Livonia, Michigan-based Masco Corporation (MAS) manufactures and distributes branded home improvement and building products. Valued at a market cap of $14.4 billion, the company is expected to announce its fiscal Q4 earnings for 2025 before the market opens on Tuesday, Feb. 10.

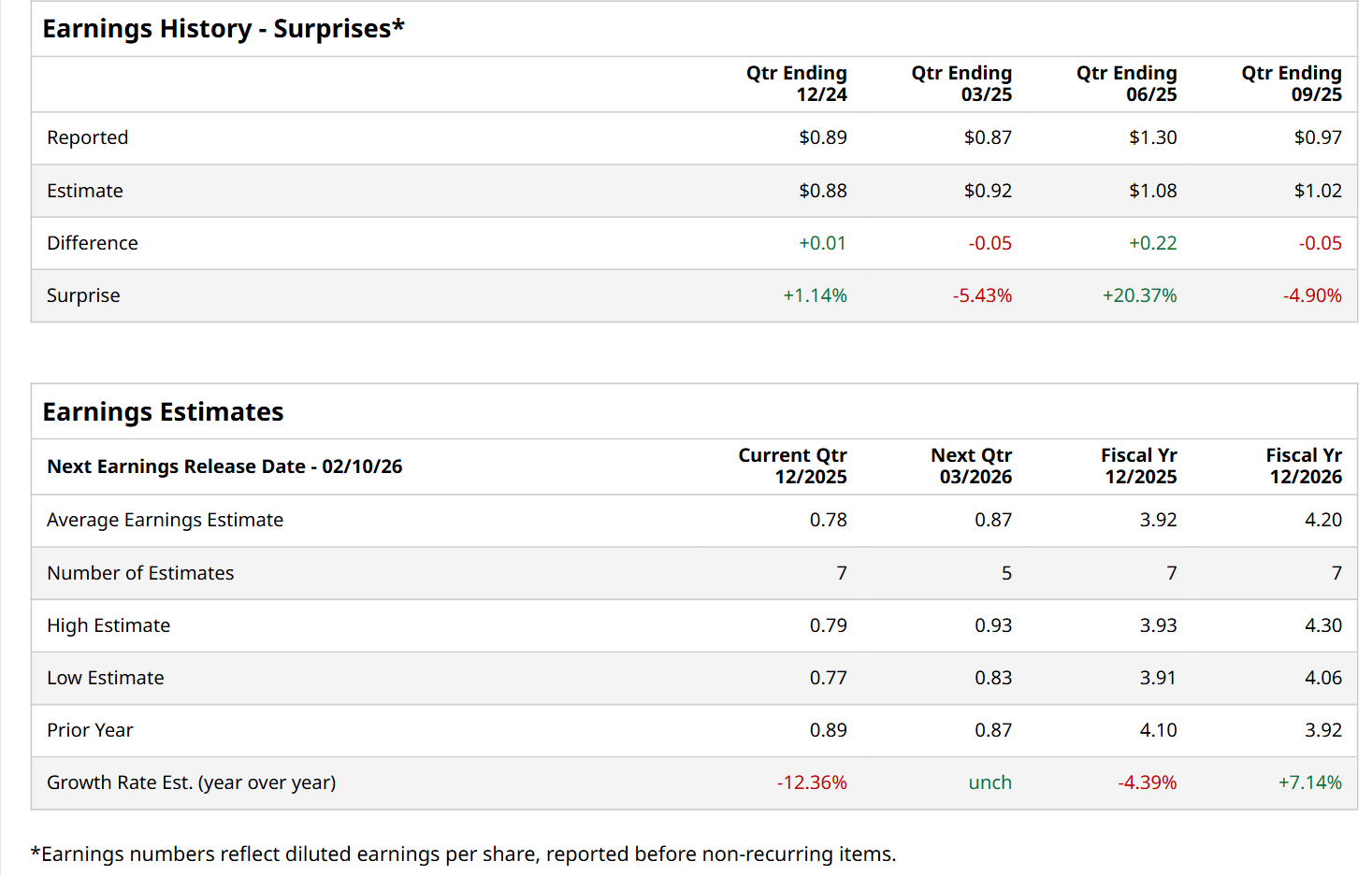

Before this event, analysts expect this home improvement company to report a profit of $0.78 per share, down 12.4% from $0.89 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. Its earnings of $0.97 per share in the previous quarter fell short of the forecasted figure by 4.9%.

For the current fiscal year, ending in December, analysts expect MAS to report a profit of $3.92 per share, down 4.4% from $4.10 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 7.1% year-over-year to $4.20 in fiscal 2026.

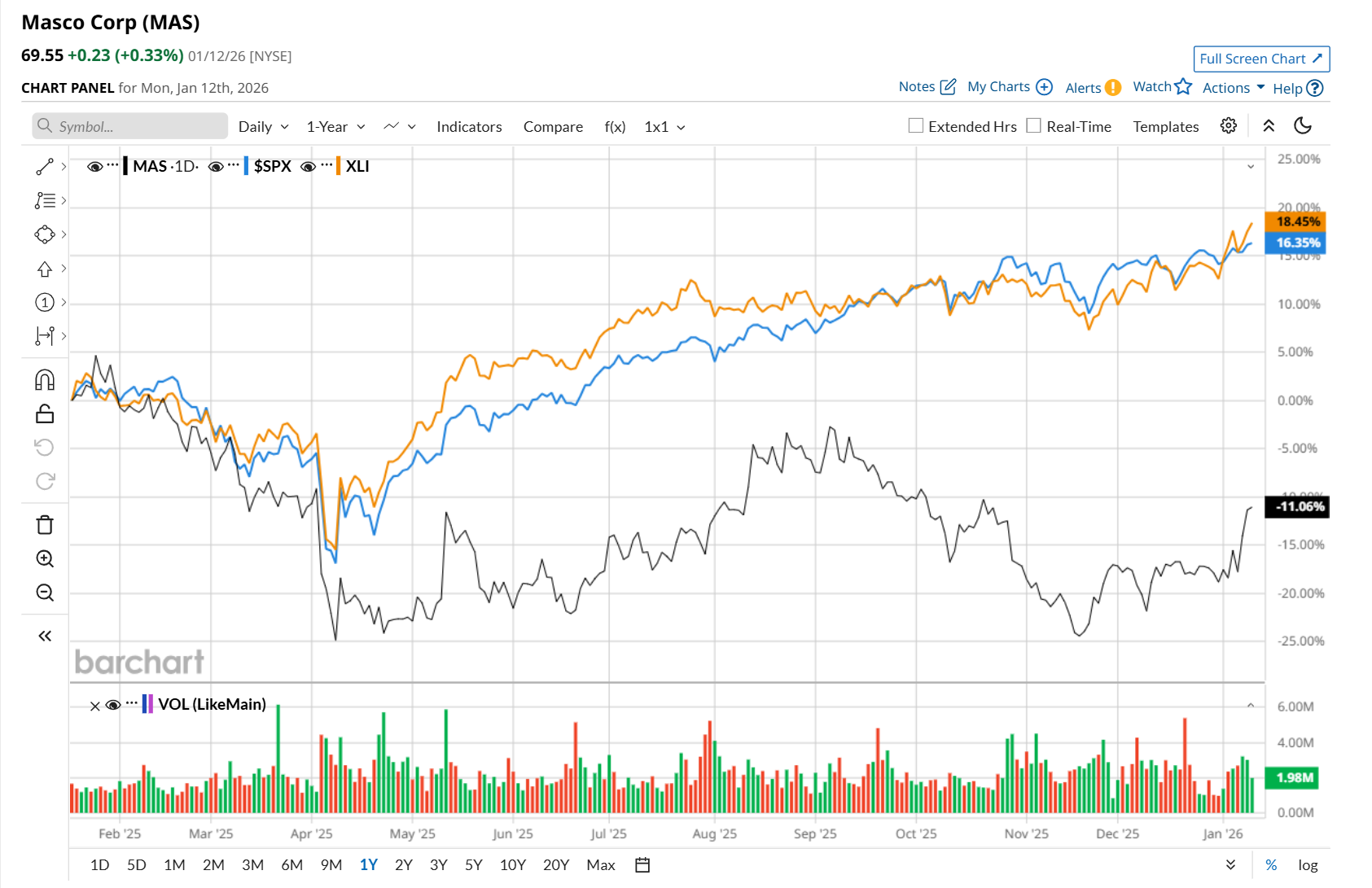

MAS has declined 3.6% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 19.7% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 23.4% uptick over the same time period.

On Jan. 8, shares of MAS rose 4.5% after the company’s VP and Chief Human Resources Officer, Jennifer A. Stone, disclosed the acquisition of 26,140 shares of company stock. The transaction increased her direct stake in Masco, and although the shares were reported as acquired at zero cost, indicating a stock grant or award rather than an open-market purchase, the insider activity was viewed positively by investors.

Wall Street analysts are moderately optimistic about MAS’ stock, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, six recommend "Strong Buy," 15 indicate “Hold," and one suggests a "Moderate Sell.” The mean price target for MAS is $73.72, indicating a 6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What’s Behind the Amazon Transformation from Mega-Cap Laggard to Breakout Monster Stock?

- Is Planet Labs Stock a Buy or Sell After a Monster Rally?

- As Shell CEO Wael Sawan Talks Venezuela Oil with Trump, Should You Buy SHEL Stock?

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?