Over the past six months, Workiva has been a great trade, beating the S&P 500 by 16%. Its stock price has climbed to $87.42, representing a healthy 27.7% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Workiva, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Workiva Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Workiva. Here are two reasons we avoid WK and a stock we'd rather own.

1. Operating Margin Rising, Profits Up

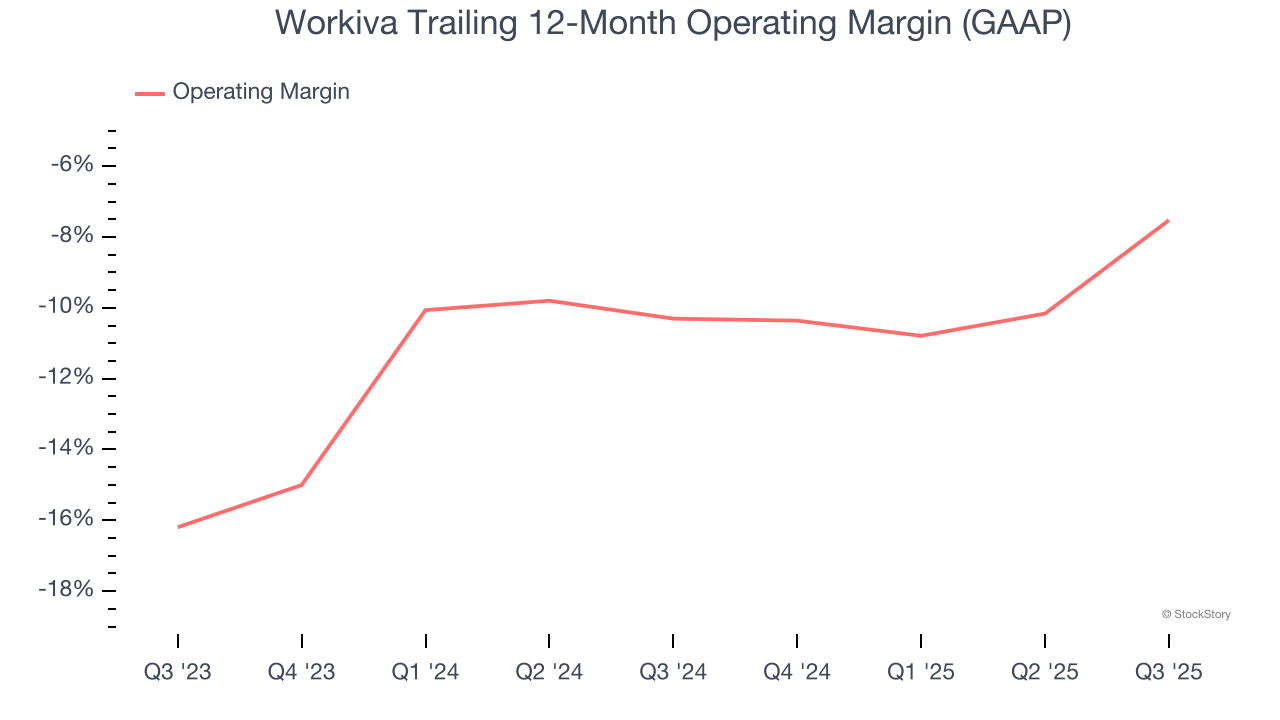

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Over the last two years, Workiva’s expanding sales gave it operating leverage as its margin rose by 2.8 percentage points. Its operating margin for the trailing 12 months was negative 7.5%, and it must keep making strides to one day reach sustainable profitability.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Workiva’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.4% for the last 12 months will decrease to 14.1%.

Final Judgment

Workiva isn’t a terrible business, but it doesn’t pass our bar. With its shares beating the market recently, the stock trades at 5.2× forward price-to-sales (or $87.42 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Workiva

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.