The Ensign Group trades at $177.99 per share and has stayed right on track with the overall market, gaining 18.8% over the last six months. At the same time, the S&P 500 has returned 14.1%.

Is ENSG a buy right now? Find out in our full research report, it’s free for active Edge members.

Why Does The Ensign Group Spark Debate?

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ: ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

Two Things to Like:

1. Elevated Demand Drives Higher Sales Volumes

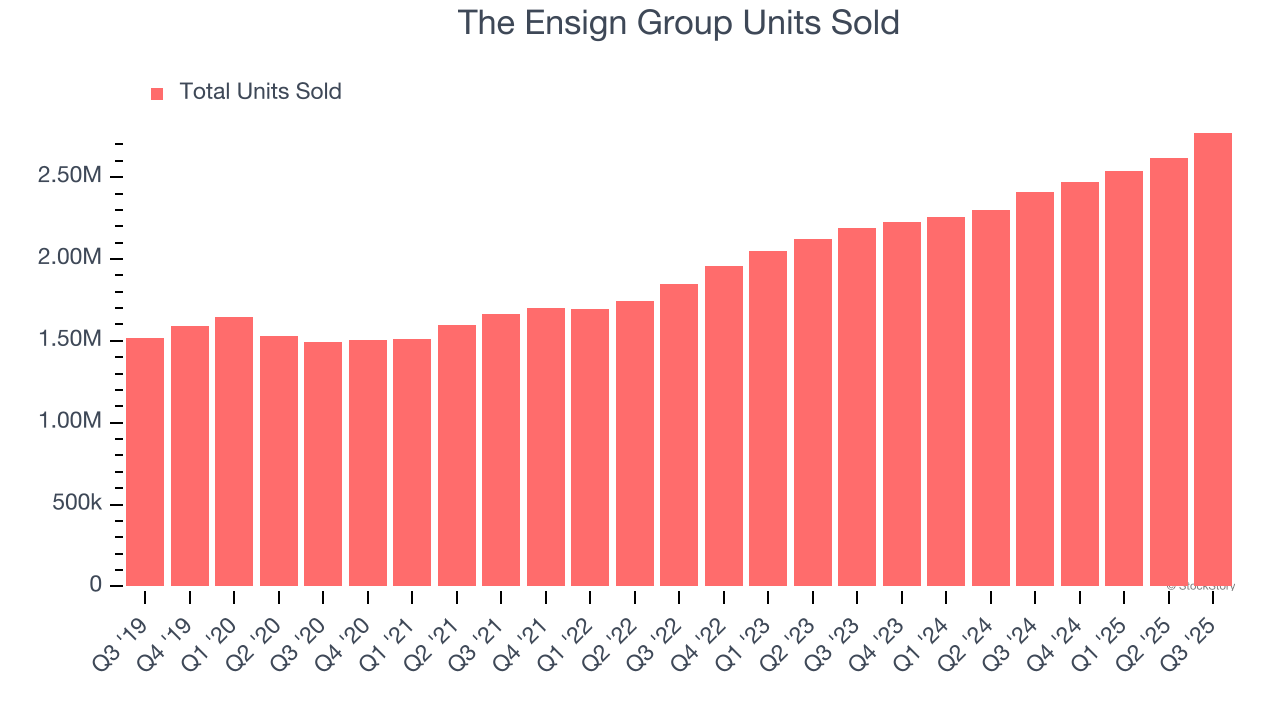

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Specialized Medical & Nursing Services company because there’s a ceiling to what customers will pay.

The Ensign Group’s units sold punched in at 2.77 million in the latest quarter, and over the last two years, averaged 11.8% year-on-year growth. This performance was impressive and shows its offerings have a unique value proposition (and perhaps some degree of customer loyalty).

2. Outstanding Long-Term EPS Growth

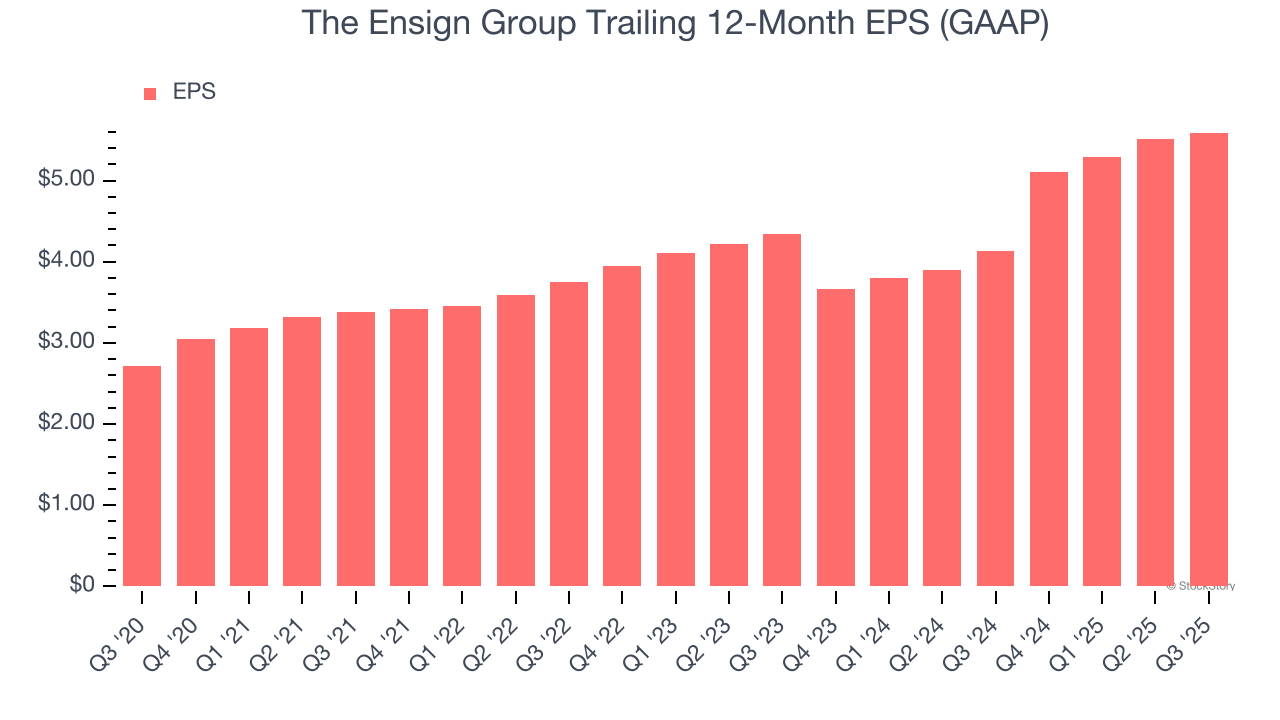

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

The Ensign Group’s astounding 15.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

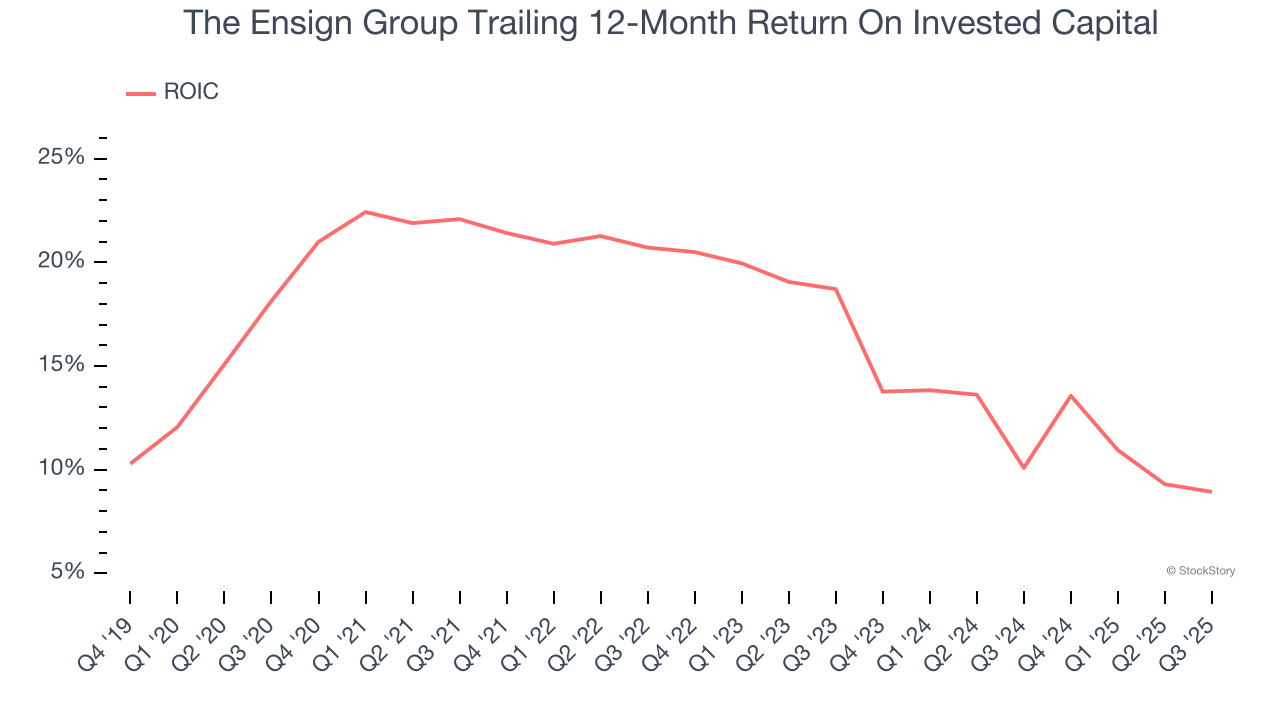

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, The Ensign Group’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

The Ensign Group’s positive characteristics outweigh the negatives, but at $177.99 per share (or 25.1× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than The Ensign Group

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.