Etsy (ETSY) stock closed nearly 10% higher on Feb. 19, after the e-commerce firm divested Depop, its fashion resale platform, to eBay (EBAY) for $1.2 billion in cash.

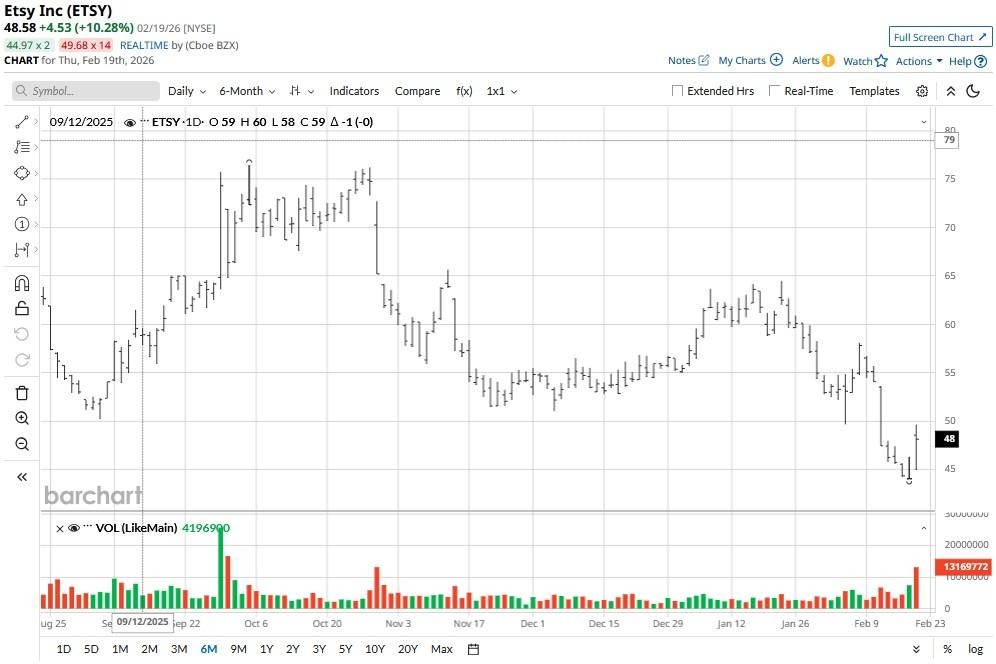

On Thursday, Etsy reported better-than-expected per-share earnings for its fiscal Q4 as well, which helped its stock price push briefly above its 20-day moving average (MA). While this technical setup often precedes a relief rally, neither fourth-quarter release nor Depop sale warrant buying ETSY stock at current levels.

Despite today’s gains, Etsy remains down about 25% versus its year-to-date high.

Investing in Etsy Stock Is a Risky Proposition

Etsy sold its fashion resale platform for $1.2 billion, much less than the $1.62 billion that it spent on buying it nearly five years ago. The divestiture completes Etsy’s exit from its failed “house of brands” strategy — a diversification push that evidently didn’t create shareholder value.

Investors are cautioned against chasing the rally in ETSY shares also because its gross merchandise sales declined significantly on a currency-neutral basis in Q4 as the company’s core marketplace experienced contraction instead of growth.

Moreover, the NYSE-listed firm is losing its ability to attract active buyers as evidenced by a 2% year-over-year decline in users to 93.54 million, despite aggressive marketing investments.

Options Data Suggests Downside Head in ETSY Shares

Etsy stock remains unattractive as a long-term holding also because the company guided for up to $2.43 billion in gross merchandise sales for its fiscal Q1 — a huge step down from $2.8 billion last year.

This signals deteriorating consumer demand as inflationary pressures and economic uncertainty continues to weigh on discretionary spending.

Moreover, since ETSY remains decisively below its longer-term MAs (50-day, 100-day, 200-day), it’s reasonable to assume that the stock’s broader downtrend remains intact.

According to Barchart, the put-to-call ratio on options contracts expiring early March sits at 4.56x currently, indicating significant skew to the downside. The lower price of $43.83 on those contracts suggests Etsy could lose nearly 9% over the next few weeks.

How Wall Street Recommends Playing Etsy

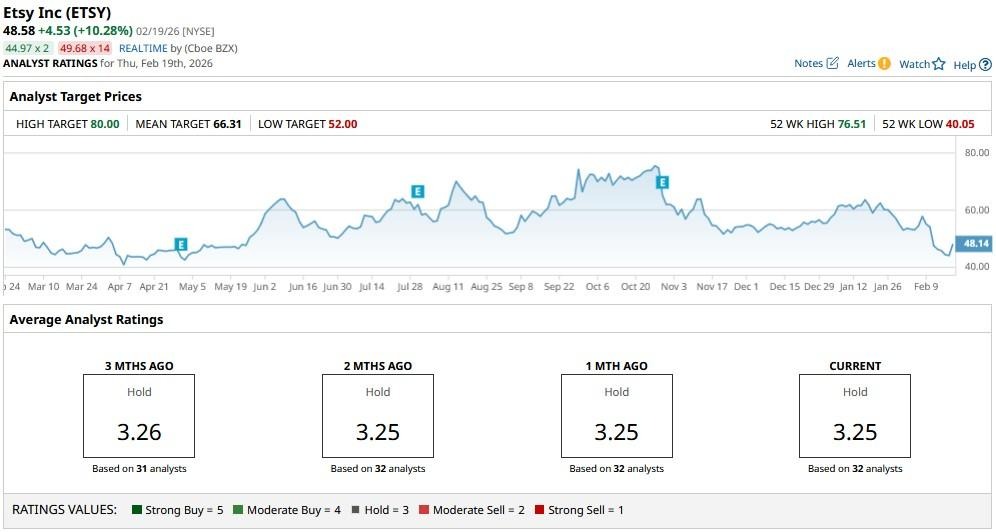

Despite aforementioned headwinds, Wall Street firms maintain a mean target of about $66 on Etsy shares.

However, downward revisions could follow after the company’s muted Q4 release on Feb. 19.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Dumped Recursion Pharmaceuticals Stock. Should You?

- Etsy Stock Breaks Above Its 20-Day Moving Average on Depop Sale. Does That Make ETSY a Buy Here?

- As Apple Tests AI Devices, Should You Buy AAPL Stock Here?

- Klarna Stock Is Deeply Oversold After Ugly Earnings Plunge. Should You Buy the Dip in KLAR Here?