With a market cap of $38.7 billion, Westinghouse Air Brake Technologies Corporation (WAB) is a global provider of technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries. It delivers advanced propulsion, braking, signaling, digital, and maintenance solutions across rail, marine, mining, and transit markets worldwide.

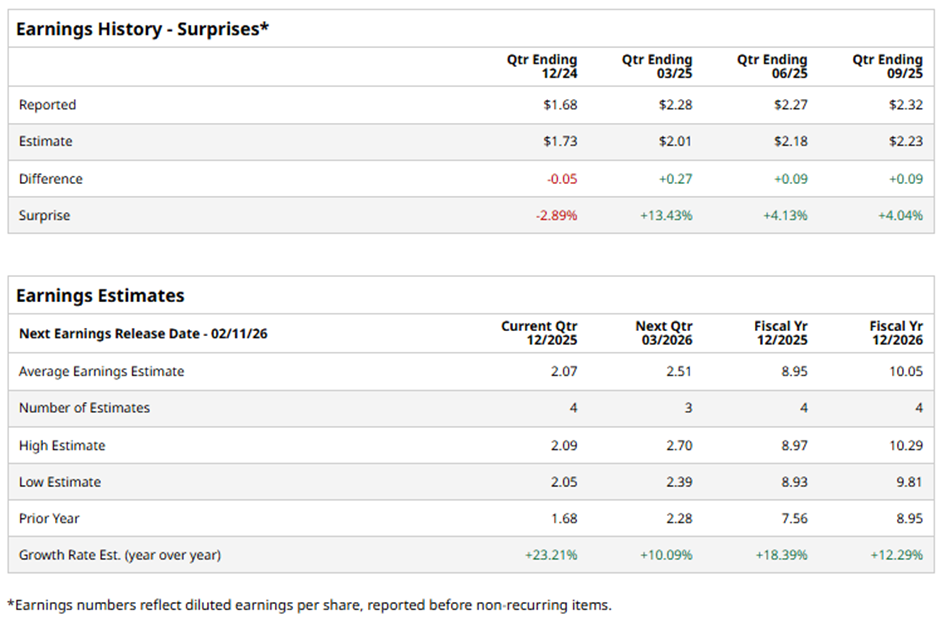

The Pittsburgh, Pennsylvania-based company is set to unveil its fiscal Q4 2025 results soon. Analysts expect WAB to report an adjusted EPS of $2.07, up 23.2% from $1.68 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts predict the locomotive parts maker to report an adjusted EPS of $8.95, a growth of 18.4% from $7.56 in fiscal 2024.

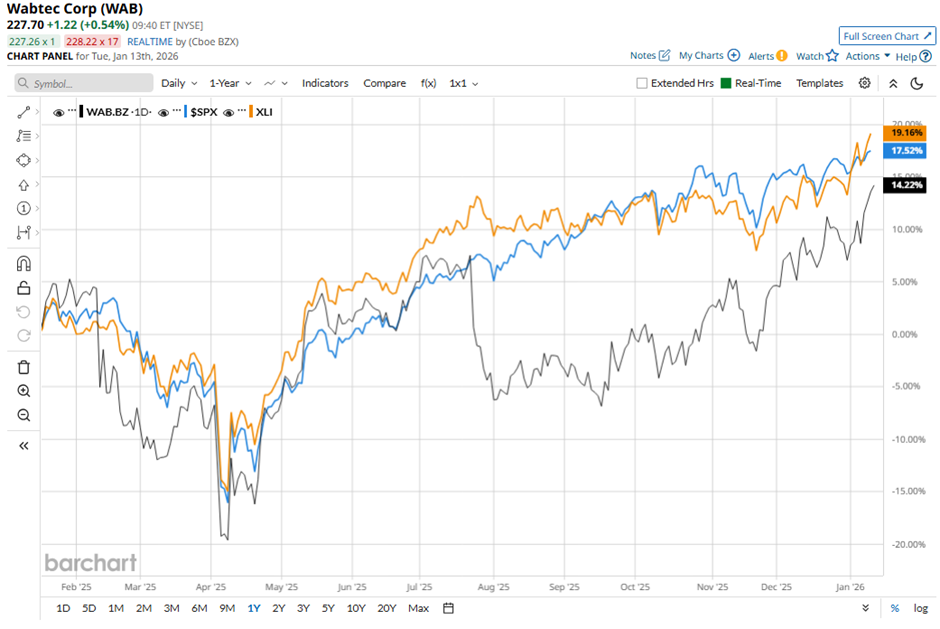

Shares of Westinghouse Air Brake Technologies have increased 19.9% over the past 52 weeks, slightly outperforming both the S&P 500 Index's ($SPX) 19.7% gain. However, the stock has lagged behind the State Street Industrial Select Sector SPDR ETF's (XLI) 23.4% return over the same period.

Wabtec reported strong Q3 2025 results on Oct. 22, including sales growth of 8.4% to $2.89 billion, and adjusted EPS of $2.32. Wabtec also raised and tightened its full-year 2025 adjusted EPS guidance to a range of $8.85 to $9.05, up 18.4% at the midpoint. Nevertheless, the stock fell 2.3% on that day.

Analysts' consensus view on WAB stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 13 analysts covering the stock, eight suggest a "Strong Buy" and five give a "Hold." This configuration is slightly more bullish than three months ago, with seven analysts suggesting a "Strong Buy."

The average analyst price target for Wabtec is $233.83, indicating a potential upside of 2.7% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart