Health and wellness products company Herbalife (NYSE: HLF) announced better-than-expected revenue in Q3 CY2025, with sales up 2.7% year on year to $1.27 billion. The company expects next quarter’s revenue to be around $1.25 billion, close to analysts’ estimates. Its non-GAAP profit of $0.50 per share was 8.4% above analysts’ consensus estimates.

Is now the time to buy Herbalife? Find out by accessing our full research report, it’s free for active Edge members.

Herbalife (HLF) Q3 CY2025 Highlights:

- Revenue: $1.27 billion vs analyst estimates of $1.27 billion (2.7% year-on-year growth, 0.5% beat)

- Adjusted EPS: $0.50 vs analyst estimates of $0.46 (8.4% beat)

- Adjusted EBITDA: $184.2 million vs analyst estimates of $158.2 million (14.5% margin, 16.4% beat)

- Revenue Guidance for Q4 CY2025 is $1.25 billion at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $650 million at the midpoint, in line with analyst expectations

- Operating Margin: 9.9%, in line with the same quarter last year

- Free Cash Flow Margin: 9.3%, up from 5.8% in the same quarter last year

- Organic Revenue rose 2.7% year on year vs analyst estimates of 2.4% growth (34.6 basis point beat)

- Market Capitalization: $822.8 million

Company Overview

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.96 billion in revenue over the past 12 months, Herbalife carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

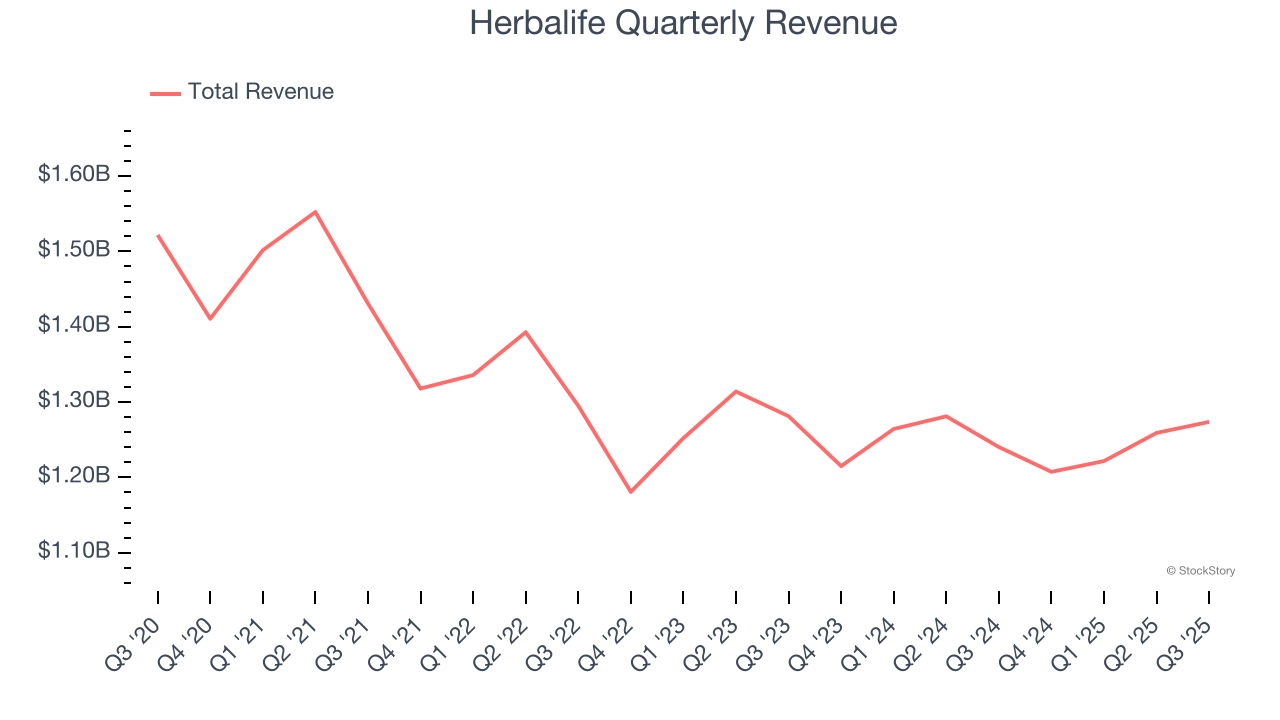

As you can see below, Herbalife struggled to generate demand over the last three years. Its sales dropped by 2.4% annually as consumers bought less of its products.

This quarter, Herbalife reported modest year-on-year revenue growth of 2.7% but beat Wall Street’s estimates by 0.5%. Company management is currently guiding for a 3.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Organic Revenue Growth

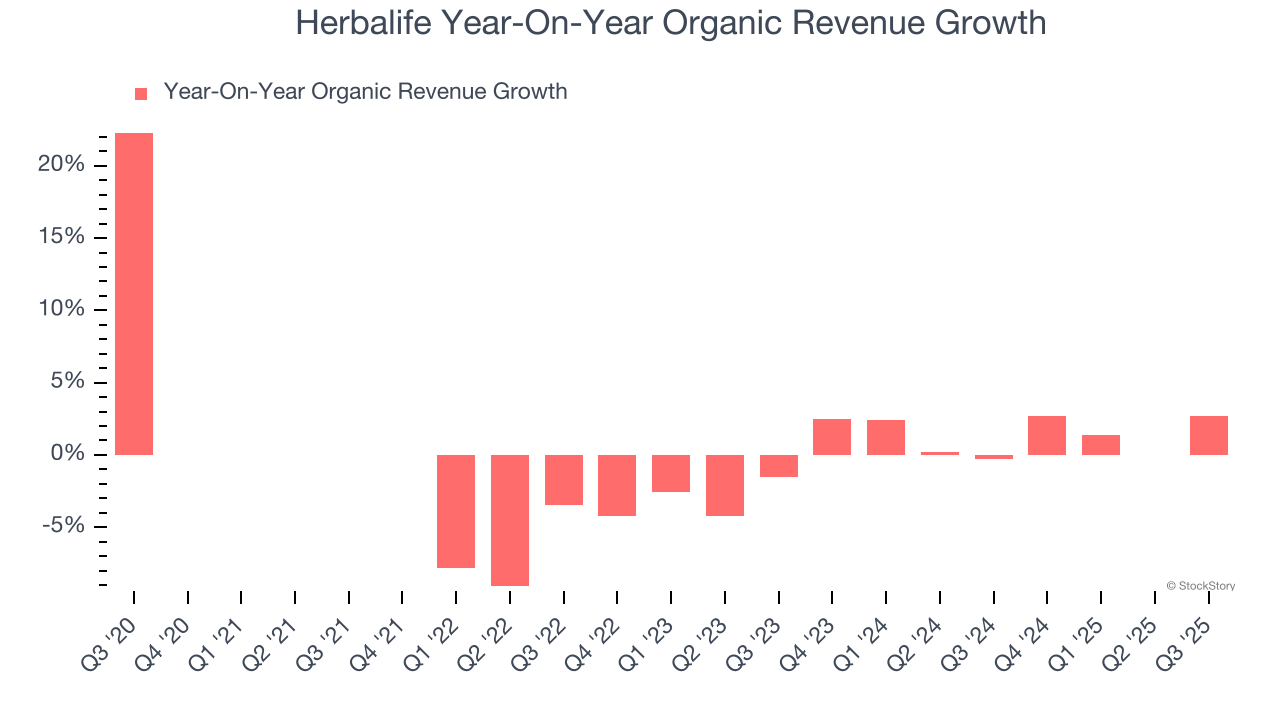

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Herbalife’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 1.4%.

In the latest quarter, Herbalife’s organic sales rose by 2.7% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Herbalife’s Q3 Results

We were impressed by how significantly Herbalife blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 6.9% to $8.87 immediately following the results.

Big picture, is Herbalife a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.