Irrespective of his position in any official capacity, Warren Buffett continues to be poignantly relevant in the world of investing. Even though he has now stepped down as the CEO of Berkshire Hathaway (BRK.A) (BRK.B), in his last days at the helm of the multi-billion-dollar conglomerate, he made some notable moves.

While his reduction of stakes in some of his all-time favorites, like Bank of America (BAC) and Apple (AAPL), may draw more attention, it is his investment in a legacy newspaper company that should be of more intrigue to market participants.

About The New York Times

Tracing its roots back centuries to 1851, The New York Times (NYT) began as a penny newspaper, which has now grown to creating, collecting, distributing, and monetizing news and information worldwide across multiple delivery platforms. Its operations now encompass digital and print journalism, including the flagship newspaper, its digital site NYTimes.com, and mobile apps, and an expanding portfolio of digital products such as NYT Games, NYT Cooking, Wirecutter (product reviews), and The Athletic (sports media).

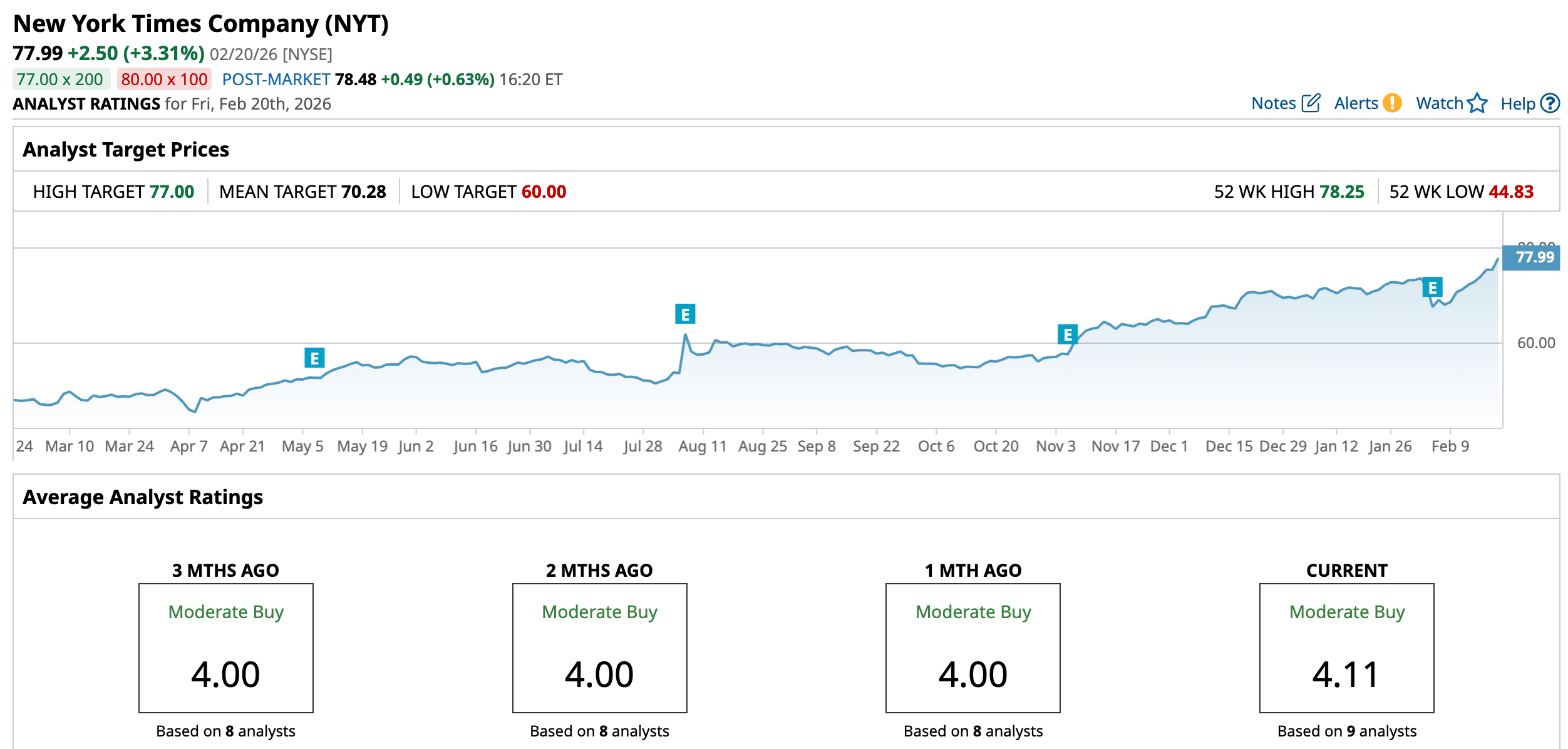

Valued at a market cap of $12.3 billion, the NYT stock has been on a tear over the past year, rising by 59.95%. Notably, the stock also offers a modest dividend yield of 0.97%, and with a payout ratio of under 30%, there remains scope for the company to grow its dividends in the future.

In his last quarter as CEO of Berkshire, Buffett purchased 5.07 million shares of the national daily for a total value of $351.7 million.

So, what led Buffett to attribute the moniker of “toast” to newspaper companies to now investing hundreds of millions of dollars to build a sizable stake in one of the leading institutions of the industry?

Robust Financials

Buffett has reiterated that he diligently monitors the financial statements of a company before investing in it, and he may have certainly liked what he saw at The Times. Even amid vociferous assumptions about the demise of print newspapers, the paper has managed to grow its revenue and earnings at CAGRs of 6.10% and 18.53%, respectively, in the past 10 years, staying relevant by repositioning itself as a digital media company successfully.

The results for the most recent quarter, Q4 2025, saw the company reporting a beat on both the revenue and earnings front, too. Total revenues for the Dec. 2025 quarter stood at $802.3 million, up 10.4% from the previous year. Subscription revenues, its biggest segment, saw a growth of 9.4% in the same period to $510.5 million. Pertinently, digital-only subscription revenues climbed by an even faster tick at 13.9% to $381.5 million, with the company expecting the same to rise by 9%-11% in Q1 2026.

Meanwhile, earnings witnessed a steady growth rate of 11.3% year-over-year (YOY) to $0.89 per share, coming in just ahead of the consensus estimate of an EPS of $0.88. Moreover, this was the ninth consecutive quarter of earnings beat from the company. Further, in each of those nine quarters, the company has recorded yearly growth in earnings.

And, cash flows remained solid for the year, with The Times seeing its net cash flow from operating activities rising by 42.4% from the prior year to $584.5 million. Overall, the company closed the quarter with a cash balance of $1.2 billion, with no debt on its books.

Key monitorable operating metrics, such as total subscribers and average revenue per user (ARPU), saw growth of 11.8% and 0.73% over the past year to 12.8 million and $9.72, respectively.

However, the share price has come at the expense of overvaluation for The Times as its forward P/E, P/S, and P/CF at 28.19, 4.01, and 22.01 are all higher than the sector medians of 3.96, 1.28, and 8.16, respectively.

Why The Good Times Will Keep Rolling?

Buffett may have taken a liking to The Times for several reasons. Chief among them can be his belief that The Daily has adapted well to the digital era.

The New York Times has successfully shifted from a traditional news model to a "portfolio-driven" digital powerhouse, a transition highlighted by its record-breaking $2 billion in digital revenue in 2025. The core of this growth is the "all-access bundle," which has effectively mitigated the industry-wide problem of subscriber churn. As of the fourth quarter of 2025, over 51% of its 12.8 million subscribers are now bundle or multiproduct users. This strategic pivot is financially validated by a digital-only Average Revenue per User (ARPU) of $9.72, representing a consistent upward trend as promotional users transition to higher-priced standard tiers. By integrating high-frequency habit products like Games, NYT Cooking, and The Athletic - which itself swung to a $5.8 million adjusted operating profit in mid-2025 - the company has created a "sticky" ecosystem where the lifetime value of a bundle subscriber is significantly higher than that of a news-only reader.

And in 2026, growth is projected to be spearheaded by a major acceleration into video journalism, a move management describes as a "major new audience opportunity." This initiative aims to capture younger, video-first demographics and is already yielding results; digital advertising revenue surged 25% in the final quarter of 2025, reaching $147.2 million due to strong demand for these new visual ad formats. To support this, the company is scaling production under a "Watch" tab within its flagship app, helping drive an expected 14% to 17% increase in digital-only subscription revenue for the first quarter of 2026.

However, the company also faces some headwinds. The most immediate threat is the risk that AI-powered search overviews will satisfy a reader’s curiosity without them ever clicking a link to The Times website. Additionally, the company is seeing a sharp rise in operating costs (up over 10% in late 2025), driven by expensive video production and legal fees from their AI battles.

Analyst Opinion

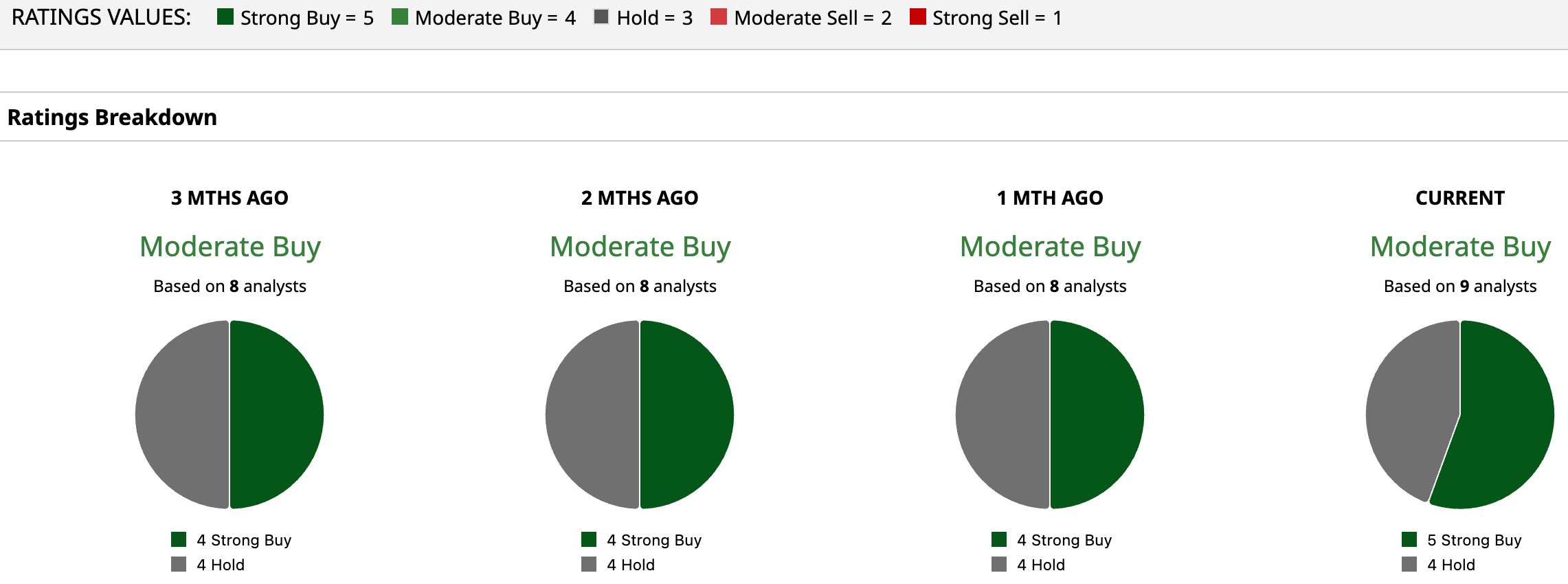

Thus, Wall Street analysts have attributed an overall rating of “Moderate Buy” for the NYT stock. However, the mean target price of $70.28 and the high target price of $77 allude to the fact that a rerating is on the cards for the stock. Nine analysts covering the stock are split with five holding at “Strong Buy” and four maintaining “Hold” ratings.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: Using Volatility Skew as a Smart Money Gauge (TGT, AAPL, ORCL)

- Warren Buffett’s Last Investment Was This Stock. Should You Follow the Oracle and Buy It Too?

- These 3 Dividend Aristocrats Look Ready to Rebound in 2026. Should You Buy Them Now?

- Grail Stock Is Deeply Oversold on Cancer Test Failings. Is There Any Hope Left to Buy the Dip?