Robinhood Markets (HOOD) has never shied away from bold moves, and its latest push underscores the company's aggressive expansion into new territories. Long before crypto went mainstream, Robinhood embraced it. And now, it has quietly built a strong and fast-growing business around prediction markets. In fact, many analysts argue that Robinhood’s entry into the prediction market arena has been the primary catalyst behind the stock’s monster rally this year.

So, with prediction markets now being viewed as a major growth opportunity, investor interest naturally surged on Dec. 16 when Robinhood unveiled a slate of new NFL-focused prediction-market features. Users can now trade what essentially function as parlay and prop bets tied to NFL games and individual players. The company also revealed plans to let users combine up to 10 outcomes across multiple NFL games into custom predictions, a feature expected to launch early next year.

With the fintech giant grabbing headlines across Wall Street following this announcement, how should investors position themselves in Robinhood stock from here?

About Robinhood Stock

Founded in 2013 and headquartered in California, Robinhood has grown into one of the most disruptive fintech platforms in the market. The company offers commission-free trading across stocks, ETFs, cryptocurrencies, and options, all through a sleek, mobile-first app designed for everyday investors. Features such as fractional share trading, instant withdrawals, and premium offerings have helped lower barriers to entry and broaden access to financial markets.

With a clear focus on younger and first-time investors, Robinhood’s mission has always been to make financial markets more accessible to everyone. Beyond basic trading, the company generates revenue through margin accounts, its Robinhood Gold subscription service, and payment for order flow. With its intuitive interface and low minimum requirements, Robinhood has built a massive user base and played a pivotal role in reshaping the traditional brokerage model.

Now, the company is grabbing fresh attention with its aggressive move into prediction markets. Robinhood first stepped into this space just ahead of the 2024 U.S. presidential election, allowing users to trade contracts tied to former Vice President Kamala Harris and President Donald Trump. That early experiment marked the beginning of a broader push into event-based trading.

This year, the company partnered with Kalshi, a leading prediction-market operator, and, more recently, announced plans to launch a futures and derivatives exchange alongside market-making giant Susquehanna International, further broadening its prediction-market offerings. So far, the strategy has paid off in spectacular fashion.

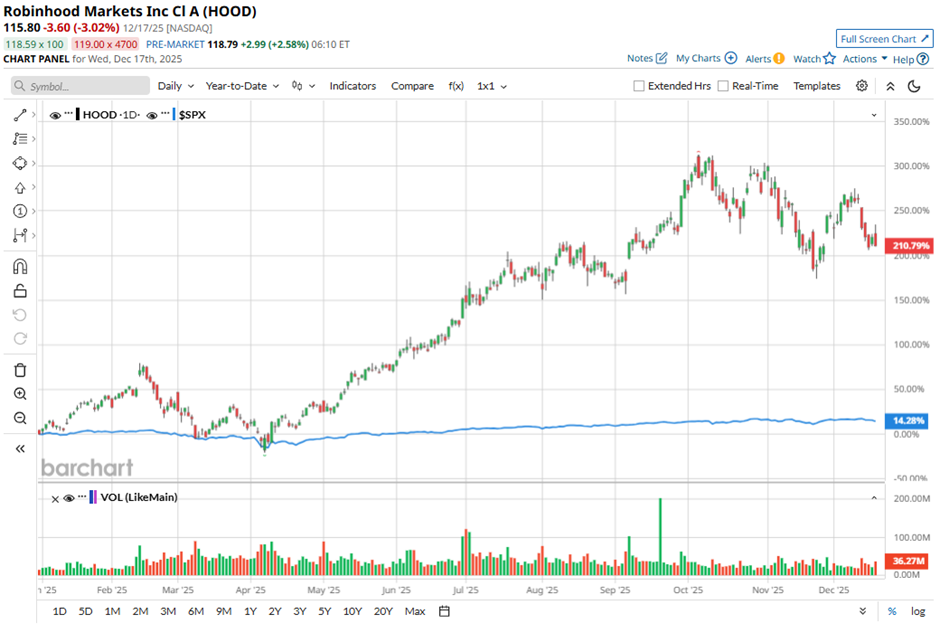

After delivering a stunning 222.09% rally last year, Robinhood’s momentum has only intensified in 2025, with the stock soaring another massive 220.53%. For context, the broader S&P 500 Index ($SPX) is up just 15.67% over the past year and 15.49% in 2025, underscoring just how dramatically Robinhood has outperformed the market. The company’s market capitalization currently stands at roughly $104.1 billion.

Inside Robinhood’s Q3 Performance

In early November, Robinhood delivered a blowout fiscal 2025 third-quarter performance, turning heads across Wall Street. The fintech giant’s results blew past expectations on both top and bottom lines, underscoring solid momentum across its core businesses. Total net revenues surged 100% year-over-year (YOY) to $1.27 billion, beating consensus estimates of $1.20 billion, as trading activity across the platform accelerated sharply.

At the heart of this surge was a massive jump in transaction-based revenues, which climbed 129% YOY to $730 million. Crypto trading led the charge, with revenues soaring more than 300% to $268 million, reflecting renewed retail interest in digital assets. Options revenue followed closely, rising 50% to $304 million, while equities revenue jumped 132% to $86 million, highlighting broad-based engagement across asset classes.

Profitability was equally impressive, with adjusted EBITDA up 177% YOY to $742 million. On the other hand, EPS surged a staggering 259% YOY to $0.61, comfortably beating the consensus estimate of $0.54. Robinhood ended the quarter with $4.3 billion in cash and cash equivalents, slightly down compared with $4.6 billion recorded at the end of Q3 2024.

Additionally, the brokerage firm’s user base continued to expand at a healthy pace. Funded customers swelled 10% YOY to 26.8 million, while investment accounts grew 11% to 27.9 million. At the same time, total platform assets skyrocketed 119% YOY to $333 billion, supported by steady net deposits, higher equity and cryptocurrency valuations, and assets acquired through recent deals.

Meanwhile, Robinhood Gold subscribers jumped 77% YOY to 3.9 million. The company’s newer initiatives are already making a meaningful impact. In August, the company expanded its Prediction Markets Hub with the launch of Pro and College Football contracts, which quickly drove engagement. In Q3 2025, total event contracts traded more than doubled sequentially to 2.3 billion, and October alone hit 2.5 billion contracts, exceeding the total volume of all Q3 combined.

CFO Jason Warnick summed it up well, noting that Q3 marked “another strong quarter of profitable growth,” with new business lines like Prediction Markets and Bitstamp generating roughly $100 million or more in annualized revenue.

Robinhood Levels Up Its Prediction Markets Game

On Dec. 16, Robinhood shares popped nearly 3.6% after the company unveiled a major upgrade to its fastest-growing prediction market platform. The new features allow users to place what are essentially parlay-style bets across multiple NFL games, putting Robinhood in more direct competition with traditional sports betting platforms, and expanding how users interact with live events.

Starting this month, users can trade pre-set combinations tied to individual NFL games, including outcomes, totals, and spreads. Looking ahead to early 2026, Robinhood plans to roll out custom combos, letting users build their own predictions with up to 10 outcomes across different NFL games. That means more flexibility, more creativity, and more ways to express a view.

The platform is also introducing real-time player performance wagers, allowing users to predict things like whether a player will score a touchdown during a game, or how many passing, receiving, or rushing yards a player will rack up. And this may just be the beginning. Robinhood has hinted that parlay-style combos could expand beyond the NFL, potentially spanning other sports, and even non-sports events, such as economic data, further blurring the line between markets, predictions, and trading.

Wall Street’s Latest Take on Robinhood Stock

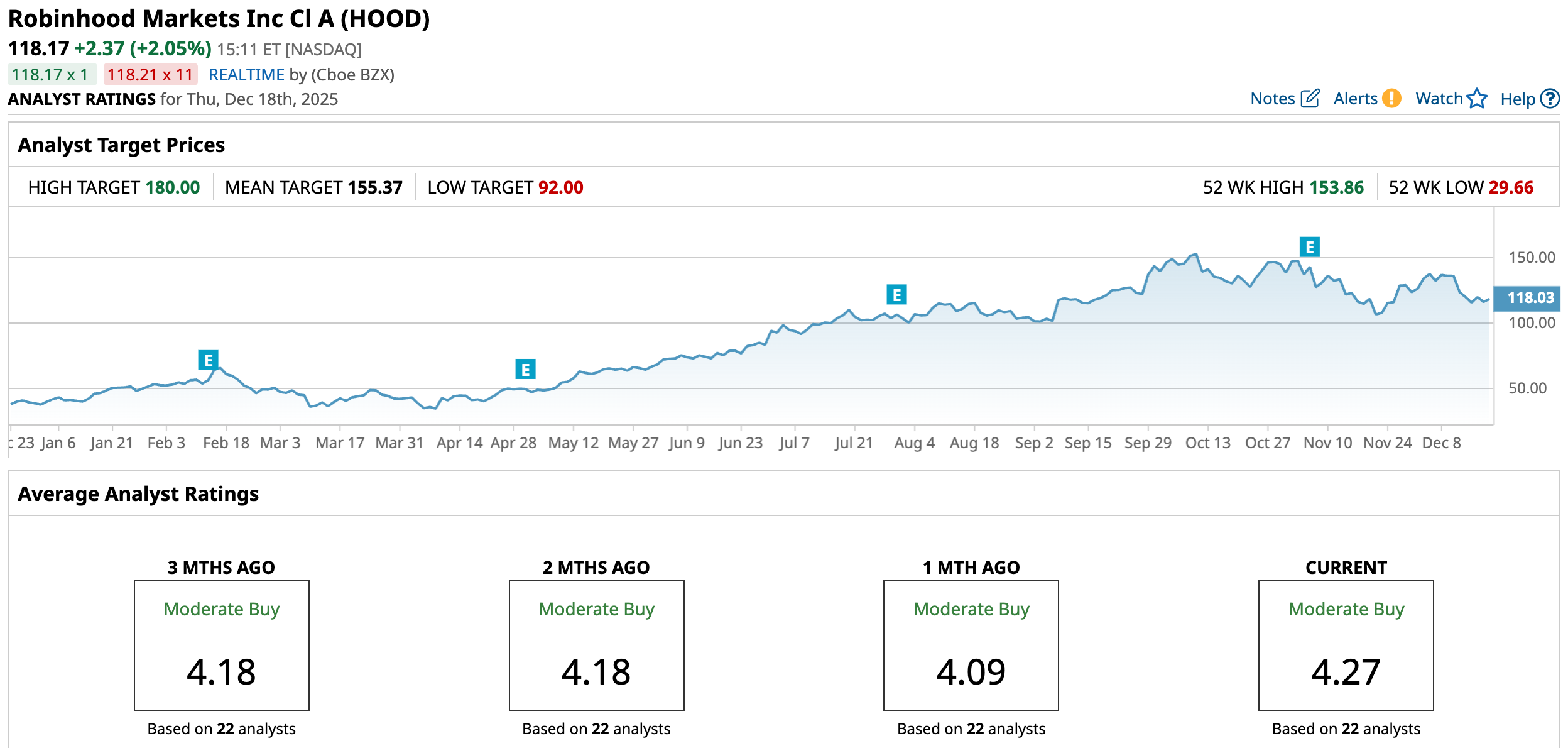

Overall, Wall Street’s outlook on Robinhood remains broadly optimistic, with the stock carrying a consensus “Moderate Buy” rating. Of the 22 analysts currently covering the stock, a strong majority lean bullish, with 14 rating it a “Strong Buy,” and two assigning a “Moderate Buy.” While five analysts recommend “Hold,” and just one carries a “Strong Sell” rating, the overall sentiment clearly tilts in Robinhood’s favor.

And that optimism is reflected in analysts’ price targets. The average price target of $155.37 implies roughly 31.7% upside from current levels, suggesting continued momentum. At the high end, the most bullish forecast calls for $180, which would translate into a potential rally of as much as 52.3% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Raised Their Micron Stock Price Target by 50%. Should You Buy Shares Here?

- iRobot Just Filed for Bankruptcy. What Does That Mean for IRBT Stock? And Why Have Investors Been Chasing Shares Higher?

- Chip Stocks Are No Longer an Automatic Path to Profits. What the Numbers Say About This Key Semi ETF Now.

- As Robinhood Moves Into Sports Betting, Should You Buy, Sell, or Hold HOOD Stock?