- Net income for Q3 2022 reached a quarterly record $7.9 million, an increase of $2.3 million, or 40.8%, from net income of $5.6 million for Q3 2021, driven primarily by increased net interest income during the quarter

- Total assets increased $225.8 million, or 10.5%, to $2.4 billion at September 30, 2022 from $2.1 billion at December 31, 2021

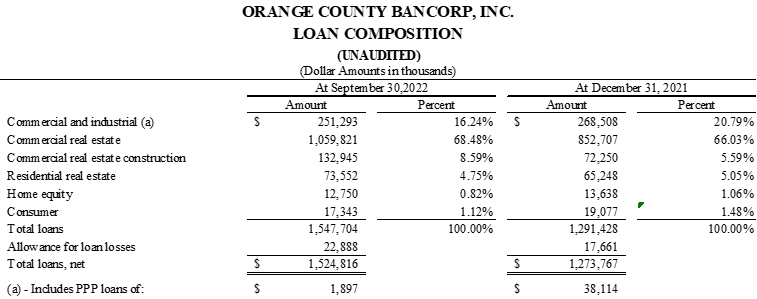

- Total loans grew $256.3 million, or 19.8%, to $1.5 billion at September 30, 2022 from $1.3 billion at December 31, 2021

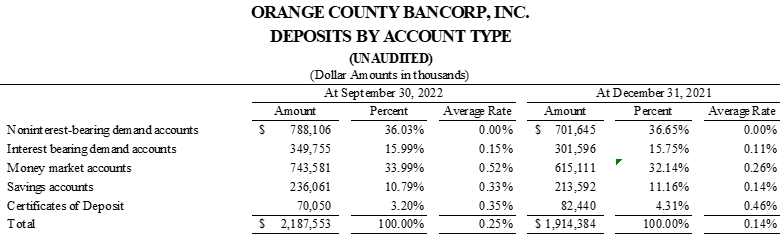

- Total deposits reached $2.2 billion at September 30, 2022, as compared to $1.9 billion at December 31, 2021, an increase of $273.2 million, or 14.3%

- Provision for loan losses of $2.1 million for Q3 2022 grew from $1.0 million during Q3 2021 due primarily to continued strong loan growth

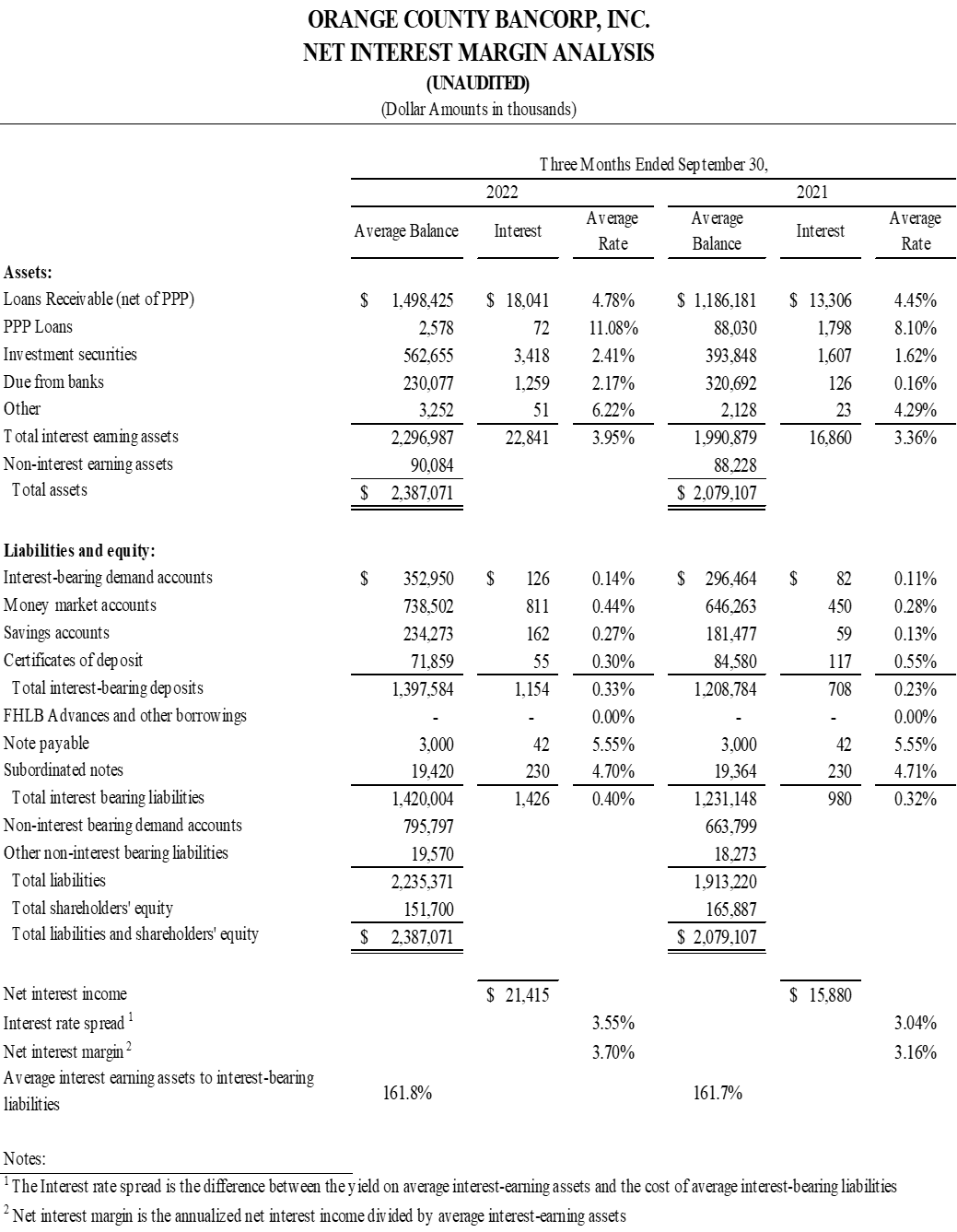

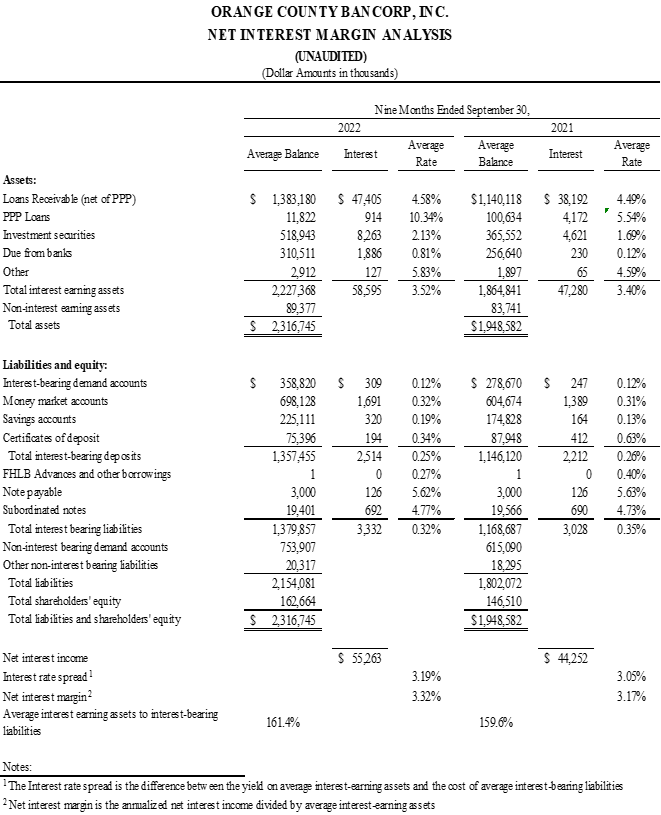

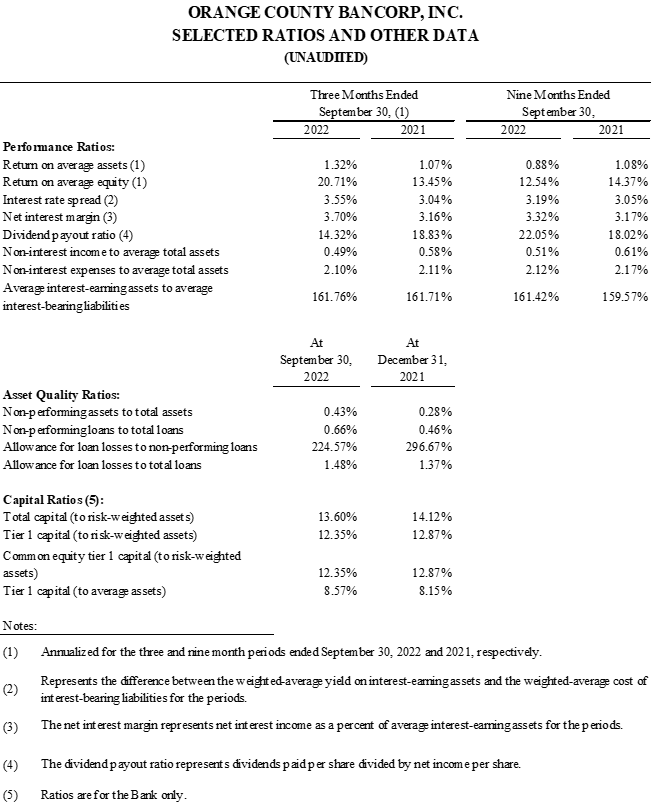

- Net interest margin for Q3 2022 rose 54 basis points, or 17.1%, to 3.70% from 3.16% for Q3 2021

- Annualized return on average assets of 1.32% for the three months ended September 30, 2022 increased 25 basis points, or 23.4%, versus the same period in 2021

- Annualized return on average equity of 20.71% for the three months ended September 30, 2022 increased 726 basis points, or 54%, versus the same period in 2021

- Trust and asset advisory business revenue of $2.3 million for the three months ended September 30, 2022 fell $150 thousand, or 6%, from $2.4 million versus the same period in 2021

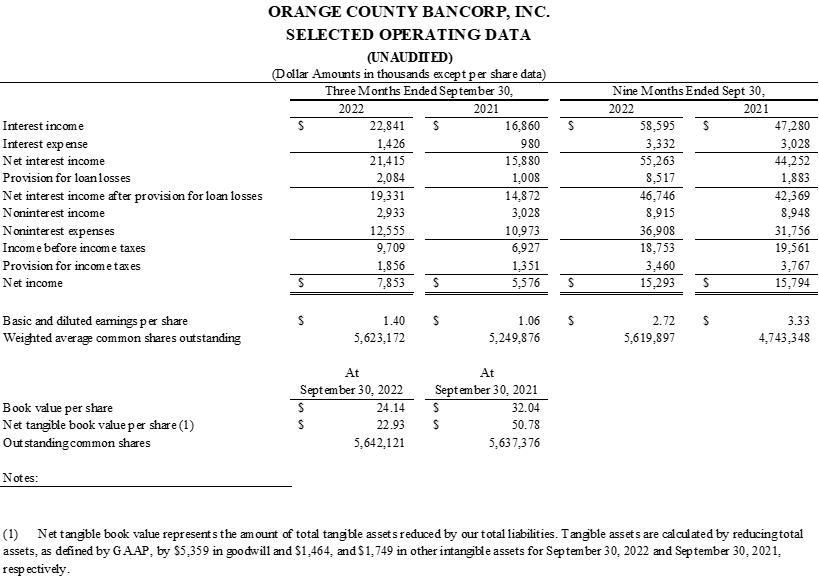

MIDDLETOWN, NY / ACCESSWIRE / October 25, 2022 / Orange County Bancorp, Inc. (the "Company") (Nasdaq:OBT), parent company of Orange Bank & Trust Company, (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of $7.9 million, or $1.40 per basic and diluted share, for the three months ended September 30, 2022. This compares with net income of $5.6 million, or $1.06 per basic and diluted share, for the three months ended September 30, 2021. The increase in net income was primarily due to a $5.5 million increase in net interest income during the quarter resulting from strong loan growth and yield increases in the current rising interest rate environment, partially offset by increases in non-interest expense and provision for loan losses related primarily to loan growth.

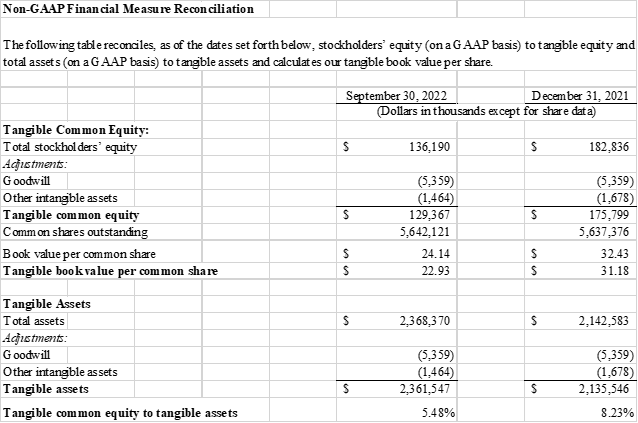

Book value per share declined $8.29, or 25.6%, from $32.43 at December 31, 2021 to $24.14 at September 30, 2022. Tangible book value per share decreased $8.25, or 26.5%, from $31.18 at December 31, 2021, to $22.93 at September 30, 2022 (see also "Non-GAAP Financial Measure" section for reconciliation). These decreases are the result of changes in market value associated with the available-for-sale investment portfolio, which continues to be impacted by rising interest rates. The Bank maintains its entire investment portfolio within the available-for-sale category.

"A number of factors, including fruits of our multiyear growth strategy, ongoing consolidation of the local banking sector, and continued dedication to our customer base combined to produce outstanding results in the most recent quarter," said Orange County Bancorp President and CEO Michael Gilfeather. "They also set a firm foundation for growth as we continue to secure our position as the leading business bank in the regions in which we operate.

When we began repositioning the Bank several years ago, it was clear local businesses would benefit from and recognize the value of a financial partner committed to understanding their needs and nuances of the local economy, and that would remain steadfast when others might waver. This strategy has paid off handsomely and been made more successful by the consolidation of several large competitors which have enabled us to hire experienced and talented personnel and access some of the region's largest businesses. Coupled with our unparalleled customer service, these action set the groundwork for record earnings of $7.9 million this quarter, up $2.3 million, or more than 40%, over the same period last year.

Access to an expanded, larger company customer base has increased our pipeline of quality lending opportunities. This resulted in $256.3 million in new loan origination in Q3, to a total of $1.5 billion, a nearly 20% increase over the same period last year. As important as loan origination is to our growth, access to low volatility, cost effective deposits is equally critical to sustain growth and profitability. For the quarter, total deposits reached $2.2 billion, up $273.2 million, or 14.3%, over the same quarter last year. As widely discussed, the Federal Reserve's continued battle against inflation has resulted in higher interest rates on loans and deposits. By actively managing both loans and deposits as well as certain advantages associated with an asset-sensitive balance sheet, we were able to expand net interest margin over 17%, to 3.70%, by quarter's end.

Wealth management revenues, including our Trust and Asset management businesses, saw quarterly revenues of $2.26 million, down slightly from $2.41 million the prior year. Fee income in these businesses is directly tied to assets under management, which fluctuate with broader market valuations. While we hope and intend to grow these revenues over time, given recent weakness in both the stock and bond markets, this quarter's modest decline is a credit to the resiliency and professionalism of our Wealth Management division.

Being the premier business bank in our region clearly doesn't insulate us from risks to the broader economy. So even as local economic activity remains strong, we know the effects of rising interest rates and inflation are impacting our clients and cannot be ignored. In times like these, we believe knowledge of our customers and the markets we serve, expansion of the size and quality of our client base, vigilance regarding underwriting standards, and effective oversight of loans once made, is critical to managing risks, and making timely adjustments before issues become problematic. Adherence to these basic ideas has been foundational to our success and would be impossible without the continued dedication and commitment of our employees. I thank them, once again, for their tireless efforts, which continue to position us for success."

Third Quarter and First Nine Months of 2022 Financial Review

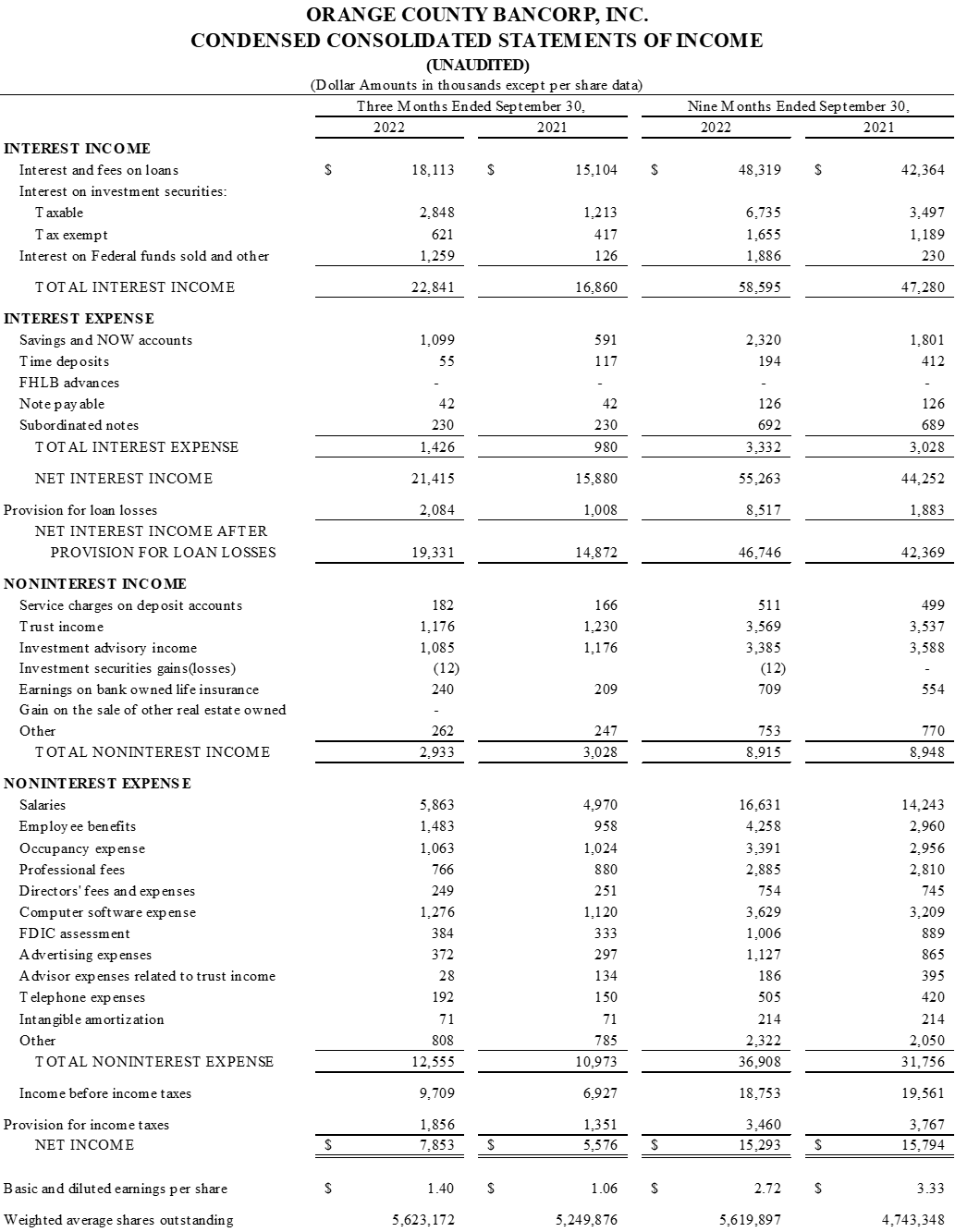

Net Income

Net income for the third quarter of 2022 was $7.9 million, an increase of approximately $2.3 million, or 40.8%, versus net income of $5.6 million for the third quarter of 2021. The increase was due primarily to an increase in net interest income during the quarter. Net income for the nine months ended September 30, 2022 was $15.3 million, as compared to $15.8 million for the same period in 2021. The slight decrease was due primarily to an increased provision for loan losses in the second quarter of 2022 associated with loan growth and impairments within the syndicated loan portfolio.

Net Interest Income

For the three months ended September 30, 2022, net interest income increased $5.5 million, or 34.9%, to $21.4 million, versus $15.9 million during the same period in 2021. For the nine months ended September 30, 2022, net interest income increased $11.0 million, or 24.9%, over the first nine months of 2021. These increases absorbed a significant decline in interest income from PPP loans recognized in 2021, which drove net interest income during both 2021 periods.

Total interest income rose $6.0 million, or 35.5%, to $22.8 million for the three months ended September 30, 2022, compared to $16.9 million for the three months ended September 30, 2021. The increase in interest income was primarily due to increased interest and fees associated with loan growth, as well as an increase of approximately 112.8% in interest income associated with higher levels of investment securities. The securities-related increase reflects the deployment of excess liquidity to realize incremental investment earnings. For the nine months ended September 30, 2022, total interest income rose $11.3 million, or 23.9%, to $59.0 million, as compared to $47.3 million for the nine months ended September 30, 2021.

Total interest expense increased $440 thousand in the third quarter of 2022, to $1.4 million, as compared to $980 thousand in the third quarter of 2021. The increase reflects the impact of rising interest rates on deposit products during the quarter. The control of interest expense has been a focus area for management in 2022, as significant additional rate increases are anticipated from continued increases in short-term interest rates resulting from Federal Reserve tightening policies. During the nine months ended September 30, 2022, total interest expense increased $304 thousand, or 10.0%, to $3.3 million, as compared to $3.0 million for the nine months ended September 30, 2021.

Provision for Loan Losses

The Company recognized a provision for loan losses of $2.1 million for the three months ended September 30, 2022, compared to $1.0 million for the three months ended September 30, 2021. The increased provision reflects reserves associated with continued growth of the loan portfolio as well as additional reserves for potential impairments within the syndicated loan portfolio. Syndicated loans represent less than 4.5% of total loans at September 30, 2022. The allowance for loan losses to total loans was 1.48% as of September 30, 2022, an increase of 11 basis points, or 8.0%, versus 1.37% as of December 31, 2021. For the nine months ended September 30, 2022, the provision for loan losses totaled $8.5 million as compared to $1.9 million for the nine months ended September 30, 2021.

Non-Interest Income

Non-interest income remained stable at $2.9 million for third quarter 2022 as compared to $3.0 million for the third quarter 2021. With assets-under-management of approximately $1.1 billion at September 30, 2022, non-interest income continues to be supported by the success of the Bank's trust operations and HVIA asset management activities. Additionally, the Company experienced increased earnings from the BOLI investment during the quarter. For the nine months ended September 30, 2022, non-interest income experienced a slight decrease of approximately $33 thousand, generating approximately $8.9 million for each of the nine-month periods ended September 30, 2022 and 2021, respectively.

Non-Interest Expense

Non-interest expense was $12.6 million for the third quarter of 2022, reflecting an increase of approximately $1.6 million, or 14.4%, as compared to $11.0 million for the same period in 2021. The increase in non-interest expense for the current three-month period was due to continued investment in Company growth, including increases in compensation and benefit costs, occupancy costs, information technology, and deposit insurance. The 2022 third quarter includes the full impact of costs associated with our newest locations in the Bronx and Nanuet, NY. Our efficiency ratio was 51.6% for the three months ended September 30, 2022, down from 58.0% for the same period in 2021. For the nine months ended September 30, 2022, our efficiency ratio was 57.5% as compared to 59.7% for the same period in 2021.

Income Tax Expense

Our provision for income taxes for the three months ended September 30, 2022 was $1.9 million, compared to $1.4 million for the same period in 2021. The increase for the current period was due mainly to an increase in income before income taxes during the quarter. Our effective tax rate for the three-month period ended September 30, 2022 was 19.1%, as compared to 19.5% for the same period in 2021. For the nine months ended September 30, 2022, our provision for income taxes was $3.5 million, as compared to $3.8 million for the nine months ended September 30, 2021. Our effective tax rate for the nine-month period ended September 30, 2022 was 18.5%, as compared to 19.3% for the same period in 2021. The reduction in effective tax rates for the 2022 third quarter and nine-month periods is due mainly to the increase in proportion of non-taxable revenue (tax-exempt interest income and earnings on bank owned life insurance) compared with total pre-tax income.

Financial Condition

Total consolidated assets increased $225.8 million, or 10.5%, from $2.1 billion at December 31, 2021 to $2.4 billion at September 30, 2022. The increase was driven mainly by growth in loans, deposits, and investment securities.

Total cash and due from banks decreased from $306.2 million at December 31, 2021, to $180.3 million at September 30, 2022, a decrease of approximately $125.9 million, or 41.1%. This decrease resulted primarily from increased loan growth in 2022 as well as management's continued focus on the deployment of excess cash into investments and attraction of lower cost deposits.

Total investment securities rose $83.6 million, or 17.9%, from $467.0 million at December 31, 2021 to $550.7 million at September 30, 2022. The increase was due to purchases of investment securities, offset by an increase in unrealized losses on investment securities since December 31, 2021 as well as paydowns and maturities during the period.

Total loans increased $256.3 million, or 19.8%, from $1.3 billion at December 31, 2021 to more than $1.5 billion at September 30, 2022. The increase was due primarily to $206.6 million of commercial real estate loan growth and $60.7 million of commercial real estate construction loan growth. PPP loans fell $36.2 million, to $1.9 million at September 30, 2022 from $38.1 million at December 31, 2021. Most of the remaining PPP loan balance is subject to SBA loan forgiveness.

Total deposits grew $273.2 million, to $2.2 billion at September 30, 2022, from $1.9 billion at December 31, 2021. This increase was driven by continued success in business account development, attorney trust deposit growth and increased deposit levels for local municipal accounts. At September 30, 2022, 52.0% of total deposits were demand deposit accounts (including NOW accounts).

Stockholders' equity experienced a decrease of approximately $46.6 million, to $136.2 million at September 30, 2022, from $182.8 million at December 31, 2021. The decrease was primarily due to a $58.9 million of unrealized losses on the market value of investment securities recognized within the Company's equity as accumulated other comprehensive income (loss) ("AOCI"), net of taxes, as a result of the increase in market interest rates. Offsetting the AOCI fluctuation, the Bank recognized an increase in retained earnings of approximately $15.3 million associated with earnings during the nine months ended September 30, 2022, net of dividends paid.

At September 30, 2022, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital to average assets ratio was 8.57%, both common equity and Tier 1 capital to risk weighted assets were 12.35%, and total capital to risk weighted assets was 13.60%. These ratios included contributions of approximately $27.5 million of capital at the Bank level representing roughly half of the net proceeds from the Company's public offering of common stock during 2021.

Asset Quality

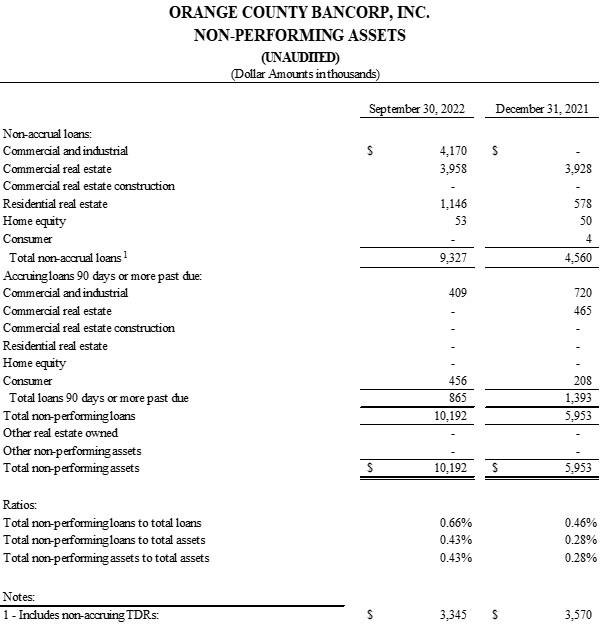

At September 30, 2022, the Bank had total non-performing loans of $10.2 million, or 0.66% of total loans, which included $3.3 million of Troubled Debt Restructured Loans ("TDRs"). The latter represents 0.22% of total loans and was relatively level as compared with $3.6 million at December 31, 2021. Accruing loans delinquent greater than 90 days experienced a decrease and totaled $865 thousand as of September 30, 2022, as compared to $1.4 million at December 31, 2021.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to more than $2.3 billion in total assets. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and acquired by the Company in 2012.

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, inflation, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. Further, given its ongoing and dynamic nature, it is difficult to predict what the continuing effects of the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, continue to result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Robert L. Peacock

SEVP Chief Financial Officer

rpeacock@orangebanktrust.com

Phone: (845) 341-5005

SOURCE: Orange County Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/722214/Orange-County-Bancorp-Inc-Announces-Record-Third-Quarter-Results