Valued at a market cap of $42 billion, Paychex, Inc. (PAYX) provides human capital management solutions (HCM), including payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses. The Rochester, New York-based company is scheduled to announce its fiscal Q2 earnings for 2026 before the market opens on Friday, Dec. 19.

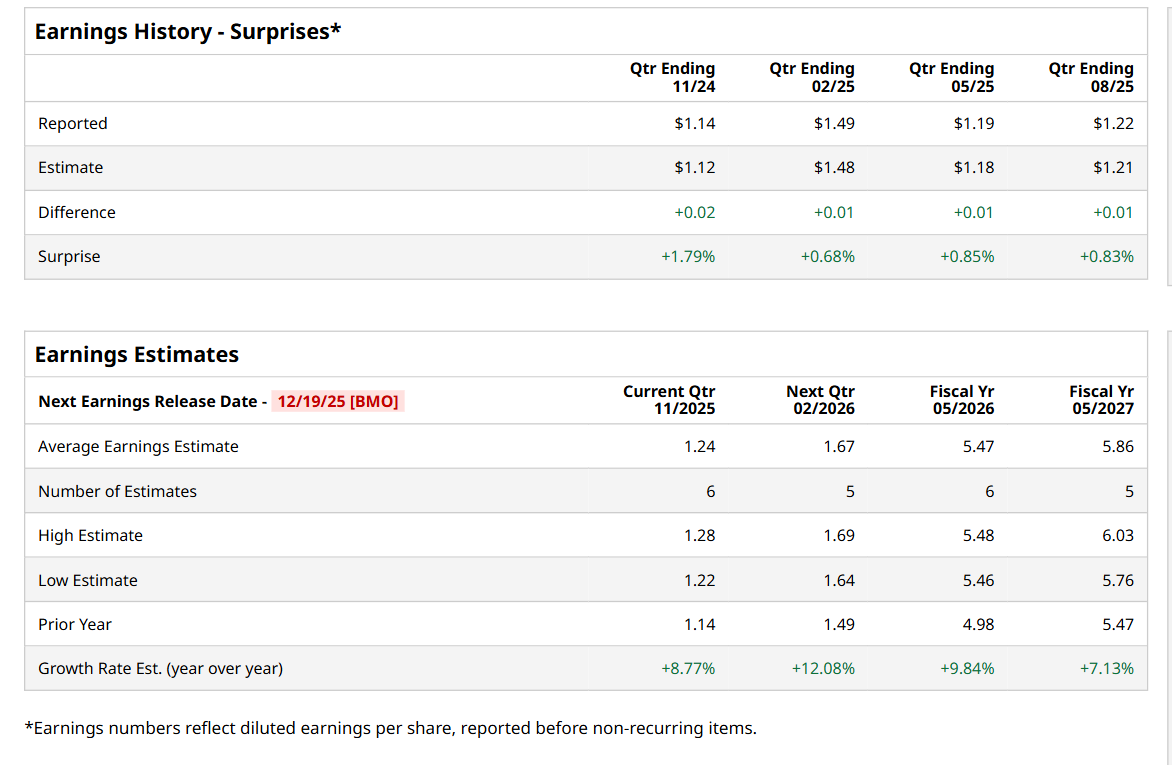

Ahead of this event, analysts expect this HCM solutions provider to report a profit of $1.24 per share, up 8.8% from $1.14 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q1, PAYX’s EPS of $1.22 exceeded the forecasted figure by a penny

For the current fiscal year, ending in May 2026, analysts expect PAYX to report a profit of $5.47 per share, up 9.8% from $4.98 per share in fiscal 2025. Furthermore, its EPS is expected to grow 7.1% year-over-year to $5.86 in fiscal 2027.

Shares of PAYX have declined 14.3% over the past 52 weeks, considerably trailing behind both the S&P 500 Index's ($SPX) 11.1% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 22% uptick over the same time period.

Despite reporting strong results, PAYX’s shares tumbled 1.4% on Sep. 30 after its Q1 earnings release. The company’s overall revenue climbed 16.8% year-over-year to $1.5 billion and came in line with analyst estimates. Meanwhile, its adjusted EPS improved 5.2% from the same period last year to $1.22, topping consensus expectations of $1.21. PAYX also raised its fiscal 2026 adjusted EPS growth outlook, now expecting it to increase in the range of 9% to 11%.

Wall Street analysts are cautious about PAYX’s stock, with an overall "Hold" rating. Among 17 analysts covering the stock, 14 recommend "Hold," and three suggest "Strong Sell.” The mean price target for PAYX is $129.36, indicating an 11.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say This 1 Lesser-Known Chip Stock Is a Top Buy for 2026. Should You Add It to Your Portfolios Here?

- Disney Made a Bold Move By Partnering with OpenAI: Will It Help DIS Stock Recover?

- ‘We’ll Be in These Stocks 10, 20 Years’: Warren Buffett’s $30 Billion Bet Gets a Big Boost as Bank of Japan Raises Rates to 30-Year High

- Forget Nvidia and Broadcom. This Forgotten Retail Stock Is a Top Performer in 2025.