Happy New Year to all my Barchart readers. I hope you took some time over the past couple of weeks to unplug from your phone and enjoy conversations with friends and family.

Between Hanukkah and Christmas, social and religious obligations and activities extend throughout much of December. It can become exhausting.

As investors, it’s a good time to review the past year in the markets and assess our successes and failures. None of us is so good that we don’t have things we could and perhaps should do better.

With the holiday season coming to an end and many readers back to work next week, I thought I’d look back at the unusual options activity from Q4 2025 and evaluate my best and worst bets from the final quarter of this past year.

Here’s hoping 2026 brings a fifth consecutive year of gains for the S&P 500.

Have an excellent weekend!

Intel $50 Call Delivers

Three days into October, I wrote about Intel’s (INTC) unusually active options expiring on Halloween and the options strategy to profit from the chip stock, whose share price in 2025 was on the mend.

The Oct. 31 $50 call on Intel caught my eye in Oct. 2 trading due to its unusual options activity. This particular strike had the third-highest Vol/OI (volume-to-open-interest) ratio on the day at 134.59. Anything over 100 is rocket fuel for options.

The ask price for the $50 call was $0.65. At the time, its share price was $37.30. I suggested a Covered Combination (or Covered Strangle) options strategy, which involved buying 100 INTC shares and selling an OTM (out-of-the-money) call and put expiring on Oct. 31.

The strategy combines a Covered Call with a Cash-Secured Put. I mistakenly wrote Naked Put in my October article. This strategy generally must be secured with cash. That mistake is on me.

Selling the $50 call generated $61 in premium income. Intel reported better-than-expected Q3 2025 results on Oct. 23. The Oct. 31 closing share price was $39.99, well below the $50 strike price, so you would have pocketed the $61.

Regarding the OTM put, I provided alternative strike prices from $30 to $37. Although I didn’t emphasize the best bet, I did say that the $30 strike was best if you didn’t want to own more than 100 INTC shares. The premium income for selling the $30 put was $38, bringing the total income earned to $99.

Based on the Oct. 2 closing share price of $37.30, your gain on the 100 shares as of Oct. 31 would have been $269, for a total profit of $368, an annualized total return of 69.2% [$368 in gains / $3,730 cost of 100 shares + $3,000 in cash to secure put * 365 / 29 days].

That’s great.

Since Oct. 31, Intel’s shares have fallen below the Oct. 2 share price, indicating that its momentum has likely stalled. However, the Barchart Technical Opinion for Intel is a 64% Buy, indicating further near-term gains.

The QQQ Thought Experiment Was a Failure Despite Apparent Success

On Nov. 7, I went with a covered strangle strategy on the Invesco Nasdaq 100 ETF (QQQ). The QQQ had the highest Vol/OI ratio the day prior at 119.52.

However, rather than going with the Nov. 10 $615 call as one-half of the strategy, I opted for the Sept. 18 $800 call, which I described as a “thought exercise.” In other words, something only aggressive investors should consider.

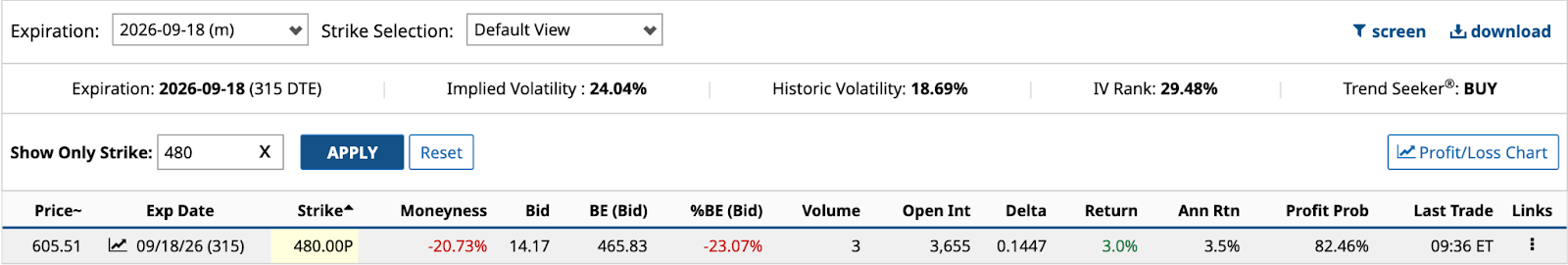

To complete the covered strangle, I selected the Sept. 18 $480 put at a $14.17 bid price.

My theory on this bet was geared toward long-term QQQ shareholders who had built up significant gains but didn’t want to sell. In this scenario, the premium income from selling the call and put was $1,916, an annualized return of 2.0% [$1,916 premium from call and put / ($48,000 cash to secure put + $61,167 cost of 100 QQQ shares) * 365 / 315 DTE].

But if you bought the shares four years ago at around $400, the annualized return on the premium income improves to 2.5% [$1,916 premium from call and put / ($48,000 cash to secure put + $40,000 cost of 100 QQQ shares) * 365 / 315 DTE], while keeping the option to purchase an additional 100 QQQ shares at $480.

The expected move by Sept. 18, up or down, is $75.79 (12.23%). That puts the lower price at $543.90, nearly $31 higher than on Nov. 7. It’s becoming less likely that the share price at expiration will be below $480.

In retrospect, I probably shouldn’t have used a DTE so far out. The returns are too small for most investors, while the risk remains real.

You won’t get another thought experiment like this one from me again. It was a bust.

The Wheel Strategy Partly Goes Off the Rails With WDAY, HOOD, and SOFI

Last up is my Nov. 27 article about implementing “Wheel” strategies for Workday (WDAY), Robinhood Markets (HOOD), and SoFi Technologies (SOFI).

This involves selling cash-secured puts on each stock for premium income until you can buy shares at a lower price through assignment. Once you’ve acquired shares of each through this process, you turn around and do Covered Calls to generate more premium income until the shares are called away and you’re forced to sell. You then repeat the process.

In my article, I selected three popular stocks — the wheel strategy is used for stocks you ultimately want to own — to start the process. The cash-secured puts selected to sell should be OTM (out-of-the-money).

Here are three:

The combined premium income from all three stocks is $579. To calculate the annualized return, first sum the costs of buying 100 shares of each stock. In my article, I went with the $115 strike for Robinhood. That’s $32,600 and a 1.77% return.

The combined premium income from all three stocks is $579. To calculate the annualized return, first sum the costs of buying 100 shares of each stock. In my article, I went with the $115 strike for Robinhood. That’s $32,600 and a 1.77% return.

However, to annualize the return, you need to use an average DTE (days to expiration) of the three, which is 39.3. That means the annualized return is 16.4% [$579 premium income / $32,600 cash * 365 / 39.3 days].

That’s a healthy return. But only HOOD has already expired, while the SOFI put expires at today’s close, with WDAY set to expire in 14 days.

As I write this on Dec. 30, Robinhood’s Dec. 26 $115 put expired slightly OTM, so no shares were purchased at $115. SoFi’s share price is $26.96, 3.7% OTM, but it is at risk of closing below the strike price. Over the long term, buying SOFI stock at $26 should generate capital gains in 3-5 years. Lastly, Workday’s share price is $217.33, well above the $185 strike price. With an expected move of $9.32, it doesn’t appear the share price will come anywhere near $185, so no shares will be acquired in this round.

The wheel strategy has partly gone off the rails because the three puts were OTM by 16.4% (WDAY), 11.5% (HOOD), and 9.6% (SOFI) when I selected them on Nov. 7. You would think one of the three would face the risk of assignment, which is part of the strategy to acquire shares at better prices.

That said, a 16.4% annualized return isn’t a bad consolation prize.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart