CTS currently trades at $44.45 per share and has shown little upside over the past six months, posting a middling return of 4.3%. The stock also fell short of the S&P 500’s 11.7% gain during that period.

Is there a buying opportunity in CTS, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is CTS Not Exciting?

We're cautious about CTS. Here are three reasons why CTS doesn't excite us and a stock we'd rather own.

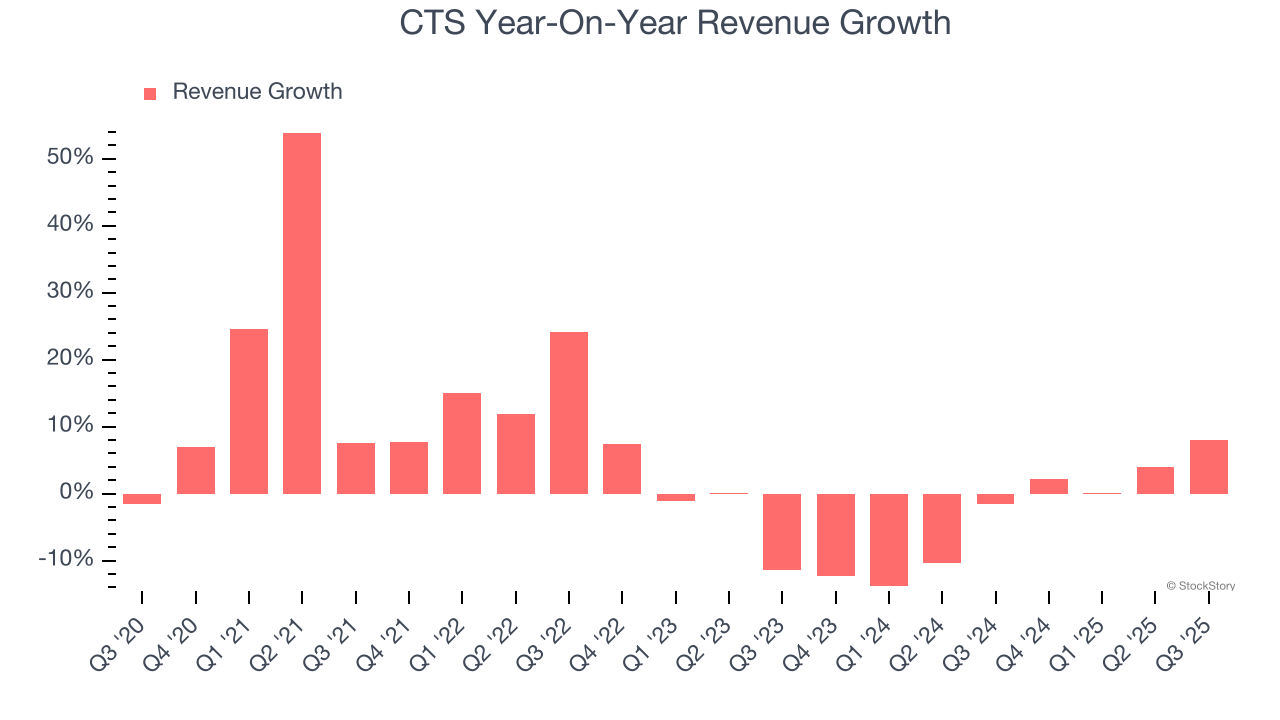

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. CTS’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.3% over the last two years.

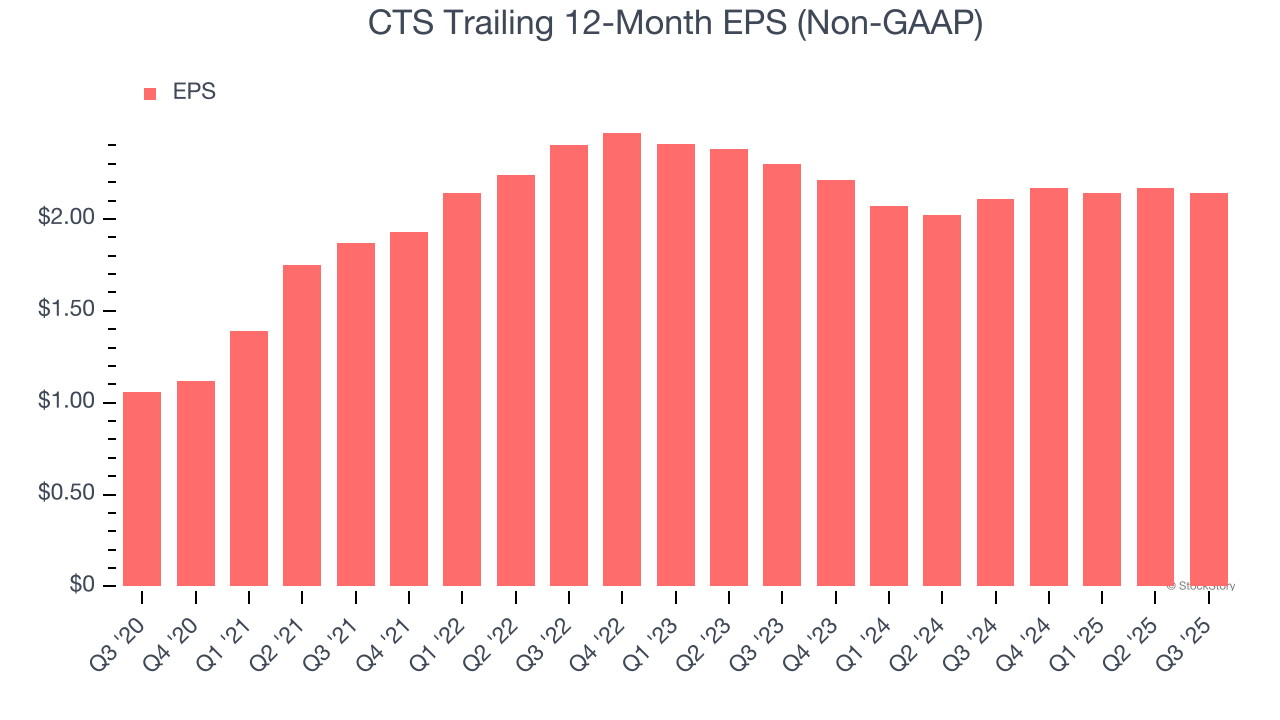

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for CTS, its EPS and revenue declined by 3.5% and 3.3% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, CTS’s low margin of safety could leave its stock price susceptible to large downswings.

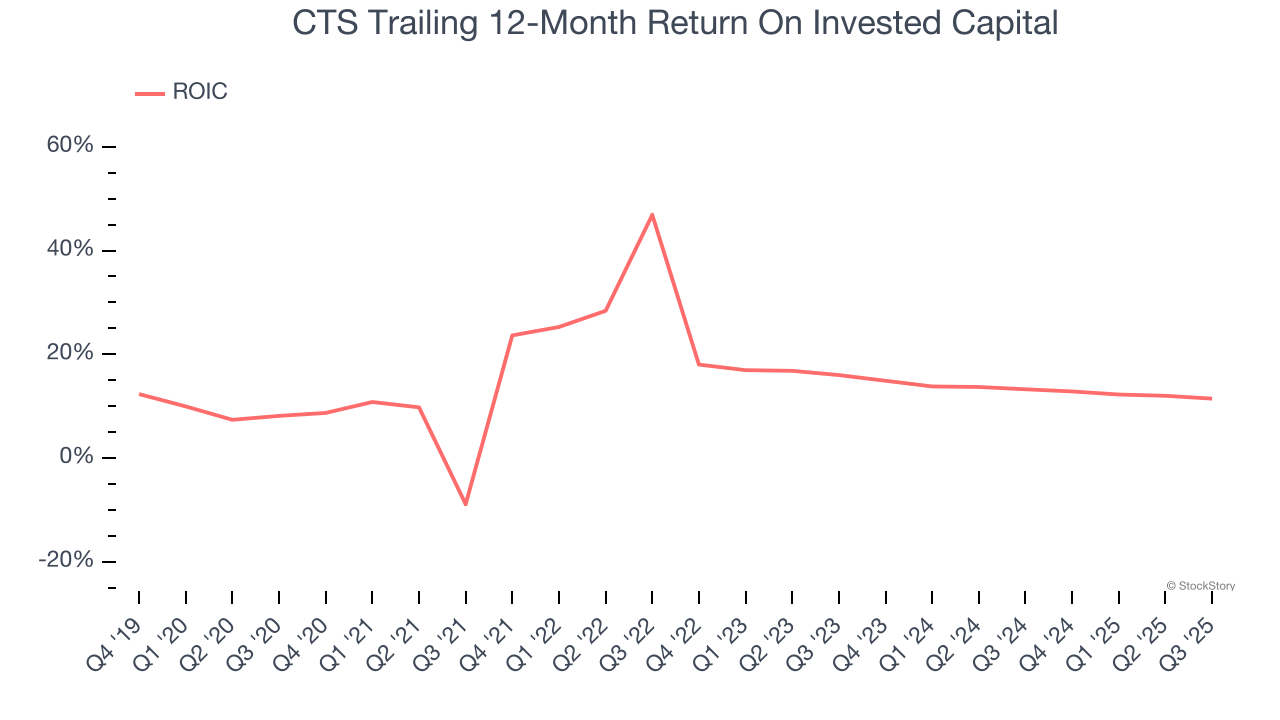

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, CTS’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

CTS isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 18.8× forward P/E (or $44.45 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.