Analysts at JPMorgan recently raised the rating on emerging data center company Cipher Mining (CIFR), citing a couple of lucrative deals that the company has struck, namely with Amazon's (AMZN) Amazon Web Services (AWS) and Fluidstack, backed by Google. JPMorgan analysts Reginald Smith and Charles Pearce believe that the company will sign more deals at other approved sites, which would drive medium-term upside.

Also, the firm's analysts upgraded Cipher Mining’s rating from “Neutral” to “Overweight,” while also raising the price target to $18, which implied a potential upside of 27%. However, after this upgrade, the stock has gained 18.1% intraday on Nov. 24, followed by surging 4.9% and 9.3% on Nov. 25 and 26, respectively.

We take a closer look at Cipher Mining to see if it still has upsides left.

About Cipher Mining Stock

Headquartered in New York City, Cipher Mining runs large-scale Bitcoin (BTCUSD) mining operations across the U.S. The company builds and manages energy-efficient data centers, mainly in Texas, using special computers to verify blockchain transactions and earn Bitcoin rewards.

It focuses on low-cost power sources and green practices to support the grid and limit environmental harm, while branching into high-performance computing (HPC), such as artificial intelligence (AI) hosting. The company has a market capitalization of $8.04 billion.

With strong catalysts like the AWS and FluidStack deals and solid analyst sentiment surrounding the stock, Cipher Mining has had a stellar run on Wall Street. Over the past 52 weeks, the stock has gained 193.88%, while over the past six months, it has gained 531.09%. Cipher Mining’s stock reached a 52-week high of $25.52 on Nov. 5, following the announcement of the AWS deal, but is down 29.6% from that level.

Cipher Mining’s stock is trading at a stretched valuation. Its stock price trades at 51.53 times non-GAAP earnings, well above the industry average of 23.24 times.

Cipher Mining’s Recent Strategic Developments

Cipher Mining is transitioning from primarily a Bitcoin mining firm to one with a comprehensive AI infrastructure that supports data centers and HPC. To bolster this pivot, the company is entering into strategic partnerships.

In September, Cipher Mining announced a 10-year HPC colocation agreement with AI cloud platform Fluidstack. Under this agreement, the company is set to deliver 168 MW of critical IT load at its Barber Lake site in Colorado City, Texas. This will also be supported by up to 244 MW of gross capacity.

Alphabet (GOOG) (GOOGL) is set to backstop $1.4 billion of Fluidstack’s lease operations to support project-related debt financing. In exchange, Google is expected to receive warrants to acquire about 24 million Cipher shares.

Alongside its Q3 update, the company also announced a 15-year hosting agreement with AWS worth $5.5 billion. Under the terms, Cipher would deliver 300 MW of capacity in 2026, marking a significant foray into the HPC space.

In addition, Cipher Mining reported forming a joint entity to develop the 1-GW Colchis site in West Texas. The company is expected to finance the majority of the project, making it approximately a 95% equity owner. The site includes a fully executed 1-GW direct-connect agreement with American Electric Power Company, (AEP), which is set to construct the dual interconnection facility, with targeted energization in 2028.

Cipher Mining’s Q3 Results Exhibited Leaps In Top and Bottom Line

On Nov. 3, Cipher Mining reported financial leaps in its third-quarter results for fiscal 2025. The company’s revenue increased by 197.5% year-over-year (YOY) to $71.71 million. Higher Bitcoin prices likely drove this gain.

In addition, the third quarter was the first full quarter of Cipher Mining’s Texas Black Pearl facility being operational, after the site started operations in late June. The stock rose by a solid 22% intraday on Nov. 3.

Due to a drop in total costs and operating expenses, Cipher Mining’s bottom line considerably improved. The company’s loss per share dropped significantly from $0.26 in Q3 2024 to just $0.01 in Q3 2025. The company also reported an adjusted EPS of $0.10 for the quarter, marking a turnaround from the loss per share of $0.01 in the prior year’s period.

However, Wall Street analysts do not have a positive view about Cipher Mining’s bottom line trajectory. For the current quarter, the company is expected to report a loss per share of $0.12. For fiscal 2025, its loss per share is projected to increase by 157.14% YOY to $0.36.

What Do Analysts Think About Cipher Mining Stock?

Apart from JPMorgan’s bullish stance, Wall Street is exceptionally bullish on Cipher Mining’s stock. Following robust third-quarter financial results, several analysts maintained their bullish stance on the company’s stock.

Analysts from Citizens initiated coverage on Cipher Mining’s stock with a “Market Outperform” rating and a $30 price target. Citizens analyst Greg Miller highlighted the company’s strategic transformation from a Bitcoin mining company to a focus on maximizing its power capacity pipeline.

BTIG analyst Gregory Lewis reiterated a “Buy” rating on the stock and maintained a $25 price target, which shows that BTIG remains optimistic about the company’s prospects. Based on Cipher Mining’s lucrative AWS deal, analysts at Canaccord Genuity maintained a “Buy” rating on the stock, while raising the price target from $16 to $27.

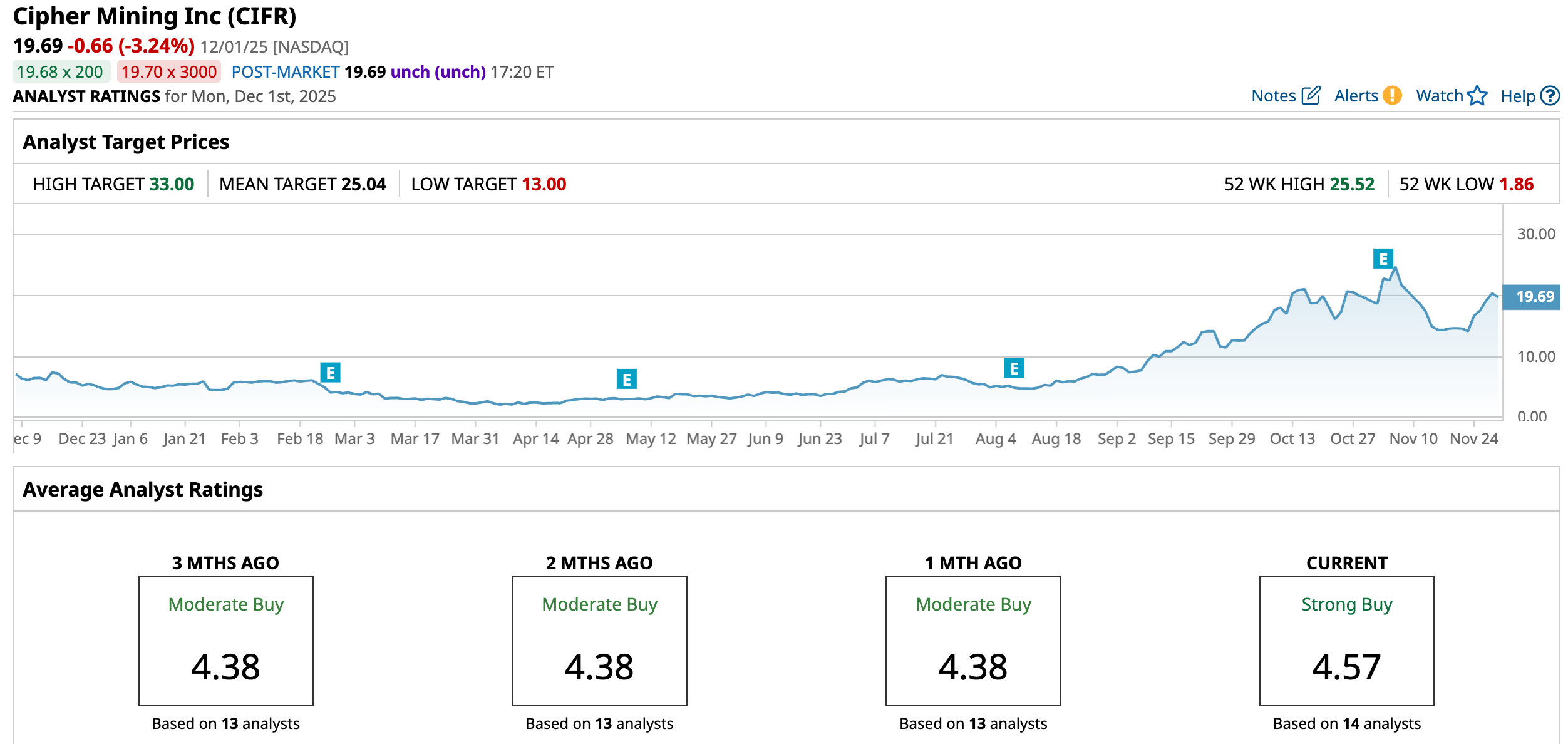

Wall Street analysts are favoring Cipher’s stock, awarding it a consensus “Strong Buy” rating. Of the 14 analysts rating the stock, a majority of 10 analysts have given it a “Strong Buy” rating, two analysts rated it “Moderate Buy,” while two analysts gave a “Hold” rating. The consensus price target of $25.04 represents 27.2% upside from current levels. The Street-high price target of $33 indicates a 67.6% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Says This Flying Car Stock Is Its Top Pick. Should You Buy It Here?

- Tesla Stock Has Been Flat - Good for Shorting Puts to Make a One-Month 2.5% Yield

- This Undiscovered Stock Could Handsomely Reward Risk Takers

- Plug Power Just Kicked Off Its NASA Contract. Should You Buy PLUG Stock Here?