We have reached the point in the artificial intelligence (AI) cycle where the story is no longer enough to support the multiples. For the past two years, you could slap an AI label on almost any tech firm and watch the stock price defy gravity. But as I’ve seen in every tech cycle since the 1990s, the market eventually sends a bill for all that exorbitant spending.

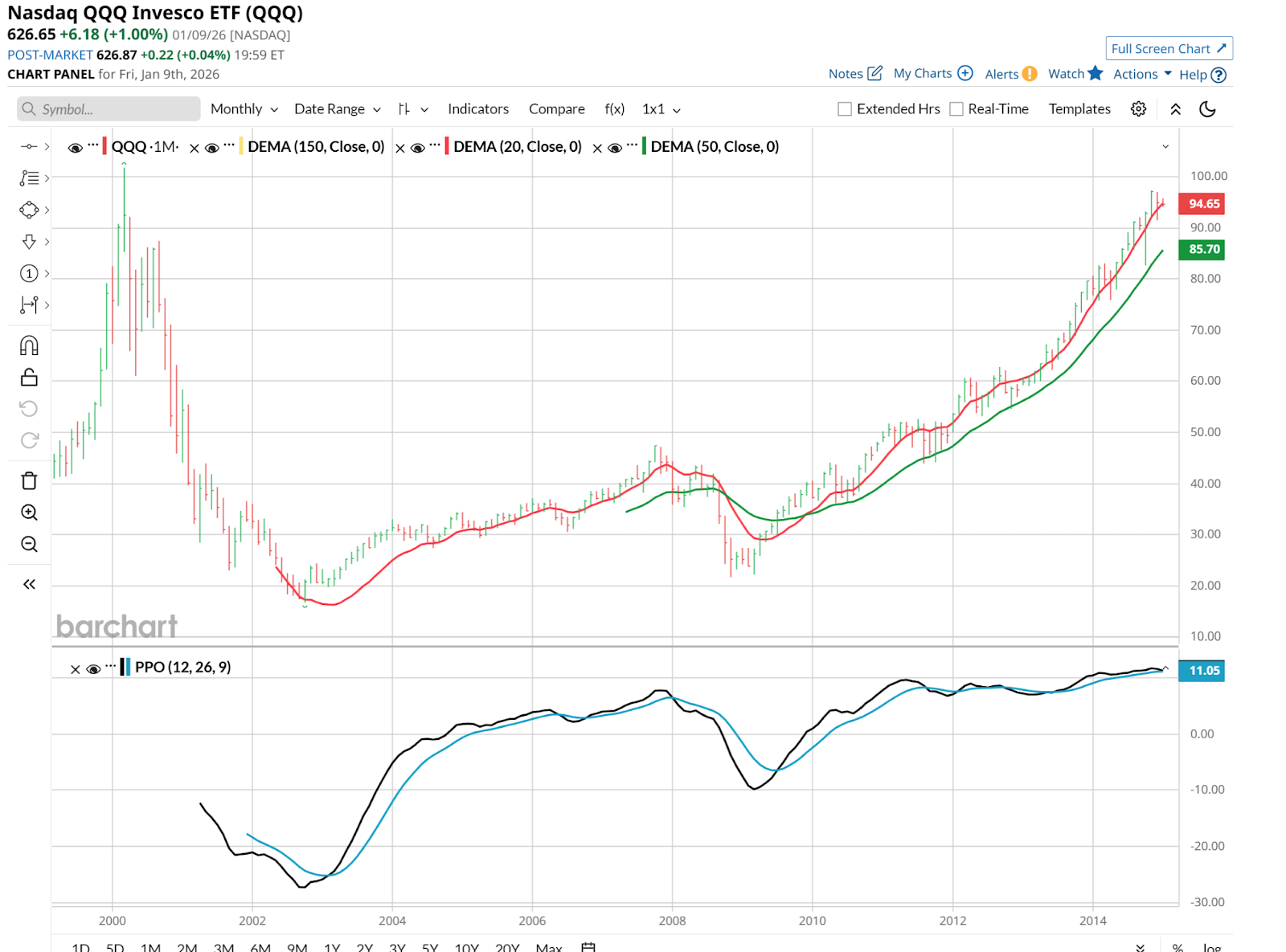

Yet at the same time, I remember quite well how tech stocks cruised higher by about 75% in late 1999 and 2000 — before they fell by about the same percentage. The back end of that round-trip move kicked off more than a decade of flat returns.

For example, the Nasdaq 100 ETF (QQQ) rocketed from $40 a share to $100 in no time, but then sat around that same level in 2015. To put it another way, that giant move started a historic dot-com bubble runup, but by the end of 2011, 12 years later, that 250% flash profit was near 0%.

In 2026, we are transitioning from the "imagination" phase to the "execution" phase. The big hyper-scalers have spent hundreds of billions on capital expenditures, and the street is finally asking: Where is the ROI? And will it get here fast enough?

If you’re looking at the software names that are simply integrating AI into existing products to justify a 40x price-to-earnings (P/E) ratio, you’re looking at a fade. The low-hanging fruit has been picked, and the technicals on many second-tier AI plays are starting to show classic exhaustion gaps.

However, the infrastructure — the plumbing of the AI revolution — remains a trade. I’m talking about the semiconductors and, increasingly, the utility companies providing the massive power loads these data centers require. These aren’t speculative stories — they are tangible, high-demand businesses with actual earnings.

But even here, you don't just "buy and hold" and hope for the best. You use a risk-first approach. I prefer owning these winners with an option collar or a trailing stop that reflects a line in the sand. Don't let a profitable trade turn into a long-term hope position when the narrative shifts.

Why a Collar Might Help Take Some Risk Out of AI

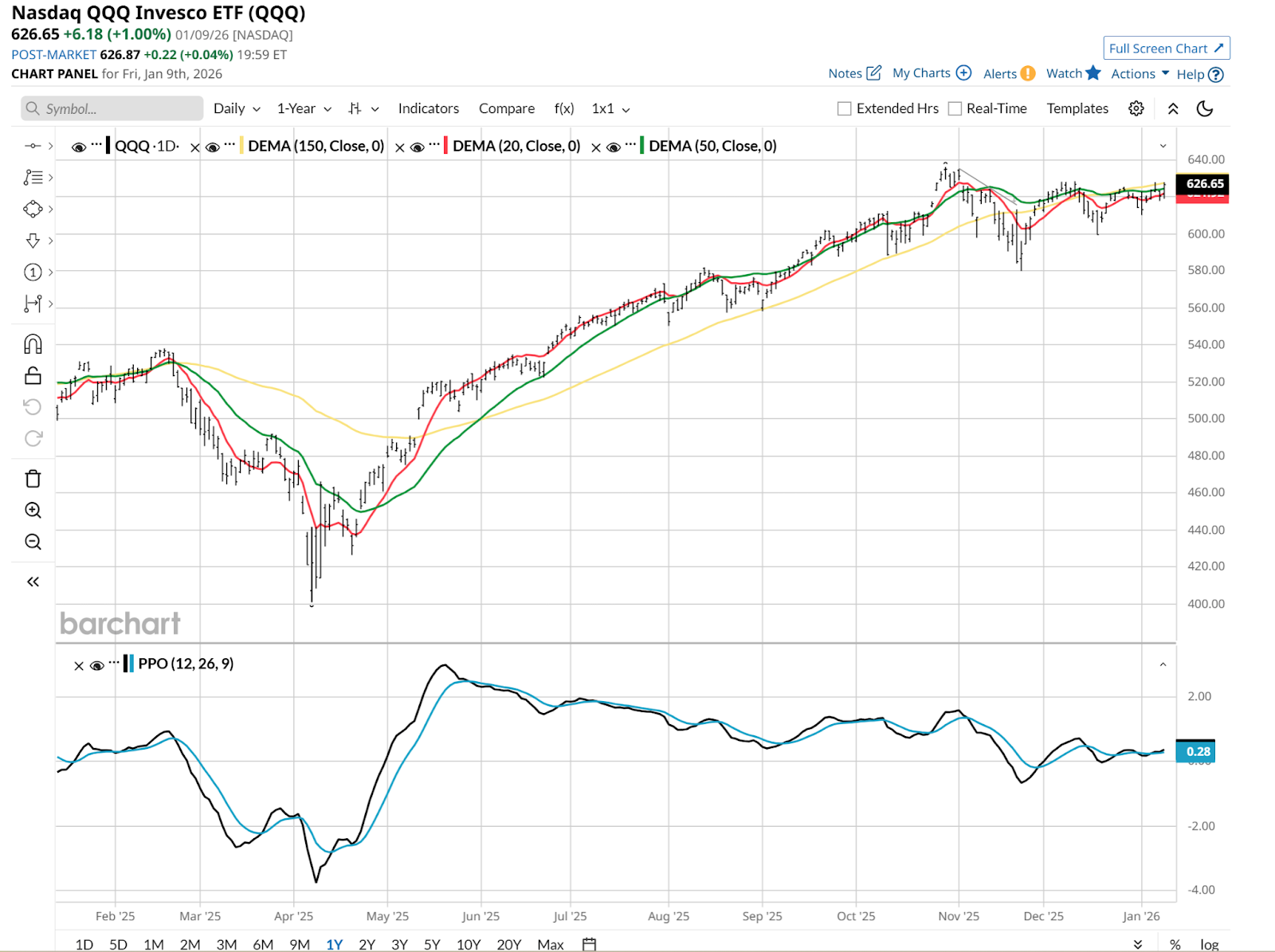

Below, you can see QQQ now. That’s a pretty flat chart to me. However, we become repeatedly psychologically blindsided by the dips that get bought. Since I don’t predict the future, how about a QQQ position of 100 shares or a multiple thereof, along with a long-term option collar to try to play this both ways?

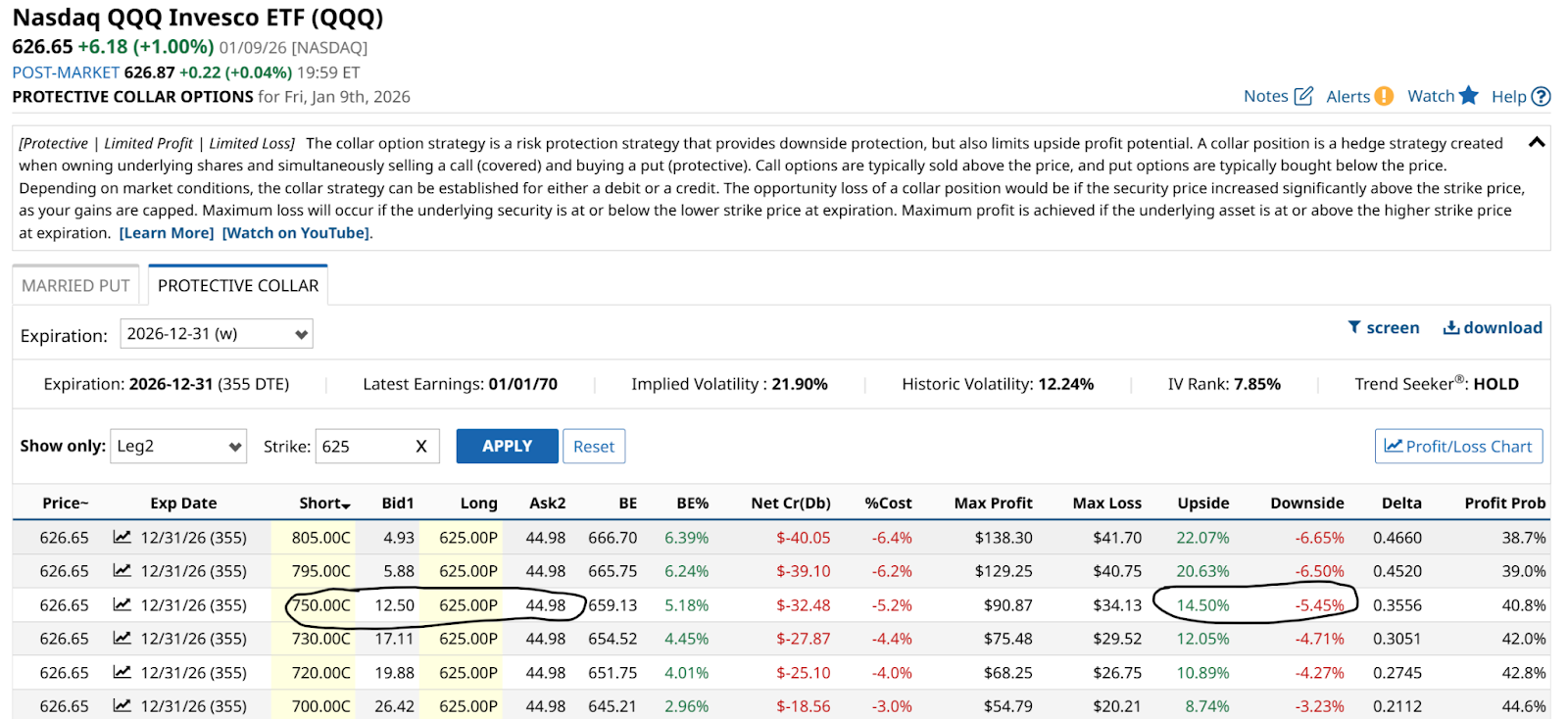

I’m looking all the way out to the end of 2026. The very last day, in fact. And as I often do, I sought to strike my put option right around the current market level, so $625. I present several options below, but the one I’ll specifically describe is the one I’ve circled.

Upside to $750 by year-end can be had for only about 5.5% downside risk. The upside is 14.5%, so more than a 2.5:1 ratio. I insist on at least 2:1 in percentage terms, so that gets above the bar. That said, the cost of the puts is high, and that means the breakeven price is $659. So the first 5% up from here, I’m just making up for my cost.

The Takeaway

Using options is science, but it’s also art. We all have different preferences. But no one enjoys losing big. Especially if that results in being the one holding the bag if AI goes bust. That’s why thinking of both sides can help you trade (and fade) this three-year QQQ rally.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart