Nvidia (NVDA) will release its fourth-quarter fiscal 2026 earnings on Feb. 25. That’s next Wednesday after the market closes. Yes, we are going to talk about it, a week in advance. Because this is the artificial intelligence (AI) trade, as much as any stock.

But lately, while some stocks have cratered on AI jitters, the main supplier of chips to all that demand has been in a rut. And there’s nothing like a quarterly earnings report to prompt a stock to bust out. Ah, but in which direction? Let’s take a look.

Nvidia’s quarterly conference call with CEO Jensen Huang has become less of a corporate update and more of a referendum on the global AI economy. While the company has a staggering track record of beating analyst estimates in 20 of the last 22 quarters, the stock has actually fallen after three of its last four reports.

What Wall Street Is Watching for When Nvidia Reports Q4 Earnings

For traders, the "freak out" isn't about whether Nvidia will miss its numbers — it’s about whether the standards of perfection have finally become impossible to meet. Here are the high-level themes currently causing jitters on the trading floor.

- Official consensus estimates are calling for roughly $65.6 billion in revenue — a 67% jump from last year. However, "whisper numbers" (the unofficial expectations of professional traders) are rumored to be closer to $67 billion. If NVDA only hits the official target, the market may treat it as a disappointment. Case in point: Even blockbuster beats failed to spark a rally because they didn't exceed that very high bar for explosive growth.

- Then there’s the Blackwell vs. Rubin Dilemma. Traders are hyper-focused on the transition between chip generations. While current Blackwell systems are sold out through mid-2026, the recent unveiling of the next-generation Rubin architecture, due to debut later this year, has created a potential delay in demand. Talk about a high-class problem! Major customers might hesitate to buy Blackwell chips today if they know the vastly superior Rubin chips are coming just a few months later.

- And, there’s the fact that Nvidia’s growth is heavily dependent on a handful of hyperscalers. Analysts are raising concerns about those intriguing (a.k.a. strange and suspicious) circular AI deals. That’s where capital flows between cloud providers and AI startups create an artificial loop of GPU purchasing. NVDA needs to show the market that demand is broadening out.

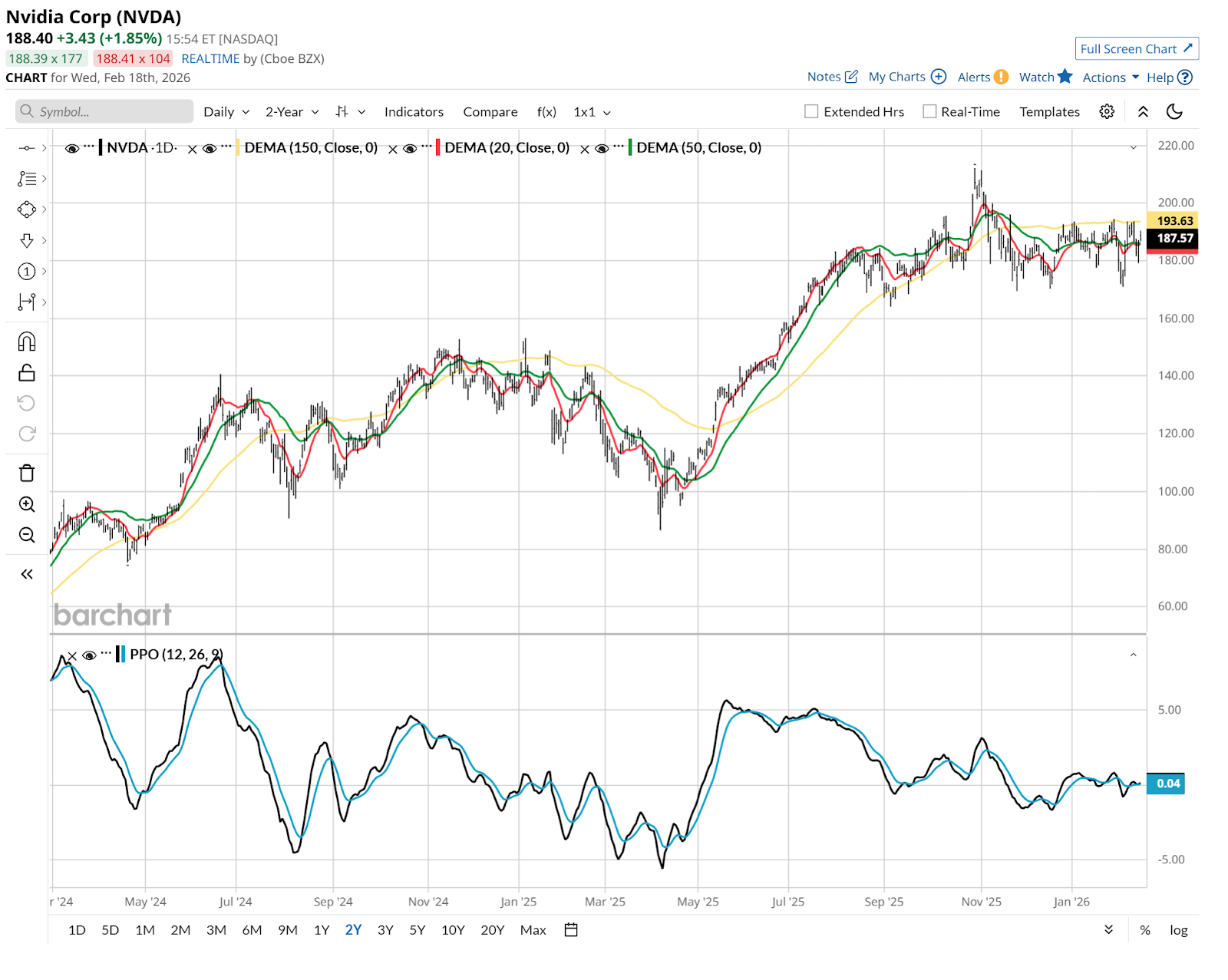

NVDA’s Chart Is Signaling Nothing — And That’s Something To Look At

Throughout last summer, it sure looked like NVDA’s stock price was going to run away and hide from the rest of the stock market. As has been the case a few times over the past few years, it had a mind of its own. But since August, the stock has done nothing. That sets up a very highly-charged earnings reaction, in one direction or the other.

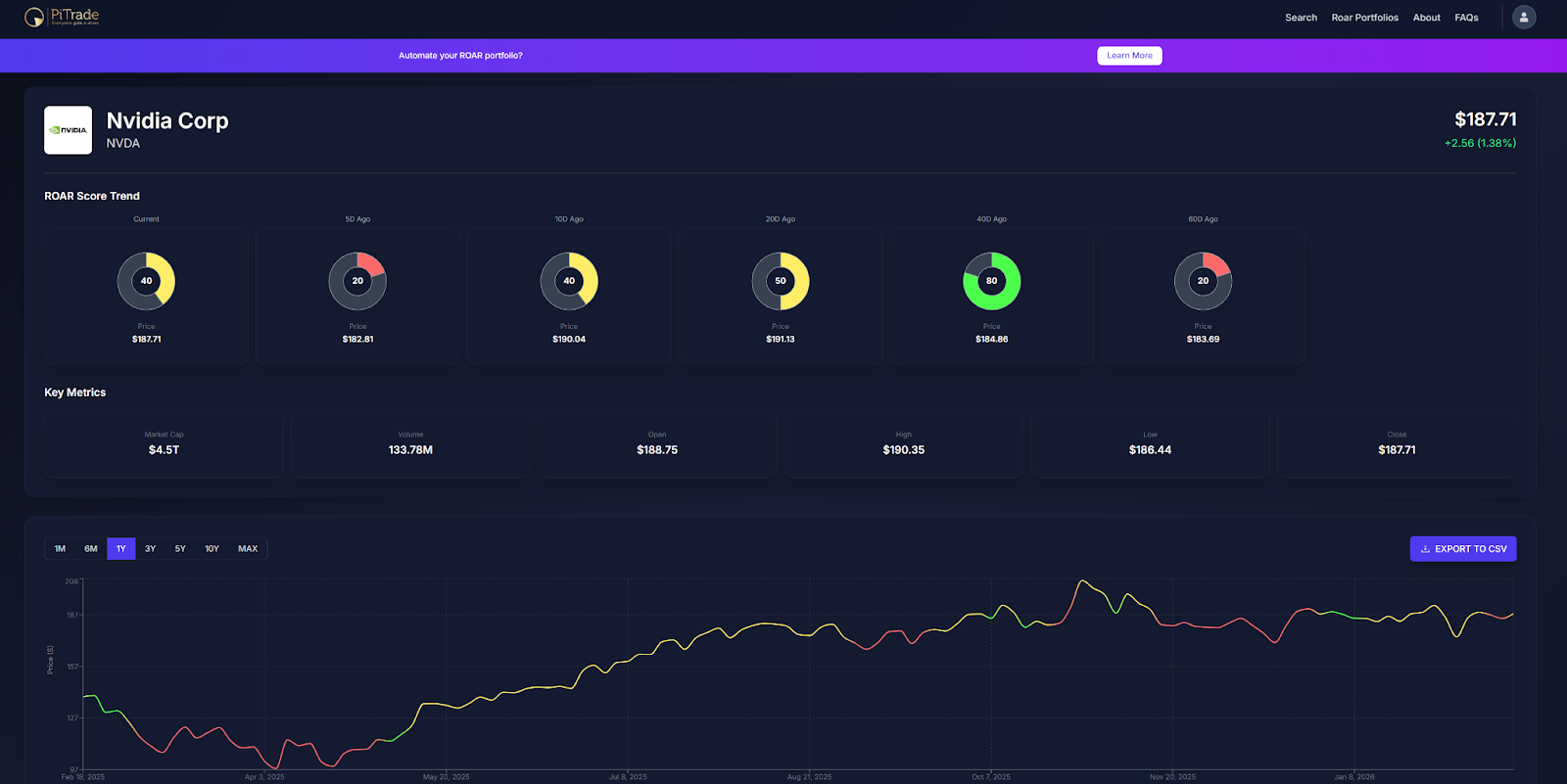

My ROAR Score Analysis on NVDA

ROAR (reward opportunity and risk) is based on my automated analysis of the technical pattern, borne from 45 years of looking at charts. NVDA stock has hinted at moving in every direction the past few months, which is what ROAR is about. It monitors the risk of major loss, since we all know any stock can rally at any time, for any reason.

But the one aspect of this single-stock ROAR take is what just happened this week. NVDA moved back to a score of 40, which translates to "slightly higher than normal risk.” That’s up from 20, which is a more stressful level.

The bottom line is that, as we inch closer to Nvidia earnings mid-week next week, the market is doing what it tends to do — start to lean more bullish, and hope for the best. But since NVDA has been as devout in its direction as a chameleon lately, that only makes me more convinced that a collar or otherwise hedged position is a must for traders approaching this latest quarterly milestone event.

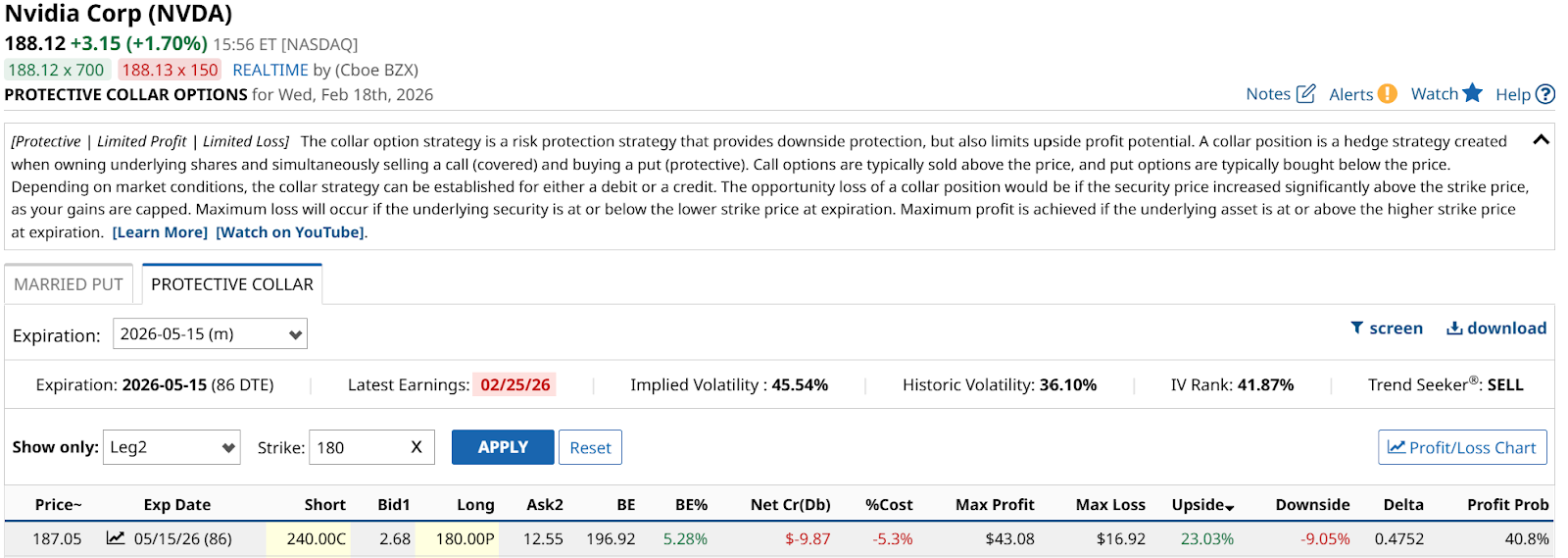

Collaring NVDA

That technical chart above is flat as a wafer (not a chip wafer, a wafer cookie). That tells me two things. First, the market is likely waiting for earnings to really tell us how it feels. And, since I am all about trying to capitalize on sudden increases in volatility, this is an ideal time to look at an option collar trade on NVDA.

When we do, we see that this old, reliable collar stock is still giving us a lot of meat to go after. NVDA’s IV rank is just above 40%, which means it is in the lower half of its 12-month trailing volatility. Yet its raw “vol” is still high. That translates into pretty good option pricing.

The goal, as always, with the collar is to give ourselves a fighting chance to get a good portion of the post-earnings pop. If there is one. And if the stock drops hard instead, we want to secure a “line in the sand” below which we are just fine, since the put option gives us the opportunity to sell NVDA at that strike price. No matter how far it falls.

In the above example, I went out a few months, to what should be right around next quarter’s earnings. The call strike at $240 and put strike at $180 combine to produce a very respectable 23% upside to 9% downside. And the 5% cost, the difference between the put cost and call premium received? That’s a pittance, given that NVDA’s stock could move like that in an hour. This is three months’ time we’re talking about.

The Takeaway

If management cannot convincingly argue that we are still in the proverbial early innings of a multi-year transition, the market may finally decide that the AI peak has been reached. I’ll let the fundamental types assess the results next week. I’ll be doing what I always do: watching the charts, and ROAR scores, for clues.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart