With a market cap of $60.4 billion, Hilton Worldwide Holdings Inc. (HLT) is a leading American multinational hospitality corporation headquartered in Virginia. It owns, leases, manages, and franchises a broad portfolio of hotels, resorts, and related lodging properties under more than 20 globally recognized brands, ranging from luxury names like Waldorf Astoria and Conrad to full-service and focused-service offerings such as Hilton Hotels & Resorts, DoubleTree, Hampton by Hilton and Hilton Garden Inn, spanning over 9,000 properties across about 140 countries and territories.

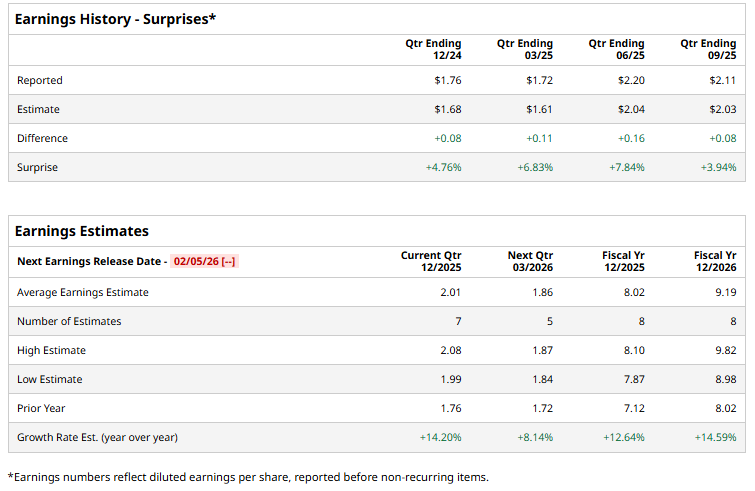

The hospitality titan is expected to announce its fiscal Q4 earnings shortly. Before this event, analysts expect this company to report a profit of $2.01 per share, up 14.2% from $1.76 per share in the year-ago quarter. The company has a stellar record of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For FY2025, analysts expect HLT to report a profit of $8.02 per share, up 12.6% from $7.12 per share in fiscal 2024. Its EPS is expected to further grow 14.6% annually to $9.19 in fiscal 2026.

Shares of HLT have gained 23.5% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.7% uptick and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11.6% return over the same time frame.

Shares of Hilton have outperformed the broader market over the past year, underpinned by the strength of its asset-light, fee-based operating model, which continues to deliver resilient, high-margin revenue growth. This performance has been reinforced by a robust global development pipeline and healthy net unit expansion as Hilton steadily adds new properties and brands. Investor confidence has been further supported by a track record of earnings beats, upward revisions to profit estimates, and sustained momentum in global travel demand, particularly across business and leisure segments, driving optimism around the company’s long-term earnings trajectory.

Wall Street analysts are moderately optimistic about Hilton’s stock, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, ten recommend "Strong Buy," three indicate "Moderate Buy," and 11 suggest "Hold.” While the stock currently trades above its mean price target of $280.69, the Street-high target of $340 implies a 13.2% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.