Live Oak Bancshares has had an impressive run over the past six months as its shares have beaten the S&P 500 by 6.5%. The stock now trades at $35.23, marking a 18.2% gain. This run-up might have investors contemplating their next move.

Is it too late to buy LOB? Find out in our full research report, it’s free for active Edge members.

Why Does Live Oak Bancshares Spark Debate?

Founded during the 2008 financial crisis with a vision to reimagine small business banking through technology, Live Oak Bancshares (NYSE: LOB) is a bank holding company that specializes in providing online banking services and SBA-guaranteed loans to small businesses across targeted industries nationwide.

Two Things to Like:

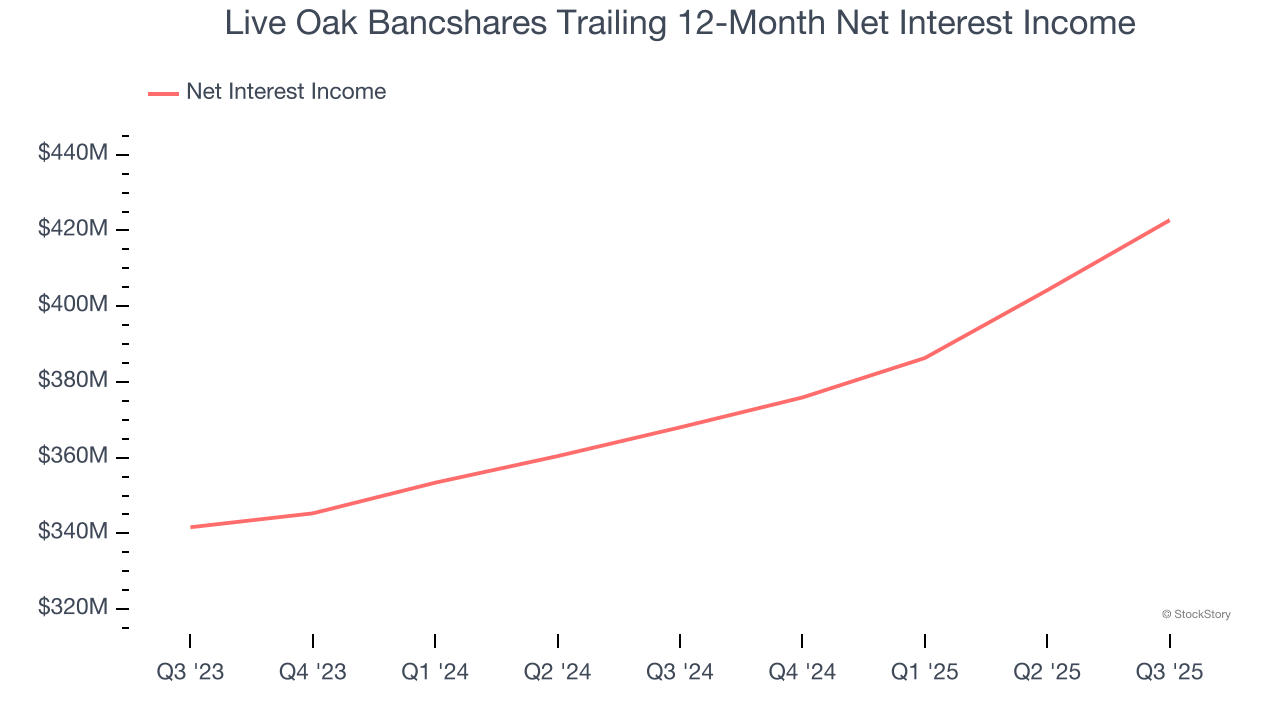

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Live Oak Bancshares’s net interest income has grown at a 19.9% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

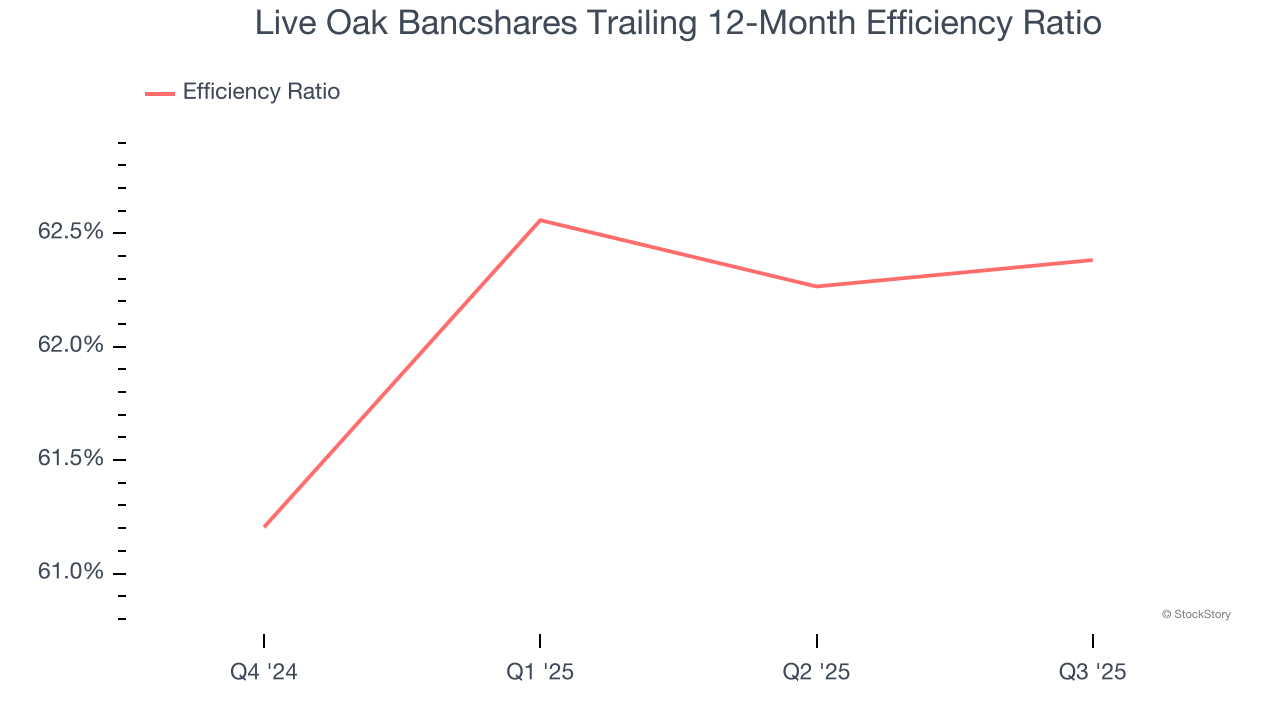

2. Forecasted Efficiency Ratio Shows Stronger Profits Ahead

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Live Oak Bancshares to rein in some of its expenses as it anticipates an efficiency ratio of 57.2% compared to 62.4% over the past year.

One Reason to be Careful:

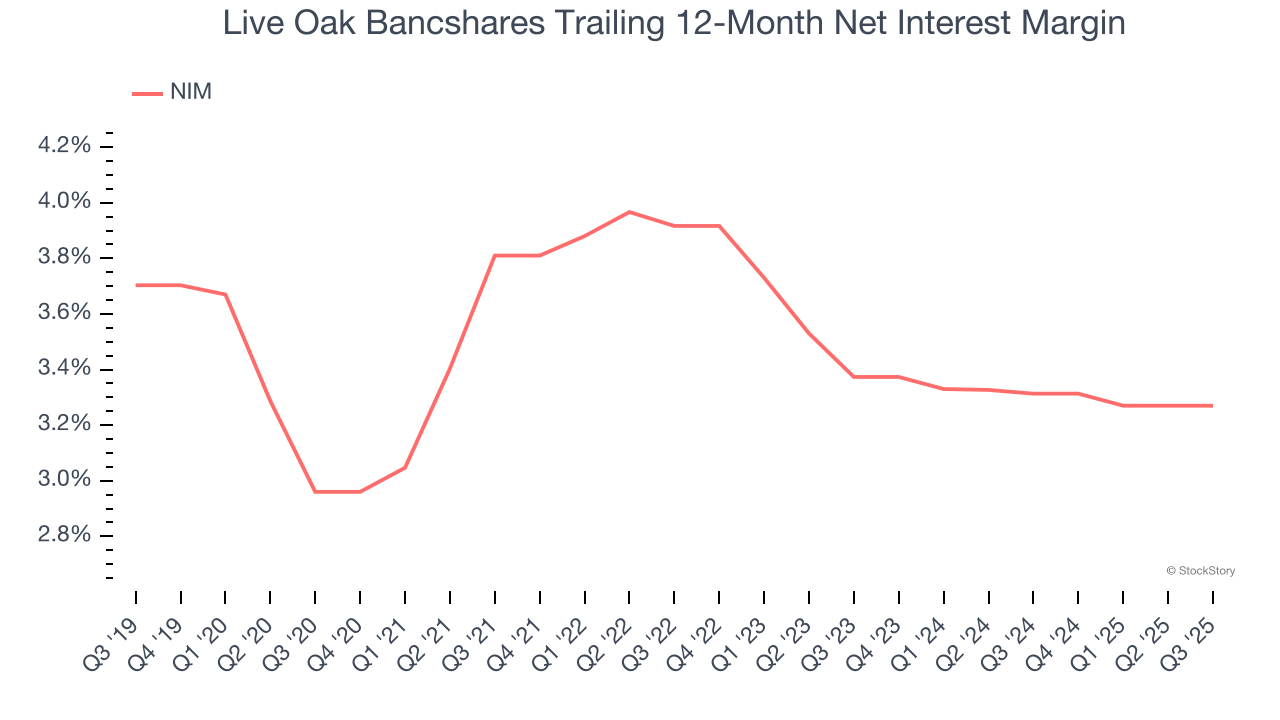

Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that Live Oak Bancshares’s net interest margin averaged a subpar 3.3%, meaning it must compensate for lower profitability through increased loan originations.

Final Judgment

Live Oak Bancshares’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 1.4× forward P/B (or $35.23 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Live Oak Bancshares

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.