Valued at a market cap of $137.6 billion, Booking Holdings Inc. (BKNG) provides online and traditional travel and restaurant reservations and related services. The Norwalk, Connecticut-based company also offers travel-related insurance products, payment facilitation, and restaurant management services to consumers, travel service providers, and restaurants.

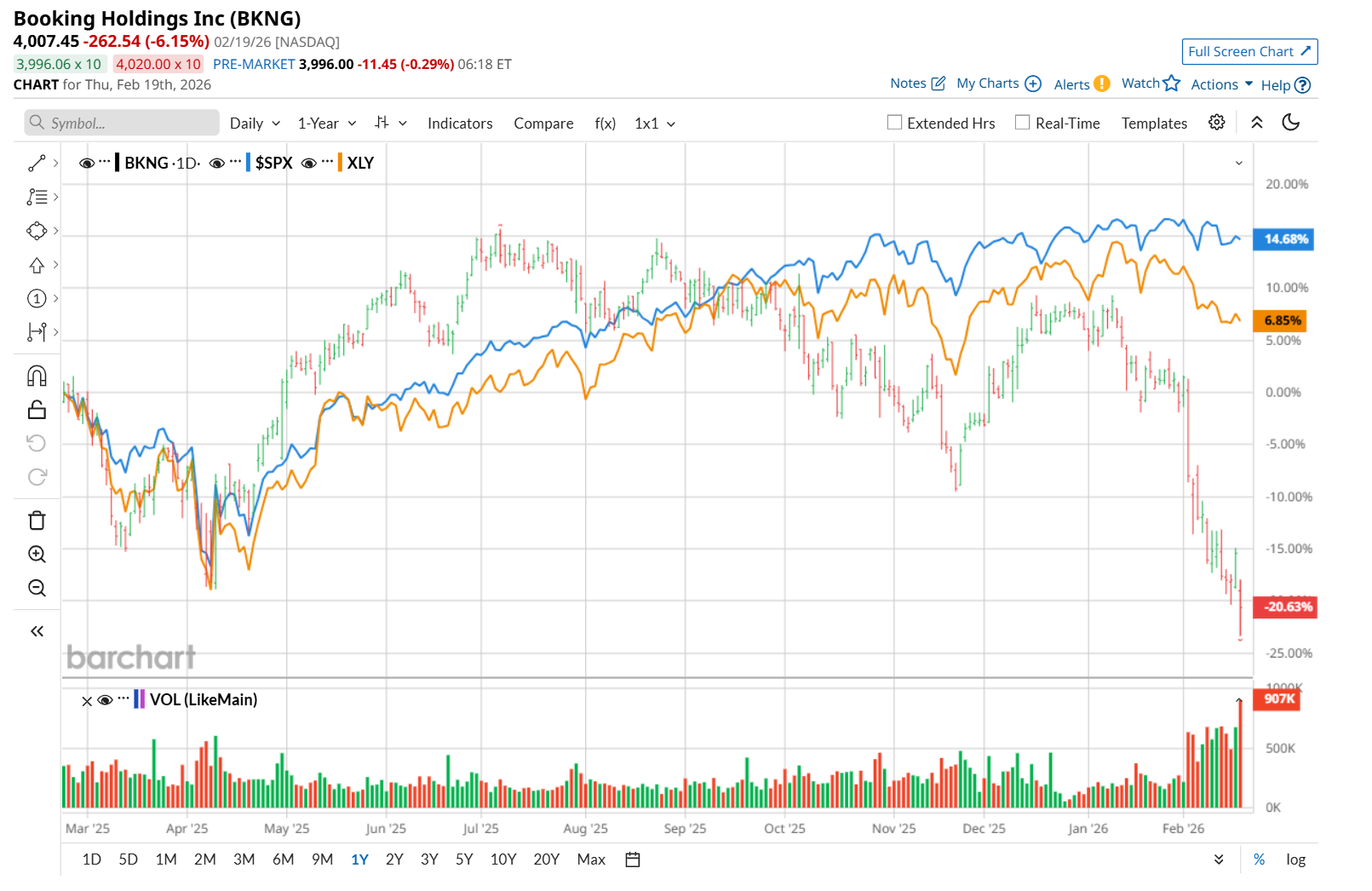

This travel services company has considerably trailed behind the broader market over the past 52 weeks. Shares of BKNG have declined 21.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.7%. Moreover, on a YTD basis, the stock is down 25.2%, compared to SPX’s marginal rise.

Narrowing the focus, BKNG has also underperformed the State Street Consumer Discretionary Select Sector SPDR ETF (XLY), which gained 2.8% over the past 52 weeks and dropped 2.7% on a YTD basis.

BKNG delivered stronger-than-expected Q4 earnings results on Feb. 18, yet its shares plunged 6.2% in the subsequent trading session. Robust travel demand across all major regions and increased investment in performance marketing and social media channels, particularly in Asia and the U.S., contributed to its upbeat results. The company’s total revenue increased 16% year-over-year to $6.3 billion, surpassing consensus estimates by 3.9%, while its adjusted EPS grew 17.4% to $48.80, topping analyst expectations of $48.23.

For fiscal 2026, ending in December, analysts expect BKNG’s EPS to grow 16.9% year-over-year to $266.55. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

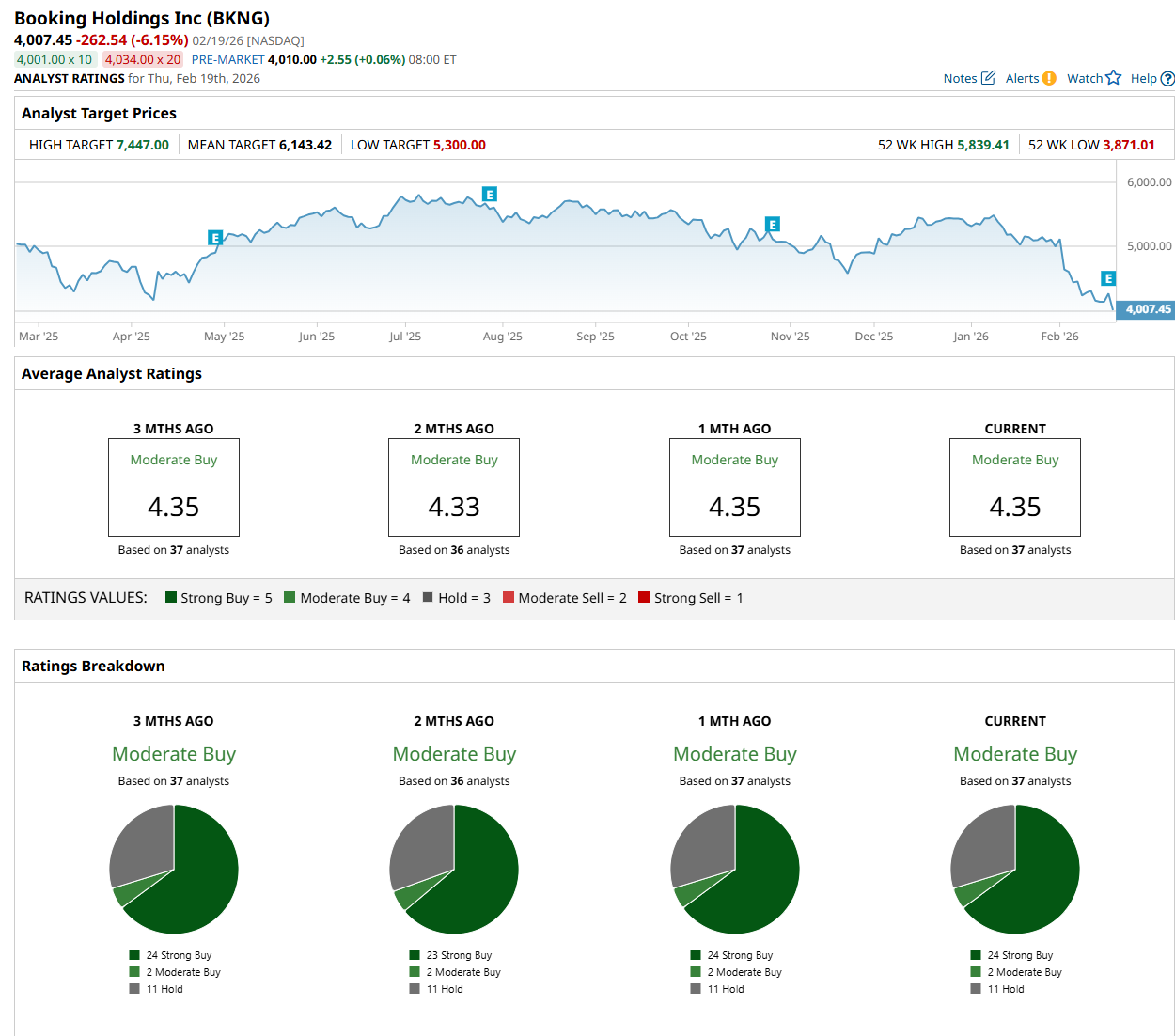

Among the 37 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 24 “Strong Buy,” two "Moderate Buy,” and 11 "Hold” ratings.

The configuration is more bullish than two months ago, with 23 analysts suggesting a “Strong Buy” rating.

On Feb.19, Scott Devitt from Wedbush maintained a “Buy" rating on BKNG, with a price target of $5,300, indicating a 32.3% potential upside from the current levels.

The mean price target of $6,143.42 suggests a 53.3% potential upside from the current levels, while its Street-high price target of $7,447 suggests an ambitious 85.8% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart