Palantir Technologies Inc (PLTR) stock may be near a bottom. I discussed this in a recent Barchart article on Feb. 18, “Has Palantir Bottomed? Probably, Based on Huge, Unusual Put Options Activity in PLTR.”

PLTR stock is now down $135.24 per share as of Friday, Feb. 20. That's down $58.93 from a recent peak of $194.17 on Dec. 24, 2025, a 30% drop in just 2 months. I showed in my article why PLTR is worth between $189 and $245 per share, or between 40% to 81% more.

As usual, trend traders have pushed up put options in PLTR stock, even for out-of-the-money (OTM) put exercise prices. That makes them attractive to short-sellers, especially if PLTR is near a bottom.

Shorting One-Month OTM Puts

For example, selling short a PLTR put option at an exercise price 7% lower than today's price yields over 3.6% over the next month. And a 11% lower strike has a 2.77% yield.

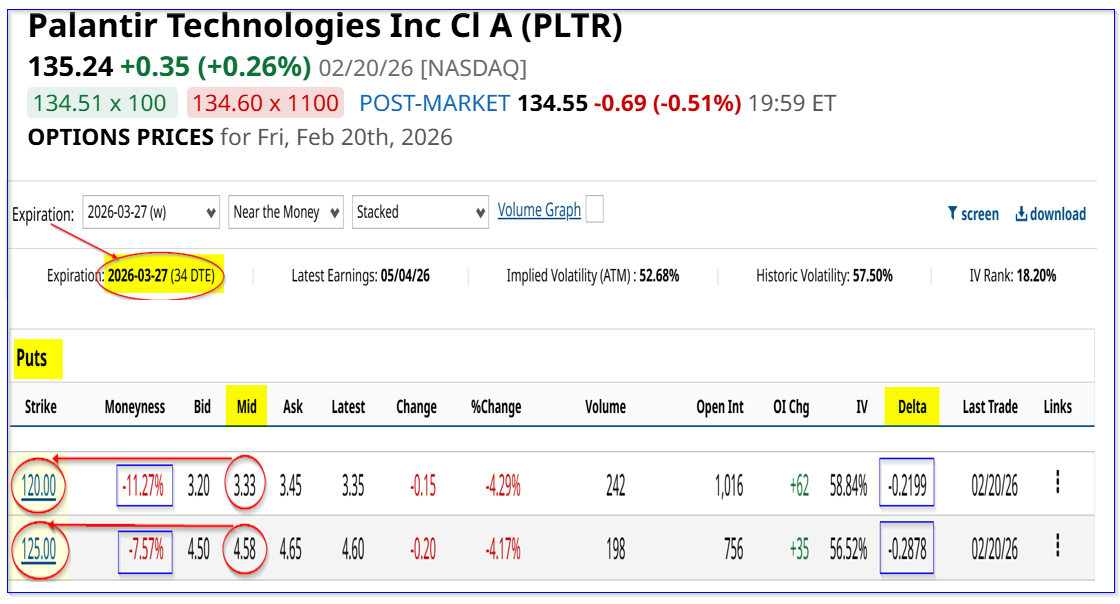

That can be seen in the following Barchart option chain for the period ending March 27, which is just over one month away.

It shows that the $125.00 strike price put, which is 7.6% lower than Friday's close, has a midpoint premium of $4.58.

That means a short seller of this put contract can make $458 after securing $12,500 in collateral. That works out to a one-month yield of 3.66%:

$458/$12,500 = 0.0366

Moreover, for more risk-averse investors, shorting the $120.00 strike price contract, over11% lower than Friday's close, yields 2.78%:

$333/12,000 = 0.02775

That is after securing $12,000 in collateral with the investor's brokerage firm.

Note that there is a large volume of put contracts at the $120 strike price, over 1,000. That could be an indication that many traders still think PLTR is going to sink another 11%.

Downside Risks

For potential investors in PLTR stock who short out-of-the-money (OTM) puts, the worst that can happen is that your account will buy PLTR shares.

But that only happens if PLTR falls 7% or 11% to $125 or $120 on or before March 27. The collateral already secured will then be assigned to buy 100 shares at the strike price.

However, if PLTR ends up lower than that strike price, it could result in an unrealized loss. That downside risk could force the investor to keep holding shares, or sell them at a potential loss (only if they want to).

But all is not lost. Here are some beneficial or mitigating factors.

Mitigating Factors and Plays

First, the investor has already received the short-put income. That effectively lowers the actual breakeven purchase point:

$125 - $4.58 = $120.42 breakeven (i.e., 11% lower)

$120 - $3.33 = $11.67 breakeven (-13.7% lower)

These breakeven points are between 11% and almost 14% lower than Friday's close at $135.24. Effectively, an investor is getting paid to wait to buy at significantly lower prices.

And for existing investors, it's a way to lower your average buy-in cost - either from the income received or from the lower buy-in if the puts are assigned.

Second, the delta ratios are low. That effectively implies that there is a low probability, based on past trading volatility, that PLTR will fall to these strike prices.

For example, the delta ratio for the $120 strike price, where there are over 1,000 contracts outstanding, is less than 22% (i.e., -0.2199). That means there is just over a 1 in 5 chance that PLTR will drop 11% to $120 by March 27.

That is why this 2.77% yield with the $120 strike price short-put play is so attractive.

Third, don't forget, the worst that can happen with a short-put play is you own PLTR shares. I have shown that the stock is worth significantly more. So, a buy-and-hold strategy has a good chance of working out.

Lastly, less risk-averse investors can buy in-the-money (ITM) call options in longer-dated periods, using this short-put income. I will write on this in a new Barchart article.

The bottom line is that PLTR's put option yields are now very high, making them attractive to short-sellers and potential value buyers in PLTR stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- If Palantir is Near a Bottom, What's the Best Play in PLTR Stock?

- The Saturday Spread: Using Volatility Skew as a Smart Money Gauge (TGT, AAPL, ORCL)

- Unusual Options Activity Alert: If You Own These 3 Stocks, It’s Time for a Protective Collar

- Palo Alto Networks Stock Has Tanked But Its Free Cash Flow is Strong - Time to Buy PANW?