Semiconductor production equipment provider Amtech Systems (NASDAQ: ASYS) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell by 13% year on year to $24.11 million. On the other hand, next quarter’s revenue guidance of $22.5 million was less impressive, coming in 9.1% below analysts’ estimates. Its non-GAAP loss of $0 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy Amtech? Find out by accessing our full research report, it’s free.

Amtech (ASYS) Q3 CY2024 Highlights:

- Revenue: $24.11 million vs analyst estimates of $23.75 million (13% year-on-year decline, 1.5% beat)

- Adjusted EPS: $0 vs analyst estimates of $0.02 ($0.02 miss)

- Adjusted EBITDA: $832,000 vs analyst estimates of $300,000 (3.5% margin, beat)

- Revenue Guidance for Q4 CY2024 is $22.5 million at the midpoint, below analyst estimates of $24.75 million

- Operating Margin: 0.1%, up from -11% in the same quarter last year

- Free Cash Flow was -$4.00 million compared to -$1.53 million in the same quarter last year

- Inventory Days Outstanding: 171, up from 154 in the previous quarter

- Market Capitalization: $83.18 million

Company Overview

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ: ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales Growth

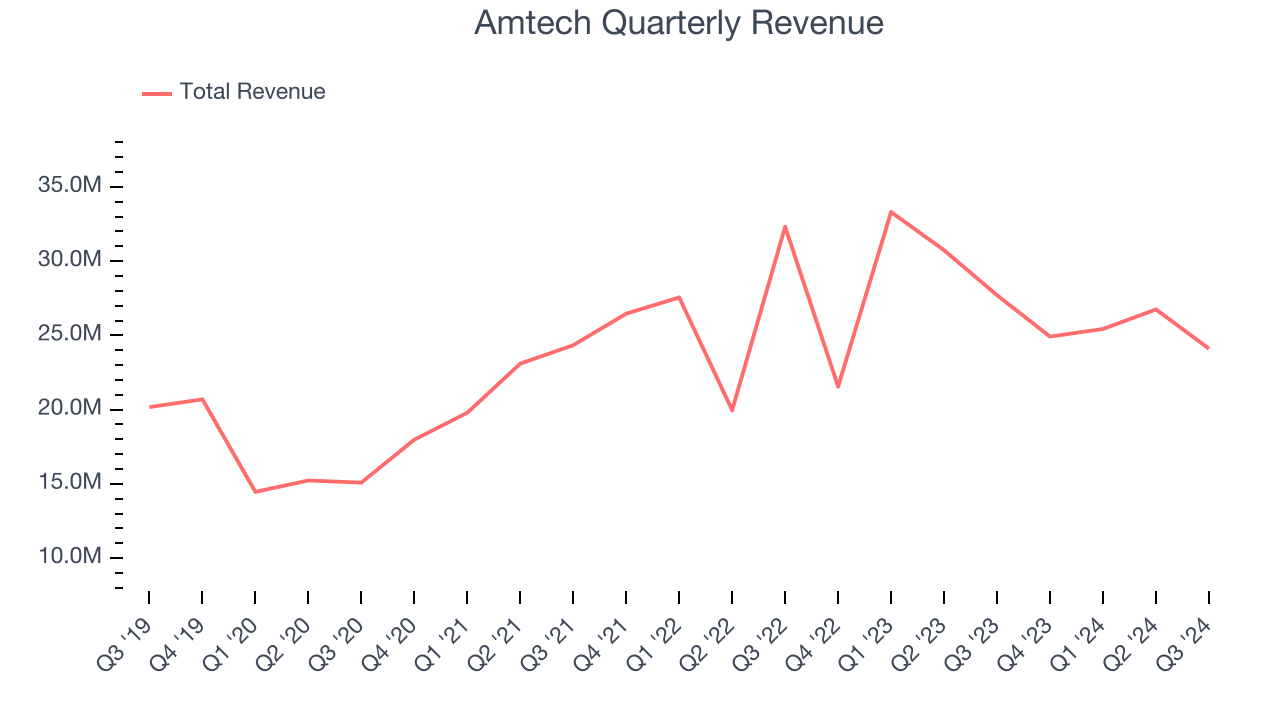

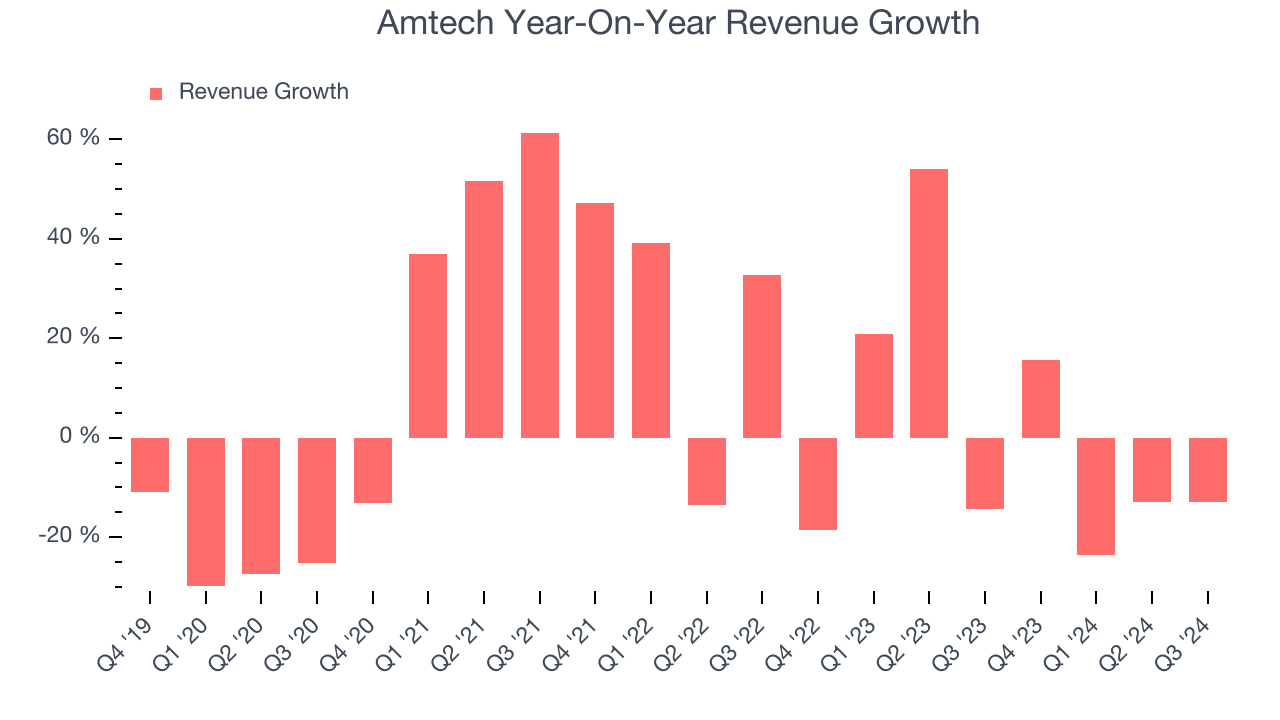

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Amtech’s sales grew at a sluggish 3.5% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Amtech’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.4% annually.

This quarter, Amtech’s revenue fell by 13% year on year to $24.11 million but beat Wall Street’s estimates by 1.5%. Company management is currently guiding for a 9.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

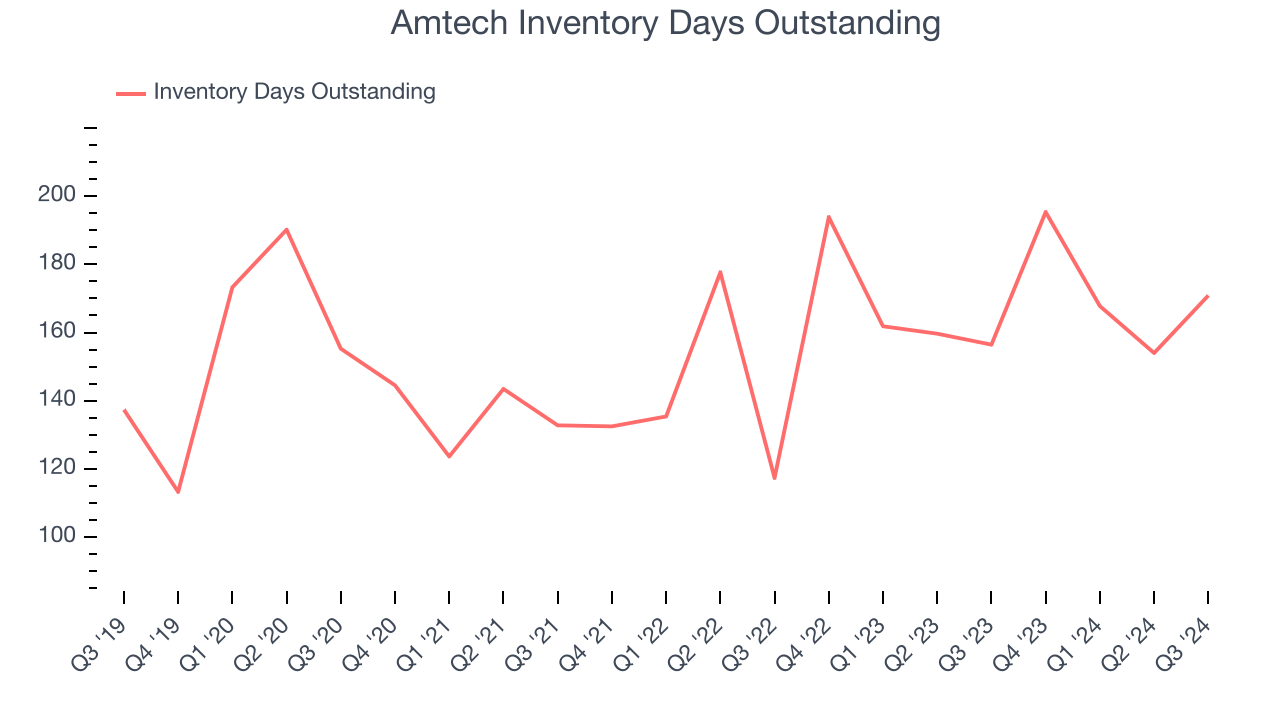

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amtech’s DIO came in at 171, which is 16 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Amtech’s Q3 Results

It was encouraging to see Amtech beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 11.3% to $5.40 immediately after reporting.

Amtech may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.