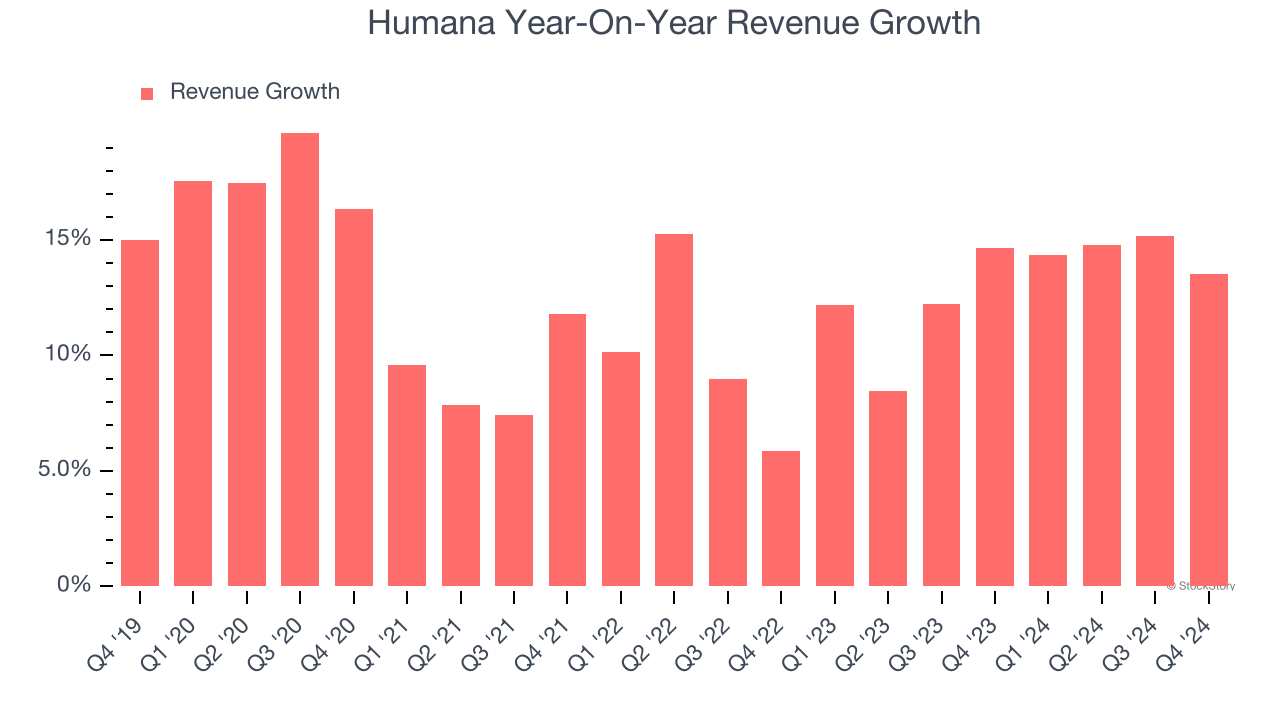

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Humana’s sales grew at a solid 12.6% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Humana’s annualized revenue growth of 13.1% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 16.35 million in the latest quarter. Over the last two years, Humana’s customer base averaged 2.4% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Humana reported year-on-year revenue growth of 13.5%, and its $29.21 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

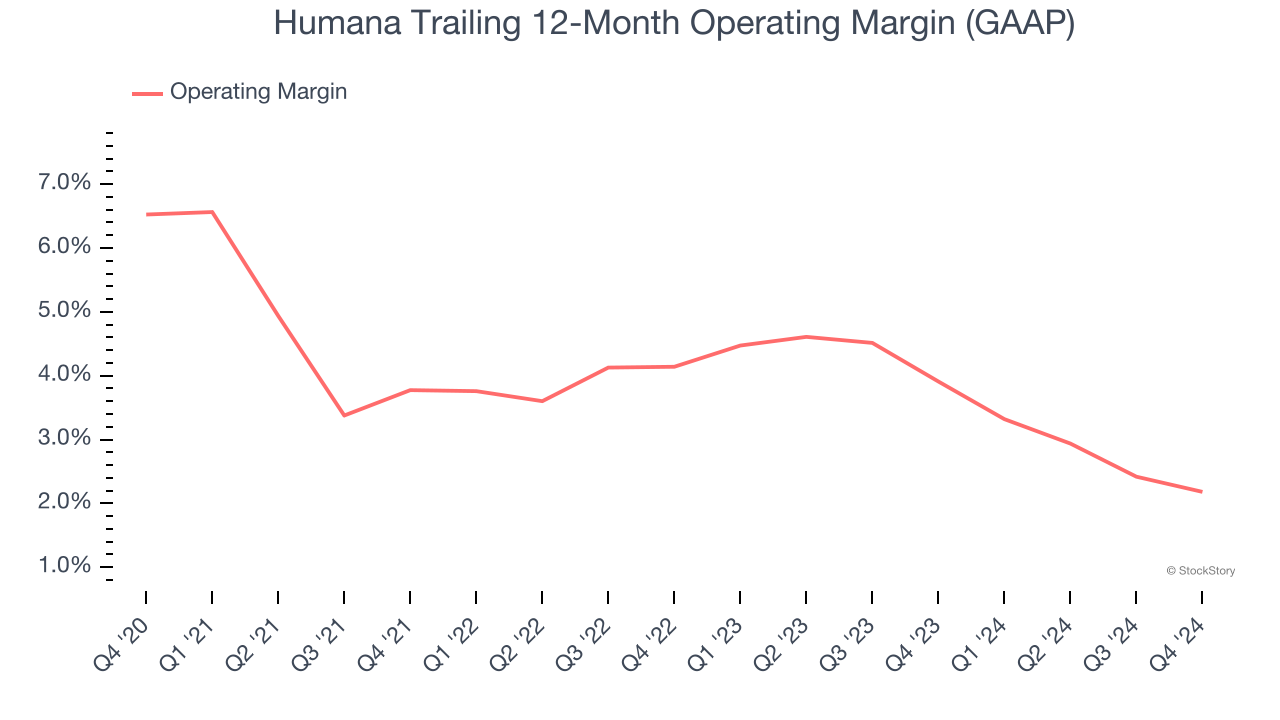

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Humana was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.9% was weak for a healthcare business.

Looking at the trend in its profitability, Humana’s operating margin decreased by 4.3 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Humana generated an operating profit margin of negative 1.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

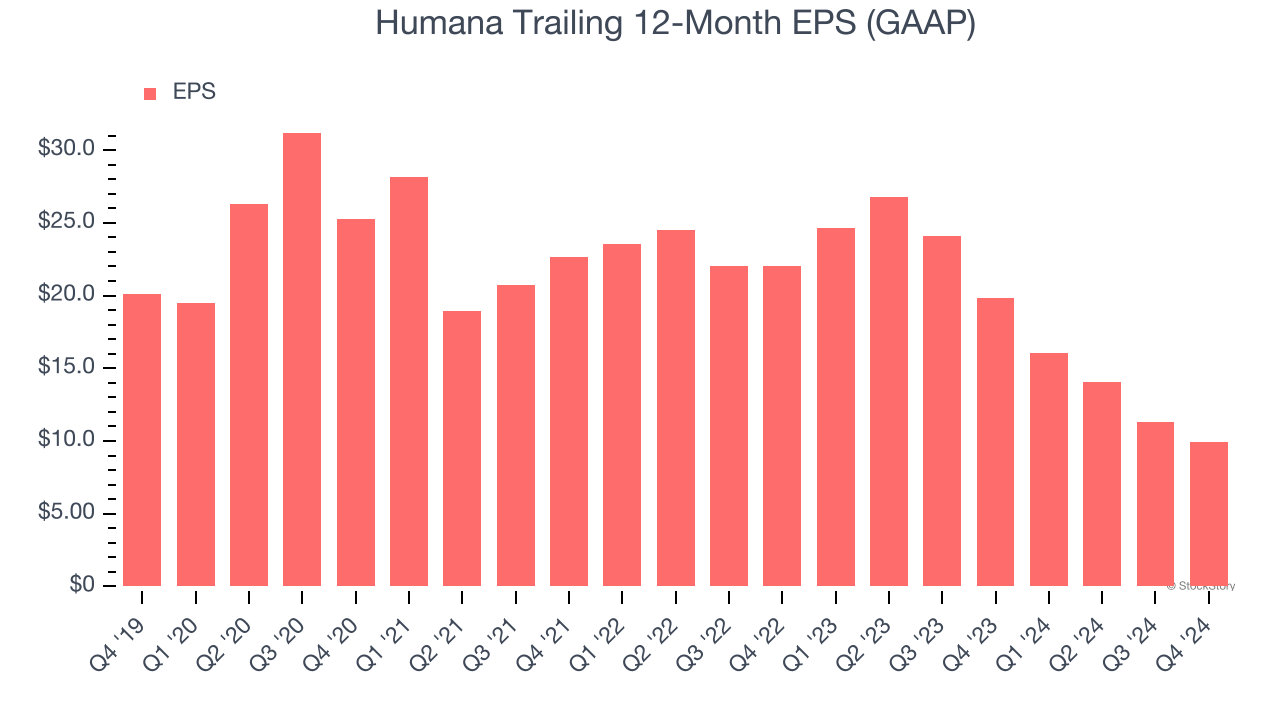

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Humana, its EPS declined by 13.1% annually over the last five years while its revenue grew by 12.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Humana’s earnings to better understand the drivers of its performance. As we mentioned earlier, Humana’s operating margin was flat this quarter but declined by 4.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Humana reported EPS at negative $5.76, down from negative $4.42 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Humana’s full-year EPS of $9.95 to grow 56.6%.

Key Takeaways from Humana’s Q4 Results

We were impressed by Humana’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter had some key positives that the market seems to be focused on. The stock traded up 3% to $274.82 immediately after reporting.

Humana had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.