The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Novanta (NASDAQ: NOVT) and the rest of the electronic components stocks fared in Q3.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

Luckily, electronic components stocks have performed well with share prices up 11.3% on average since the latest earnings results.

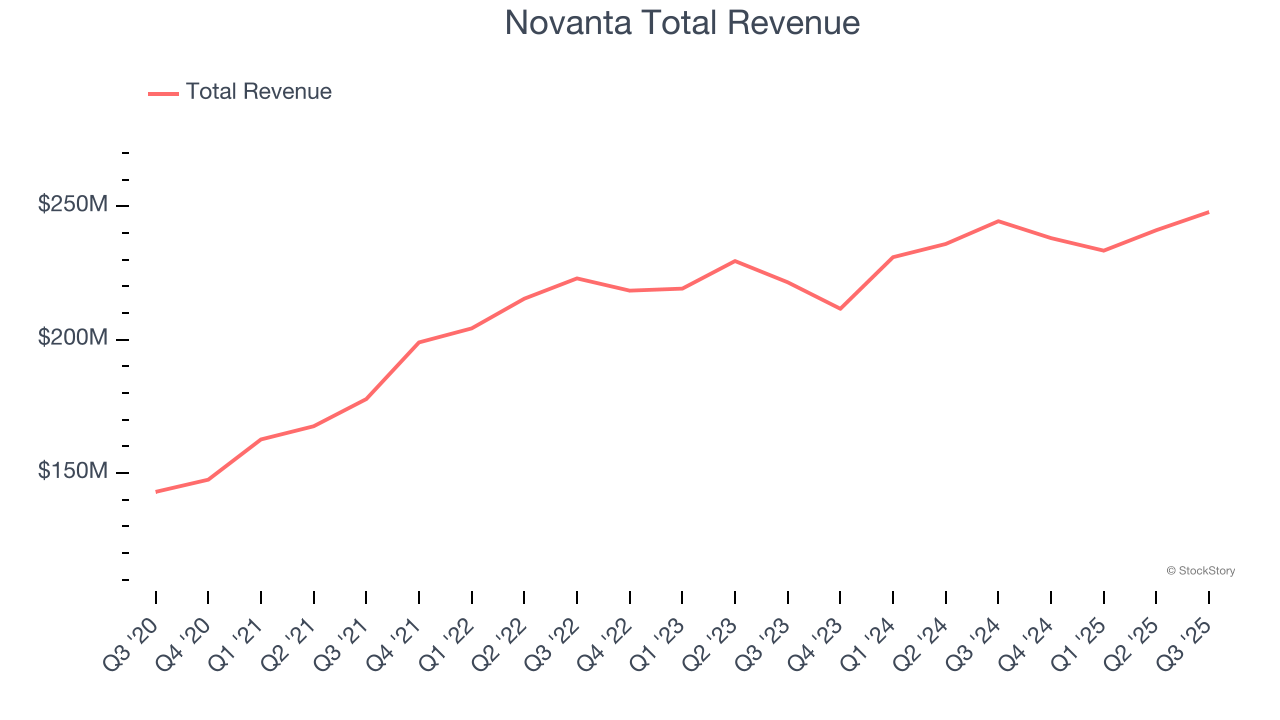

Weakest Q3: Novanta (NASDAQ: NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ: NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $247.8 million, up 1.4% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates.

Novanta delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 11.4% since reporting and currently trades at $120.43.

Read our full report on Novanta here, it’s free for active Edge members.

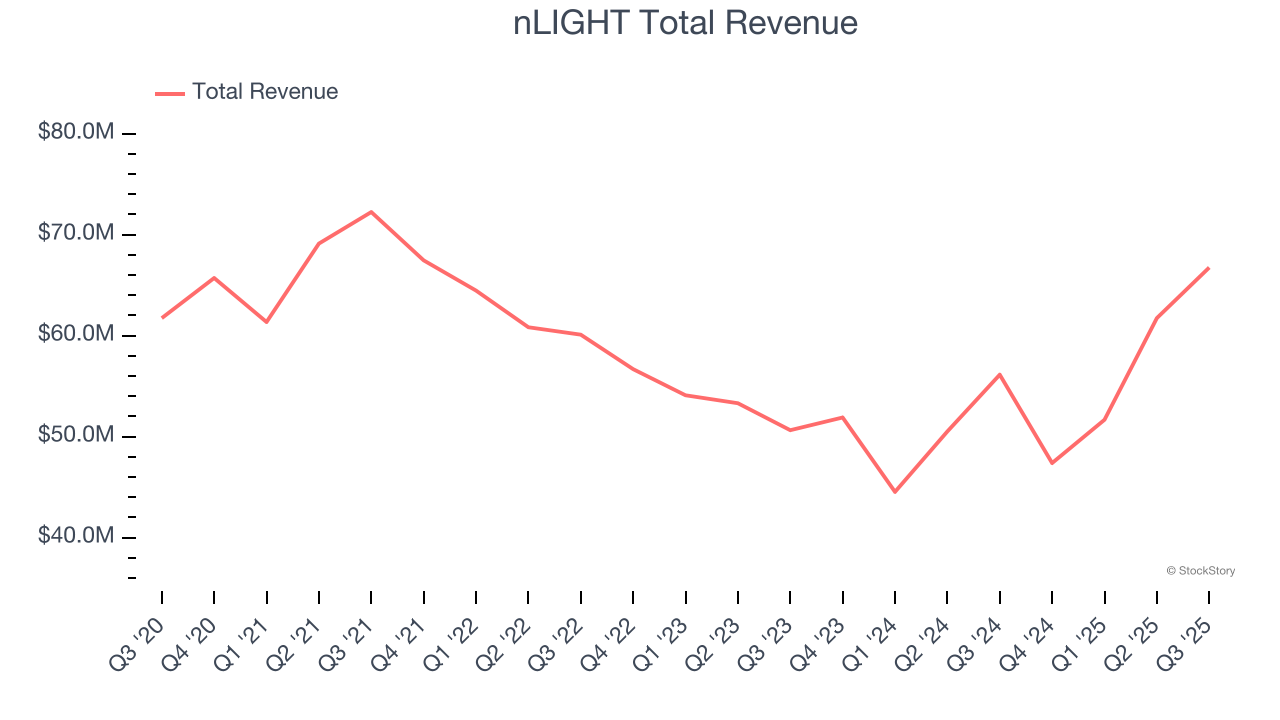

Best Q3: nLIGHT (NASDAQ: LASR)

Founded by a former CEO and Harvard-educated entrepreneur Scott Keeneyn, nLIGHT (NASDAQ: LASR) offers semiconductor and fiber lasers to the industrial, aerospace & defense, and medical sectors.

nLIGHT reported revenues of $66.74 million, up 18.9% year on year, outperforming analysts’ expectations by 5.4%. The business had an incredible quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 29.2% since reporting. It currently trades at $38.50.

Is now the time to buy nLIGHT? Access our full analysis of the earnings results here, it’s free for active Edge members.

Corning (NYSE: GLW)

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE: GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Corning reported revenues of $4.27 billion, up 14.4% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted an impressive beat of analysts’ Display Technologies revenue estimates but a miss of analysts’ Optical Communications revenue estimates.

Corning delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 1.5% since the results and currently trades at $88.41.

Read our full analysis of Corning’s results here.

Advanced Energy (NASDAQ: AEIS)

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Advanced Energy reported revenues of $463.3 million, up 23.8% year on year. This result beat analysts’ expectations by 5%. It was a stunning quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The stock is up 11.6% since reporting and currently trades at $217.76.

Read our full, actionable report on Advanced Energy here, it’s free for active Edge members.

Belden (NYSE: BDC)

With its enamel-coated copper wire used in WWI for the Allied forces, Belden (NYSE: BDC) designs, manufactures, and sells electronic components to various industries.

Belden reported revenues of $698.2 million, up 6.6% year on year. This number surpassed analysts’ expectations by 2.7%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ Enterprise revenue estimates.

The stock is flat since reporting and currently trades at $119.08.

Read our full, actionable report on Belden here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.