Over the past six months, Accenture’s stock price fell to $247.08. Shareholders have lost 19.7% of their capital, which is disappointing considering the S&P 500 has climbed by 21.3%. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy ACN? Find out in our full research report, it’s free for active Edge members.

Why Does Accenture Spark Debate?

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE: ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Two Positive Attributes:

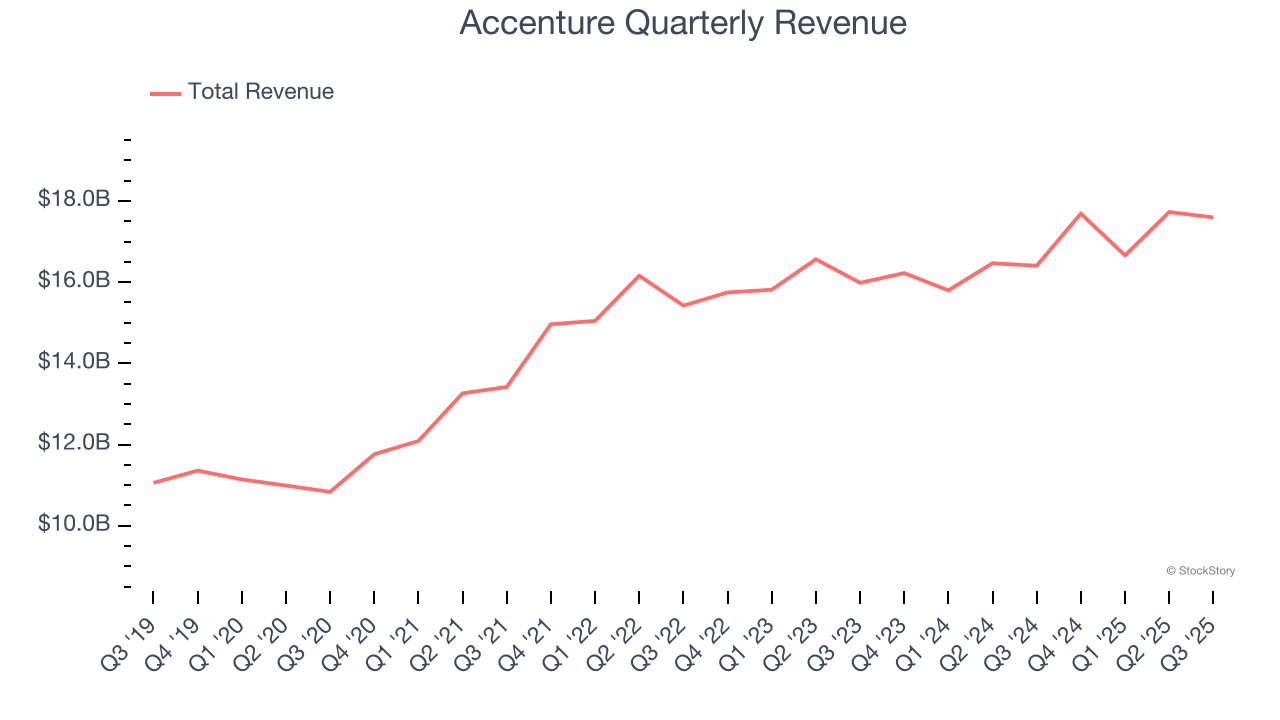

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Accenture’s 9.5% annualized revenue growth over the last five years was impressive. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $69.67 billion in revenue over the past 12 months, Accenture is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

One Reason to be Careful:

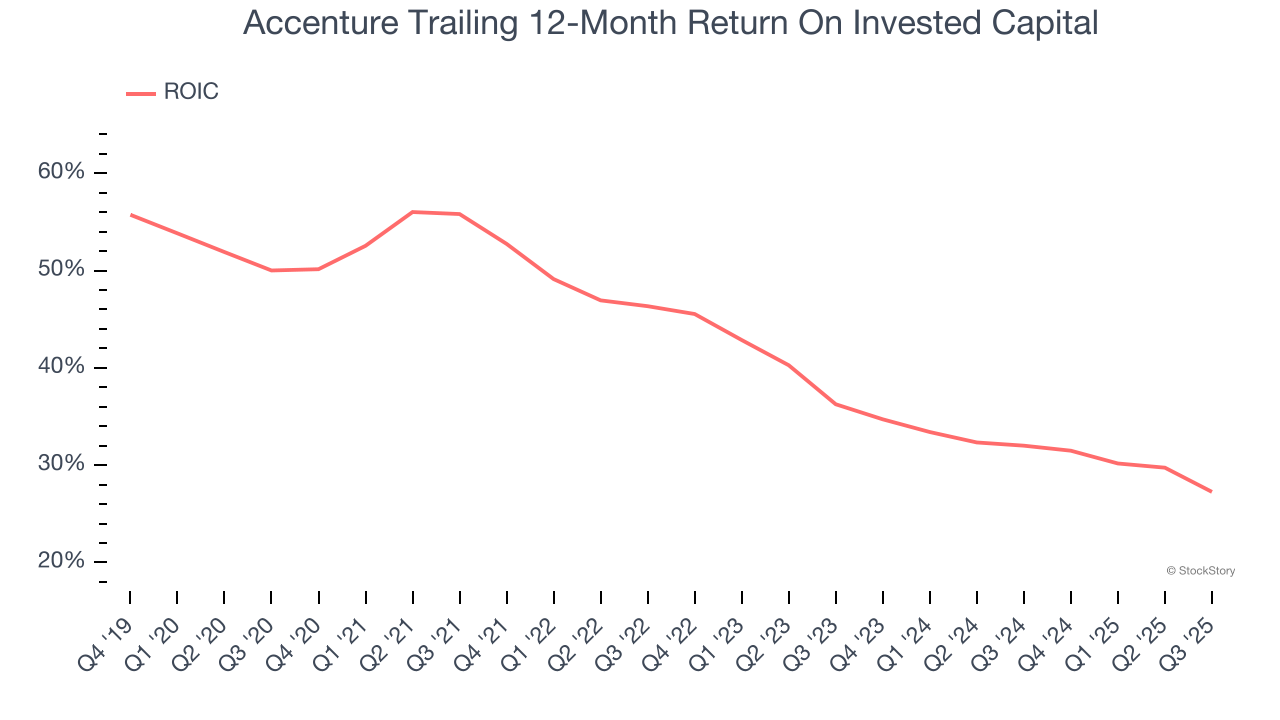

New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Accenture’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Accenture’s merits more than compensate for its flaws. With the recent decline, the stock trades at 18× forward P/E (or $247.08 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Accenture

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.