Financial services company Robinhood (NASDAQ: HOOD) announced better-than-expected revenue in Q3 CY2025, with sales up 100% year on year to $1.27 billion. Its GAAP profit of $0.61 per share was 12.1% above analysts’ consensus estimates.

Is now the time to buy Robinhood? Find out by accessing our full research report, it’s free for active Edge members.

Robinhood (HOOD) Q3 CY2025 Highlights:

- CFO Jason Warnick announced his intention to retire next year

- Revenue: $1.27 billion vs analyst estimates of $1.20 billion (100% year-on-year growth, 6% beat)

- EPS (GAAP): $0.61 vs analyst estimates of $0.54 (12.1% beat)

- Full-year expense guidance: top end of previous range

- Operating Margin: 49.8%, up from 23.7% in the same quarter last year

- Free Cash Flow was -$1.59 billion, down from $3.49 billion in the previous quarter

- Funded Customers: 26.8 million, up 2.5 million year on year

- Market Capitalization: $121.6 billion

"Our team’s relentless product velocity drove record business results in Q3 and we’re not slowing down— Prediction Markets are growing rapidly, Robinhood Banking is starting to roll out, and Robinhood Ventures is coming,” said Vlad Tenev, Chairman and CEO of Robinhood.

Company Overview

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Revenue Growth

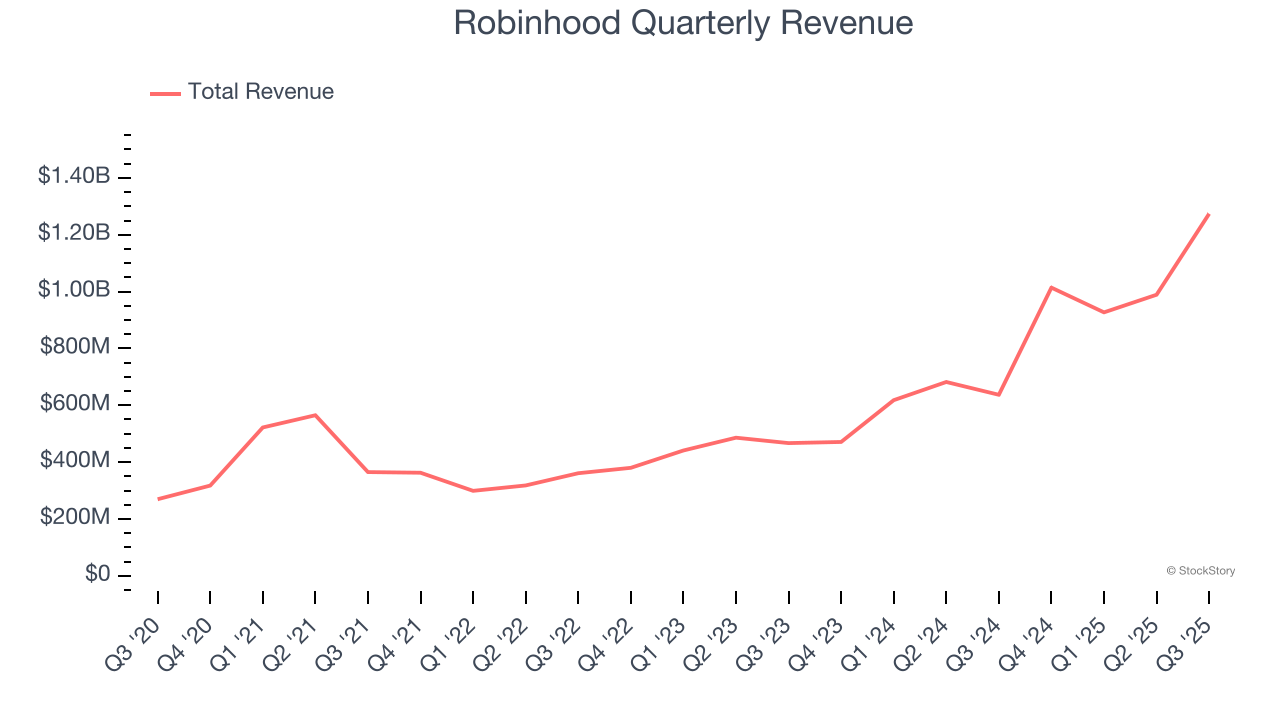

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Robinhood’s 46.4% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Robinhood reported magnificent year-on-year revenue growth of 100%, and its $1.27 billion of revenue beat Wall Street’s estimates by 6%.

Looking ahead, sell-side analysts expect revenue to grow 17.9% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and implies the market is baking in success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Funded Customers

User Growth

As a fintech company, Robinhood generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

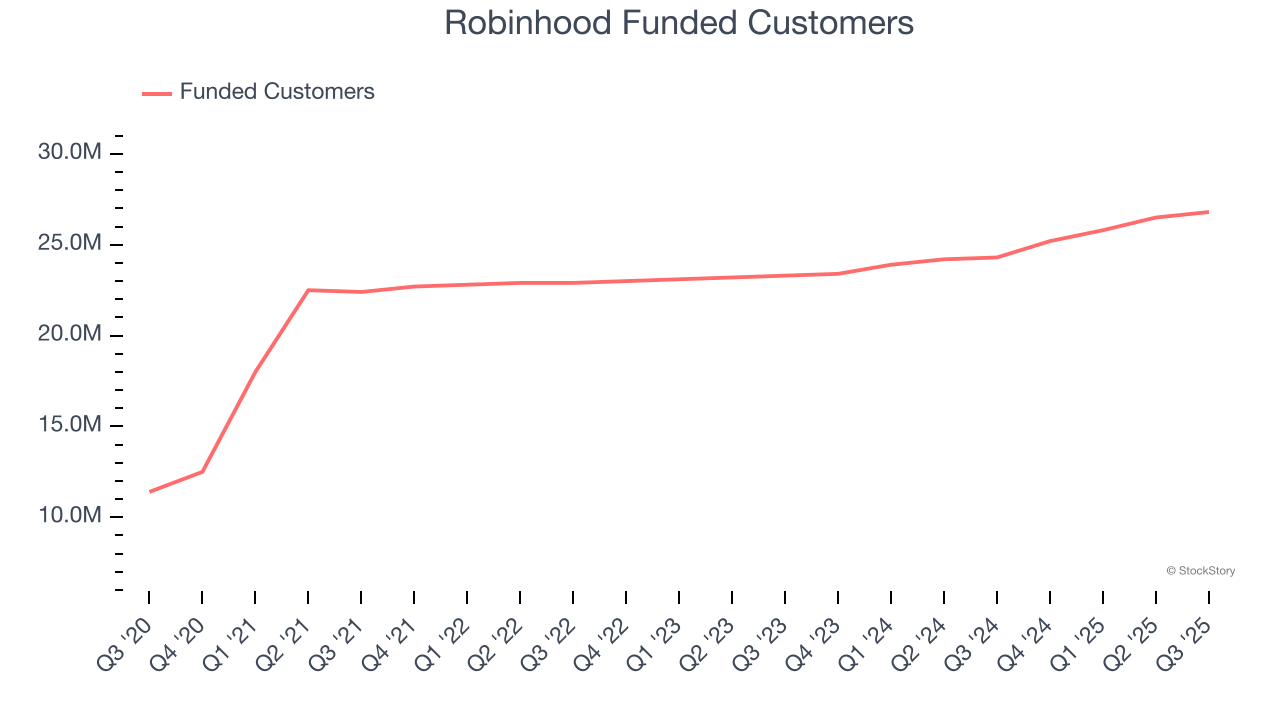

Over the last two years, Robinhood’s funded customers, a key performance metric for the company, increased by 6.2% annually to 26.8 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Robinhood wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, Robinhood added 2.5 million funded customers, leading to 10.3% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

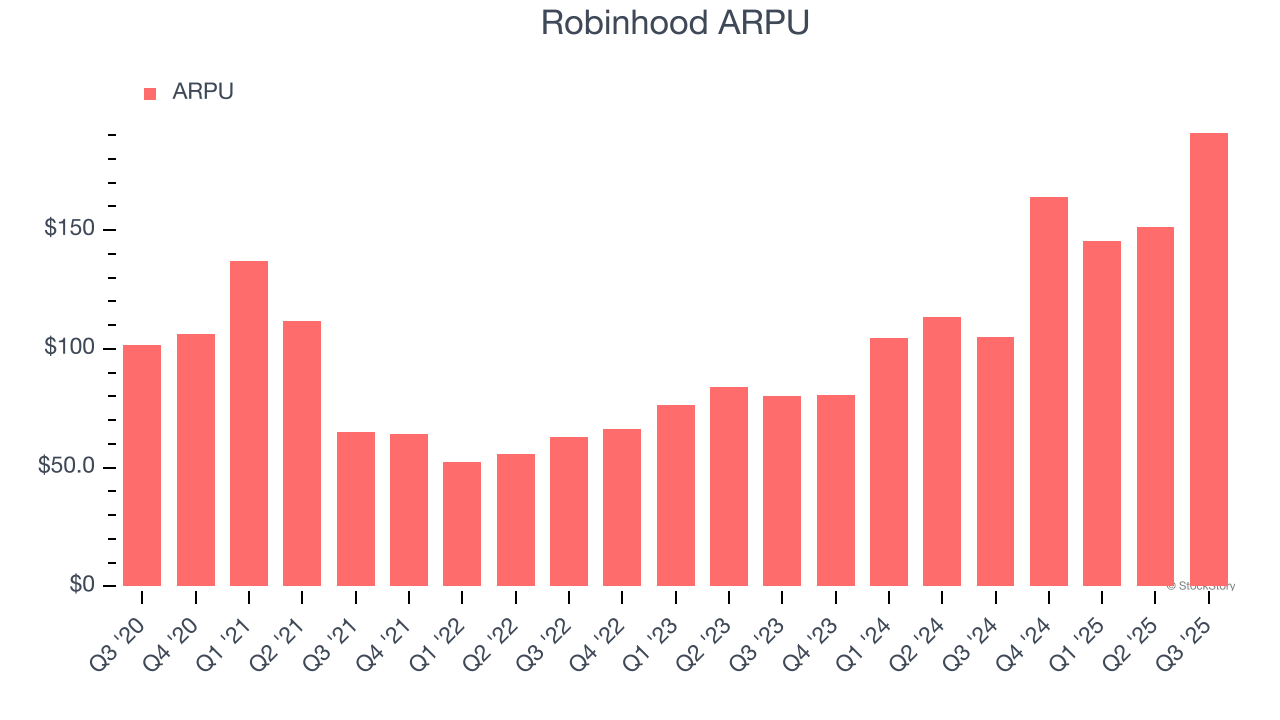

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on Robinhood’s platform and the company’s take rate, or "cut", on each transaction.

Robinhood’s ARPU growth has been exceptional over the last two years, averaging 47.7%. Its ability to increase monetization while growing its funded customers demonstrates its platform’s value, as its users are spending significantly more than last year.

This quarter, Robinhood’s ARPU clocked in at $191. It grew by 81.8% year on year, faster than its funded customers.

Key Takeaways from Robinhood’s Q3 Results

We enjoyed seeing Robinhood beat analysts’ revenue expectations this quarter. We were also glad it expanded its number of users. On the other hand, its number of funded customers was just in line, full-year operating expense guidance is at the top of the previously-provided range (implied profits therefore at the lower end), and the CFO is retiring. Overall, this print had many moving pieces. Investors were likely hoping for more, and shares traded down 2.8% to $138.75 immediately after reporting.

Big picture, is Robinhood a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.